Key Takeaways

- Ecopro BM's sales volume is projected to increase significantly, enhancing revenue and profitability, driven by electric vehicle launches and improved inventory management.

- Strategic investments in productivity and expansion into new markets aim to boost revenue, reduce costs, and strengthen the company's profitability and competitive position.

- Declining revenues, high debt, and geopolitical risks strain Ecopro BM's financial health, highlighting cost management and market demand issues amid heavy investment pressures.

Catalysts

About Ecopro BM- Ecopro BM Co. Ltd. develops and sells cathode materials used in batteries in Korea and internationally.

- Ecopro BM anticipates a sales volume increase of around 40% in 2025, driven by the inventory depletion of key customers and the launch of new electric vehicles. This increase in sales volume is expected to significantly improve revenue.

- The company is investing in productivity improvements to spread out fixed costs, resulting in cost savings. This is expected to significantly improve operating profit.

- Ecopro Materials plans to diversify its customer base and increase sales volume by acquiring new non-captive customers and expanding sales to existing ones. This strategy aims to boost revenue and create a stable revenue stream.

- The acquisition of Green Eco Nickel is expected to drive significant improvement in consolidated profit for Ecopro Materials, contributing additional sales and operating profit to the group's financials.

- Ecopro's strategic entry into Indonesia and expansion into upstream projects like nickel refinery is expected to solidify cost competitiveness, leading to enhanced profitability across the group by reducing raw material costs.

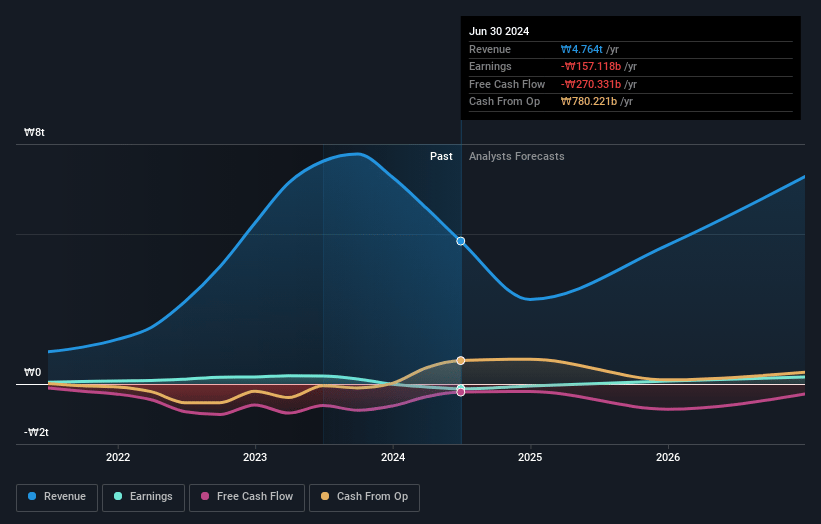

Ecopro BM Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ecopro BM's revenue will grow by 34.6% annually over the next 3 years.

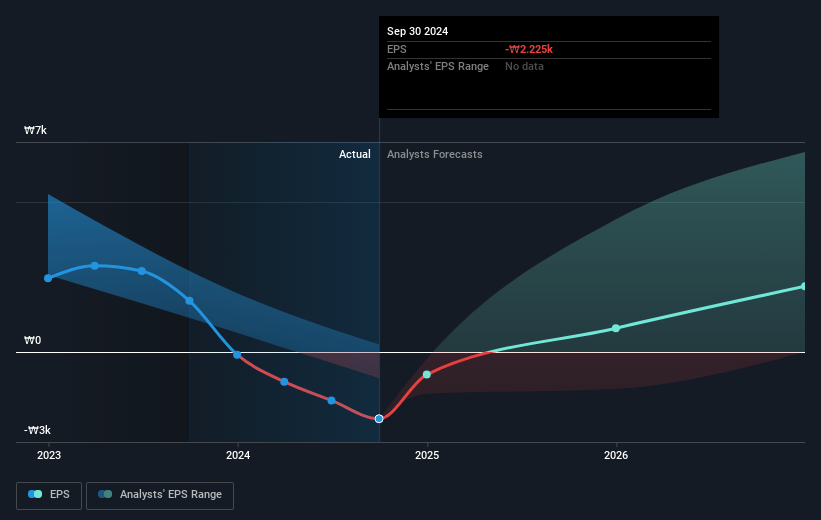

- Analysts assume that profit margins will increase from -3.5% today to 2.8% in 3 years time.

- Analysts expect earnings to reach ₩187.3 billion (and earnings per share of ₩1942.94) by about April 2028, up from ₩-96.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩372.0 billion in earnings, and the most bearish expecting ₩68.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.2x on those 2028 earnings, up from -102.4x today. This future PE is greater than the current PE for the KR Electrical industry at 18.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.15%, as per the Simply Wall St company report.

Ecopro BM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ecopro BM's Q4 2024 consolidated revenue fell 11% quarter-over-quarter and annual revenue was down 60% year-over-year, reflecting declining sales volume and metal price falls, which could continue to pressure revenue and profitability.

- Operating losses for Ecopro BM and Ecopro Materials reflect underlying issues in cost management and market demand, indicating risks to future earnings growth.

- High debt ratios and rising total liabilities, especially for Ecopro Materials with a 41% Q-o-Q increase in liabilities and Ecopro BM's financial reliance on borrowing, threaten net margins as they increase financial risk and potential interest expenses.

- Dependence on unstable markets and the volatile geopolitical landscape, particularly U.S. trade policies and potential IRA changes, introduces risks related to external demand and competitive positioning, impacting future revenue streams.

- Ecopro's ongoing significant investments, including ₩500 billion anticipated CapEx for 2025, risk straining financial resources and increasing liability without guaranteed returns, potentially impacting earnings if projected utilization and productivity improvements are not realized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩114652.174 for Ecopro BM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩200000.0, and the most bearish reporting a price target of just ₩60000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩6740.3 billion, earnings will come to ₩187.3 billion, and it would be trading on a PE ratio of 77.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of ₩101200.0, the analyst price target of ₩114652.17 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.