Last Update 01 Nov 25

Fair value Increased 1.19%Narrative Update: Analyst Price Target for Kia Revised Upward

Analysts have raised their price target for Kia from $132,241 to $133,815. They cite strengthened revenue growth expectations and a reduced discount rate as key drivers of the updated valuation.

What's in the News

- Kia has completed a share buyback tranche by repurchasing 183,891 shares (0.05%) for KRW 18,706.11 million between October 1, 2025 and October 15, 2025 under the buyback announced on July 25, 2025 (Key Developments).

- As of October 15, 2025, Kia has fully repurchased 3,376,272 shares (0.87%) for KRW 349,999.92 million under the current buyback program (Key Developments).

- Between July 25, 2025 and September 30, 2025, Kia repurchased 3,192,381 shares (0.82%) for KRW 331,293.81 million as part of the ongoing share buyback (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from ₩132,241 to ₩133,815.

- Discount Rate has decreased from 11.72% to 11.15%.

- Revenue Growth expectation increased from 3.61% to 4.46%.

- Net Profit Margin shows a marginal decline from 7.32% to 7.19%.

- Future P/E ratio remains nearly unchanged, moving from 7.73x to 7.73x.

Key Takeaways

- Expansion into electric and hybrid vehicles, flexible production, and new markets is driving revenue growth while reducing dependence on mature regions.

- Emphasis on upmarket models and cost management is boosting pricing power and margins, with raw material stabilization supporting profitability.

- Intensifying trade tensions, shifting consumer demand, and increased competition are compressing Kia's margins, limiting EV growth, and creating volatility in profits and long-term competitiveness.

Catalysts

About Kia- Manufactures and sells vehicles in South Korea, North America, and Europe.

- Kia is expanding its electrified vehicle lineup with new models like EV4, EV5, EV2, and additional hybrids, enabling it to better capture rising demand for electric and hybrid vehicles amid tightening emissions regulations globally; this is likely to drive revenue growth and support higher average selling prices over time.

- The company is leveraging flexible production capacity and vertical integration, rapidly shifting its output mix between ICE, hybrid, and EVs in response to evolving market and regulatory dynamics-particularly in the U.S. and Europe-positioning itself for improved net margins as supply chain resilience and cost controls take effect.

- Aggressive international expansion and new model launches in fast-growing markets such as India, the Middle East, and Africa, supported by regional production bases (e.g., China), are boosting sales diversification and are expected to drive top-line growth, reducing earnings volatility from overreliance on mature markets.

- Continued emphasis on upmarket vehicles, product value enhancement, and improvement in model mix (notably strong performance of high-demand models like Carnival Hybrid and EV3) are forecasted to sustain higher pricing power and support robust operating margins, especially as new product cycles begin.

- Stabilization of raw material and battery costs, combined with recuperative actions against tariff impacts (such as strategic market allocation and reduced incentives), is expected to mitigate downward pressures on profitability and provide upside potential for net earnings as these measures take full effect.

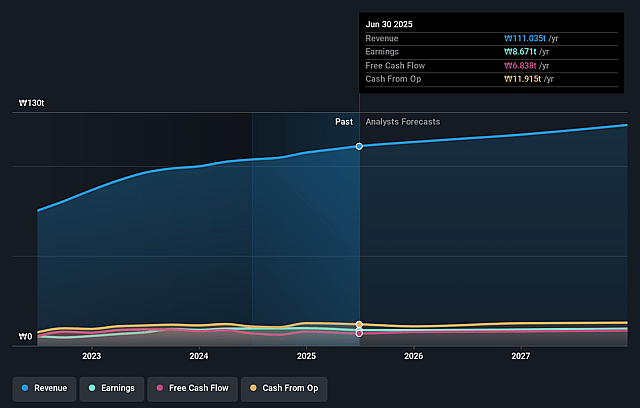

Kia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kia's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.8% today to 7.3% in 3 years time.

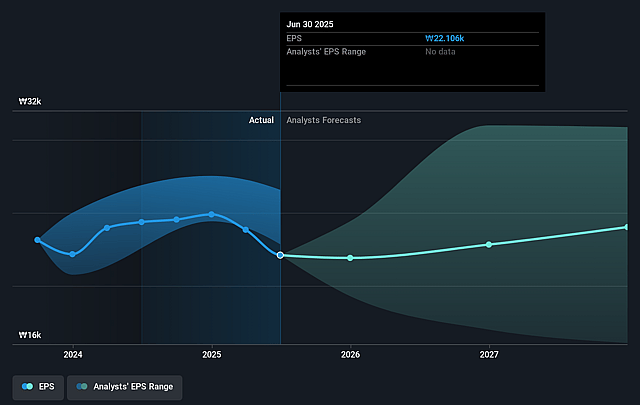

- Analysts expect earnings to reach ₩9037.0 billion (and earnings per share of ₩24021.86) by about September 2028, up from ₩8671.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩12277.0 billion in earnings, and the most bearish expecting ₩6398.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, up from 4.8x today. This future PE is greater than the current PE for the KR Auto industry at 4.8x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.72%, as per the Simply Wall St company report.

Kia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global trade tensions and escalating tariffs-especially in the U.S. and Europe-are materially eroding Kia's operating profits and raising cost of sales, with continued uncertainty around future tariff levels threatening further margin compression and revenue risk in key export markets.

- Heightened competition in core markets, including from Chinese EV entrants in Europe and aggressive incentive-driven battles, is forcing Kia to increase incentives to sustain market share, undermining pricing power and contributing to a deterioration in net margins and overall earnings quality.

- Slowing near-term demand growth for EVs combined with a "trade down" in customer spending on high-option, high-margin trims is negatively affecting Kia's product mix, limiting ASP growth and reducing profitability from electrified vehicles-potentially hindering the company's ability to leverage the global shift toward electrification for revenue expansion.

- Existing overreliance on hybrid and traditional ICE models in certain geographies exposes Kia to secular declines in car ownership (due to urbanization and mobility-as-a-service trends) and leaves the company vulnerable to regulatory penalties or lost share if it cannot accelerate its EV transition, threatening long-term top-line and margin potential.

- Continued fluctuations in foreign exchange rates, uncertainty regarding raw material costs, and pressure to maintain elevated capital expenditures for electrification and new model launches create volatility in financial results and may strain net profits and cash flow, impacting Kia's ability to return value to shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩132241.379 for Kia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩179000.0, and the most bearish reporting a price target of just ₩105000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩123496.8 billion, earnings will come to ₩9037.0 billion, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 11.7%.

- Given the current share price of ₩107000.0, the analyst price target of ₩132241.38 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.