Last Update 08 Dec 25

4716: Future Earnings Power Will Support Further Upside Despite Higher Discount Rate

Analysts have modestly raised their price target on Oracle Corporation Japan, citing a slightly higher discount rate and future price-to-earnings assumptions that support a fair value estimate of ¥17,420.00.

Valuation Changes

- Fair Value Estimate is unchanged at approximately ¥17,420.00, indicating no material revision to the intrinsic value assessment.

- The Discount Rate has risen slightly from about 6.43 percent to around 6.51 percent, reflecting a modest adjustment to the required return assumption.

- Revenue Growth is effectively unchanged at roughly 8.72 percent, suggesting no meaningful shift in top line growth expectations.

- The Net Profit Margin is effectively unchanged at about 22.90 percent, indicating stable assumptions for future profitability.

- The Future P/E has risen slightly from roughly 34.09x to about 34.16x, signaling a marginally higher multiple applied to projected earnings.

Key Takeaways

- Strong demand for Oracle's cloud services, augmented by major partnerships, could lead to sustained revenue growth and expanded customer base.

- Investments in generative AI infrastructure may drive future revenue and earnings growth through AI-related services and platforms.

- Robust cloud services growth, strategic partnerships, and successful client migrations indicate Oracle Japan's strong market presence and potential for sustained revenue and earnings growth.

Catalysts

About Oracle Corporation Japan- Engages in the development and sale of software and hardware products and solutions in Japan.

- The strong demand for Oracle's cloud services, highlighted by substantial growth in partnerships with major corporations like NRI and Toyota Systems, could lead to continued revenue growth as the company expands its customer base in various industries.

- The transition of systems, such as Shiseido's sales and customer analysis system to Oracle Cloud, demonstrates a focus on infrastructure efficiency and cost reduction, likely enhancing net margins through improved operational efficiencies.

- Oracle's investments in generative AI infrastructure, as seen in their agreement with NRI, suggest potential future revenue growth from AI-related services and platforms, which could drive increased earnings.

- Although on-premise license growth is expected to stabilize or decline slightly, the emphasis on cloud adoption indicates a strategic shift that should support sustainable revenue increases from cloud service adoption.

- A continued strong performance in Oracle's services business, especially with cloud migrations, should support earnings growth, although the focus remains on expanding the software side, which may drive higher margins and profitability.

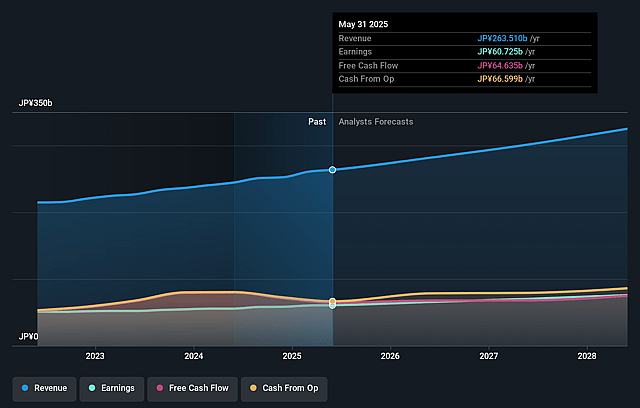

Oracle Corporation Japan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oracle Corporation Japan's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.0% today to 23.3% in 3 years time.

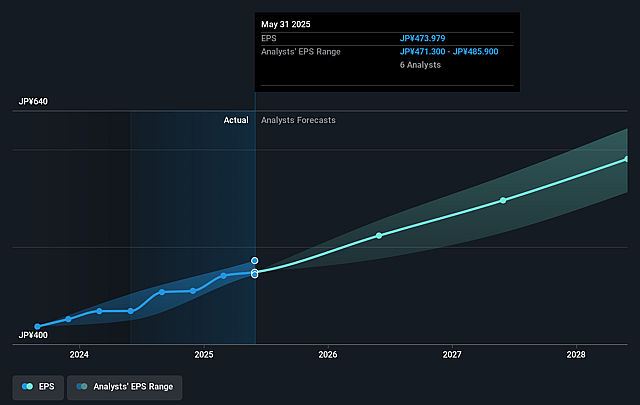

- Analysts expect earnings to reach ¥75.7 billion (and earnings per share of ¥590.32) by about September 2028, up from ¥60.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.8x on those 2028 earnings, up from 32.2x today. This future PE is greater than the current PE for the JP Software industry at 21.8x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Oracle Corporation Japan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The substantial growth in Oracle Japan's Cloud Services revenue, with a 26.5% increase, indicates a robust demand for cloud solutions, which suggests continued revenue expansion. This contradicts the idea of share price decline as strong cloud service adoption can drive future financial performance and solidify revenue streams.

- The strategic partnerships with major companies like NRI, Toyota Systems, Yamaha, and Shiseido demonstrate Oracle's strong market presence and ability to capture key clients across various industries, which can lead to sustained revenue growth and increased market share.

- The migration of existing clients to Oracle's cloud infrastructure, such as Shiseido's significant cost reduction and performance improvement, highlights potential increases in operational efficiency and customer retention, positively impacting Oracle's net margins.

- Oracle's services business is experiencing strong momentum, significantly supported by cloud migrations, suggesting an upward trend in service-related earnings which complements their software growth strategy. This indicates the potential for continued revenue diversification and stability.

- The successful implementation of Oracle Cloud Technology by high-profile customers in mission-critical systems underscores Oracle's capability to address complex enterprise needs, enhancing its reputation and likely leading to increased earnings through expanded client engagements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥17620.0 for Oracle Corporation Japan based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥325.1 billion, earnings will come to ¥75.7 billion, and it would be trading on a PE ratio of 35.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of ¥15250.0, the analyst price target of ¥17620.0 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Oracle Corporation Japan?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.