Key Takeaways

- Expansion of deals and strategic partnerships positions PeptiDream for substantial future revenue growth from clinical advancements and imaging collaborations.

- New facilities and collaborations could enhance operational efficiency, production, and earnings, with a focus on upcoming drug approvals boosting revenue.

- PeptiDream's strategy relies heavily on large deals and expanding pipelines, which faces risks from deal materialization, clinical trials, and currency fluctuations.

Catalysts

About PeptiDream- A biopharmaceutical company, engages in the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

- PeptiDream's expansion of its RI-PDC deal with Novartis, including $180 million upfront and substantial downstream financials, showcases significant potential for increased revenue as new clinical candidates progress from their 2019 collaboration and anticipate further advancements in 2025. This expansion is likely to impact future revenue growth positively.

- The input from PDRadiopharma's Alzheimer's-related imaging products such as Amyvid and Tauvid, following strong reimbursement pricing and insurance coverage, sets a foundation for increased revenue from these projects contributing substantially from 2025 onward.

- PeptiDream's strategic partnerships and new manufacturing facilities like the Kazusa Akademia Park site projected for late 2027 offer operational efficiencies and increased production capabilities, potentially enhancing revenue streams and mitigating risks, impacting net margins positively in the medium term.

- The projected mid-to-long-term revenue growth goal of ¥100 billion is hinged on drug approvals and consistent NDA submissions, signaling robust pipeline progression that could boost revenue and earnings significantly starting in 2027.

- Anticipated new collaborations, out-licensing deals, and internal program advancements such as the GhR antagonist, CD38-ARM program with Biohaven, and oral peptide therapeutics are expected to increase upfront fees and milestone payments, impacting earnings and revenue growth positively in the upcoming years.

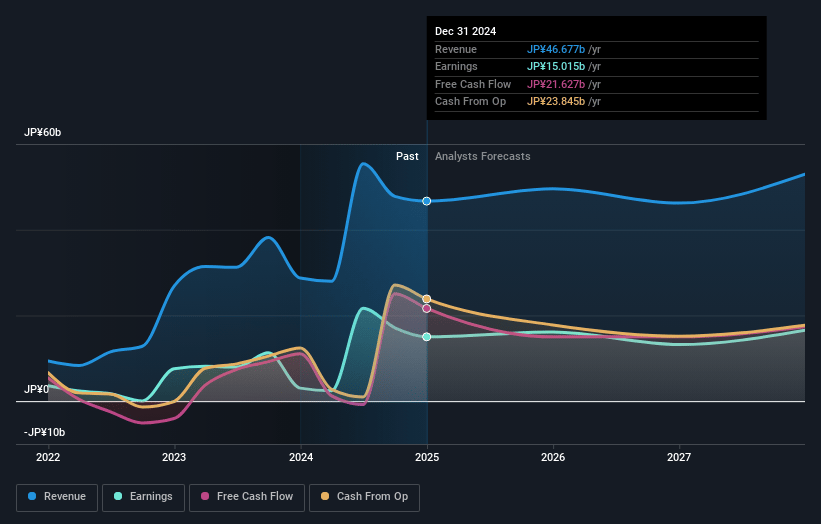

PeptiDream Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PeptiDream's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.2% today to 30.5% in 3 years time.

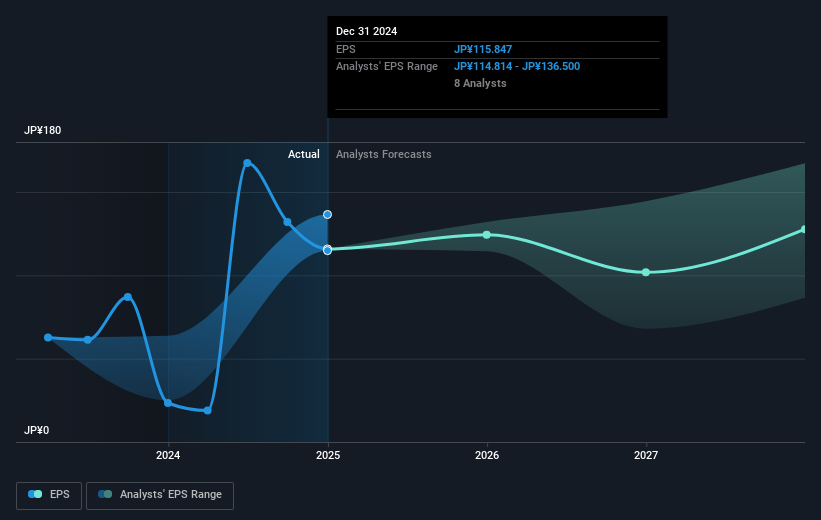

- Analysts expect earnings to reach ¥16.2 billion (and earnings per share of ¥125.34) by about May 2028, up from ¥15.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥21.7 billion in earnings, and the most bearish expecting ¥11.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.6x on those 2028 earnings, up from 16.7x today. This future PE is greater than the current PE for the JP Biotechs industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.98%, as per the Simply Wall St company report.

PeptiDream Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PeptiDream's reliance on significant deals, such as the one with Novartis, presents a risk if such large deals do not materialize in future years, potentially impacting revenue growth projections.

- The ambitious timeline for the construction and operation of a new manufacturing site suggests a heavy reliance on future pipeline success; any delays or failures in clinical trials could impede expected revenue contributions from these facilities.

- The current strategy of building a robust radiopharmaceutical pipeline heavily depends on successful clinical trials and regulatory approvals, adding risk to future net margins if these do not progress as planned.

- PeptiDream's strategic focus on expanding its peptide therapeutics pipeline carries inherent market risks, such as heightened competition and rapid technological changes, which could impact future earnings and profitability.

- The potential impact of currency fluctuations, particularly the yen's strength against the dollar, could adversely affect revenue and profitability, especially considering that many deals are denominated in dollars.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥3542.857 for PeptiDream based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4900.0, and the most bearish reporting a price target of just ¥2800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥53.2 billion, earnings will come to ¥16.2 billion, and it would be trading on a PE ratio of 32.6x, assuming you use a discount rate of 5.0%.

- Given the current share price of ¥1937.0, the analyst price target of ¥3542.86 is 45.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.