Key Takeaways

- Diversifying game portfolio, expanding internationally, and embracing community-driven models support sustained growth, user retention, and recurring revenue opportunities.

- Strategic acquisitions and AI-driven efficiencies enhance productivity, broaden market reach, and help stabilize earnings while improving profit margins.

- Heavy investment in new projects and ongoing reliance on PUBG heighten operational risks, cost pressures, and the vulnerability of sustained profitability and shareholder returns.

Catalysts

About KRAFTON- Engages in the software development and related ancillary businesses in Asia, Korea, the United States, Europe, and internationally.

- KRAFTON's expanding focus on developing and publishing new global IPs beyond PUBG-including inZOI, Subnautica 2, and Last Epoch-diversifies revenue streams, reduces concentration risk, and leverages growing consumer appetite for premium online and mobile gaming content, supporting long-term revenue and earnings growth.

- The company's robust push into emerging and international markets (such as India, Europe, and North America), combined with regionally tailored publishing strategies and frequent collaborations, positions KRAFTON to benefit from rising mobile internet access and shifting digital consumption behaviors, directly impacting topline growth and user base expansion.

- KRAFTON's deepening investment in creator-driven and community-centric publishing models (evidenced by inZOI's viral community engagement and UGC strategy, as well as actively supporting streamers and advocates) is likely to drive higher player retention, time spent, and recurring in-game monetization, supporting higher gross margins and more predictable revenues.

- Ongoing R&D in AI-powered game development and operational efficiencies (demonstrated by substantial research outputs and the adoption of new technologies in game design) are expected to enhance development productivity, reduce long-term costs, and improve net margins.

- Strategic acquisitions-such as Eleventh Hour Games (Last Epoch) and ADK Group (ad tech and animation)-expand KRAFTON's addressable market and unlock new cross-platform and cross-media revenue opportunities, helping to smooth earnings volatility and fuel sustained revenue growth.

KRAFTON Future Earnings and Revenue Growth

Assumptions

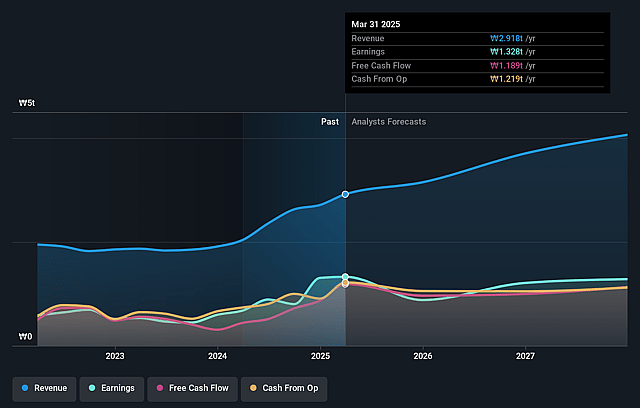

How have these above catalysts been quantified?- Analysts are assuming KRAFTON's revenue will grow by 15.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.5% today to 29.3% in 3 years time.

- Analysts expect earnings to reach ₩1308.3 billion (and earnings per share of ₩28447.67) by about July 2028, down from ₩1328.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩1915.9 billion in earnings, and the most bearish expecting ₩908.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, up from 11.4x today. This future PE is greater than the current PE for the KR Entertainment industry at 18.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.19%, as per the Simply Wall St company report.

KRAFTON Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- KRAFTON's aggressive investment in new IPs, global studios, and diversified publishing models increases capital expenditures and operational complexity, raising the risk that costly projects may not achieve commercial success, which could pressure future revenues and net margins.

- The postponement and legal dispute surrounding Subnautica 2 reveal execution risks and potential challenges in managing an expanded development pipeline, indicating possible future delays or underperformance that may negatively affect earnings and investor confidence.

- Overreliance on the PUBG franchise persists, with the majority of current revenue still concentrated in this IP, making the company vulnerable to shifts in gamer preferences, franchise fatigue, or competitive threats, which could cause long-term revenue and earnings volatility.

- Sustained increases in operating expenses, including higher labor costs, third-party development fees, and marketing expenditure, amidst slowing or uneven revenue growth across platforms, can erode net margins and limit long-term profitability improvements.

- Lack of clear and enduring shareholder return policies after the expiration of the 3-year plan, combined with ongoing high investment outflows and uncertainty about future dividends or buybacks, may reduce shareholder value and limit earnings per share growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩456480.0 for KRAFTON based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩540000.0, and the most bearish reporting a price target of just ₩360000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩4469.8 billion, earnings will come to ₩1308.3 billion, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 9.2%.

- Given the current share price of ₩326500.0, the analyst price target of ₩456480.0 is 28.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.