Key Takeaways

- Strategic brands and R&D pipeline drive revenue growth, with innovative therapies offering promising future opportunities.

- Cost optimization initiatives enhance net margins and operational efficiencies, supporting long-term earnings.

- Patent litigation risks, regulatory uncertainties, and substantial debt may strain Astellas Pharma's financial flexibility, impacting margins, profit growth, and future strategic initiatives.

Catalysts

About Astellas Pharma- Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

- Astellas Pharma's strategic brands, such as VEOZAH, PADCEV, and IZERVAY, are expected to drive significant revenue growth, with projected increases of up to 40% year-on-year. This growth momentum will act as a catalyst for higher future revenue streams.

- The company has implemented SMT cost optimization initiatives that resulted in a SG&A ratio improvement by 3.1 percentage points. These initiatives are expected to generate a recurring annual benefit of ¥120 billion to ¥150 billion by FY 2027, positively impacting net margins.

- Astellas' R&D pipeline, particularly the progress of ASP3082 in targeted protein degradation, is anticipated to enhance long-term earnings. Successful PoC in pancreatic cancer suggests promising revenue opportunities from innovative therapies.

- The company is targeting additional indications for existing drugs like XTANDI and PADCEV, which are expected to sustain growth beyond current revenue levels and contribute significantly to near-future earnings through expanded market reach.

- Astellas is focusing on optimizing the value creation and delivery process through organizational changes, aimed at enhancing agility and cross-functional operations. This strategic shift is likely to improve operational efficiencies and earnings over time.

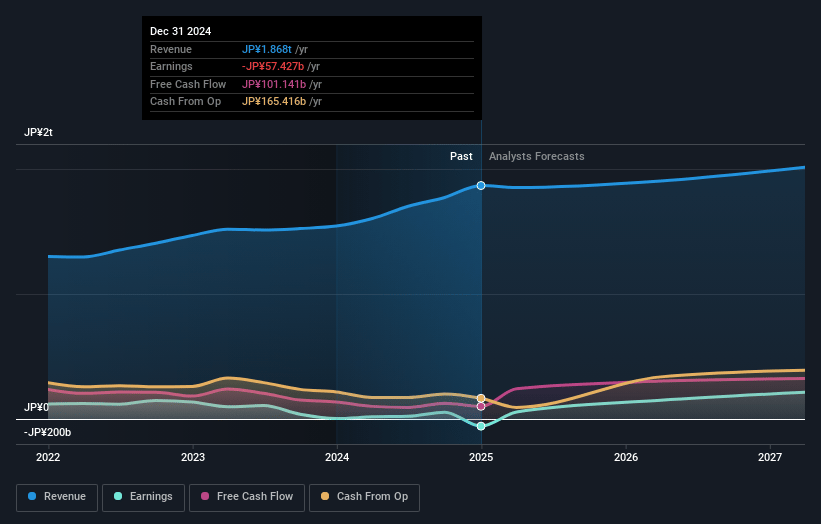

Astellas Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Astellas Pharma's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 10.7% in 3 years time.

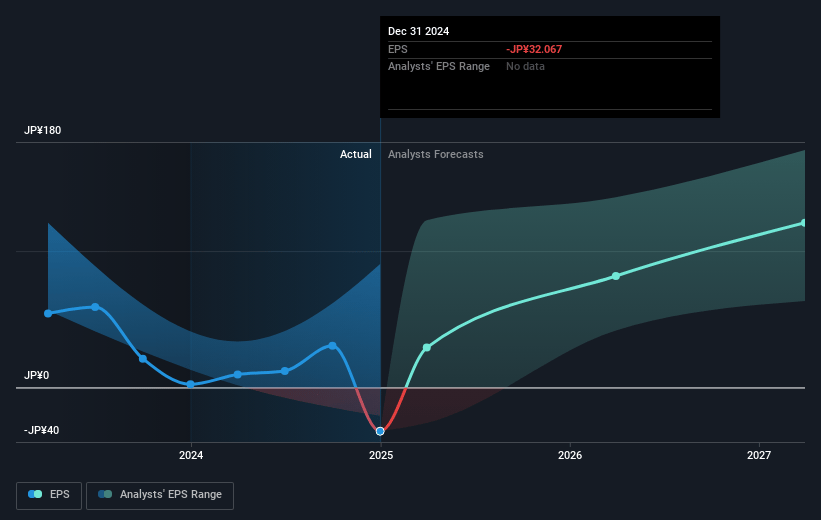

- Analysts expect earnings to reach ¥199.2 billion (and earnings per share of ¥114.12) by about May 2028, up from ¥50.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥300.0 billion in earnings, and the most bearish expecting ¥134.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, down from 50.4x today. This future PE is greater than the current PE for the JP Pharmaceuticals industry at 15.0x.

- Analysts expect the number of shares outstanding to decline by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.59%, as per the Simply Wall St company report.

Astellas Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Patent litigation risks associated with mirabegron in the U.S. could potentially lead to significant competition and impact revenue if generic products enter the market prematurely.

- Regulatory and tariff uncertainties, particularly due to the lack of clarity on how tariffs may affect supply chains, could increase costs and impact net margins.

- There are execution risks in the rapid expansion and market penetration of strategic brands like IZERVAY and PADCEV, particularly in terms of achieving sales forecasts and handling competition, which could affect revenue projections.

- Dependence on achieving Proof of Concept (PoC) in various focus areas to drive future growth poses a risk, as failed outcomes could hinder long-term revenue and earnings potential.

- The substantial debt incurred from the acquisition of Iveric Bio could strain financial flexibility, impacting the company's ability to fund further strategic initiatives or withstand adverse financial results, potentially impacting net margins and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1813.333 for Astellas Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2500.0, and the most bearish reporting a price target of just ¥1300.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1860.0 billion, earnings will come to ¥199.2 billion, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 4.6%.

- Given the current share price of ¥1427.5, the analyst price target of ¥1813.33 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.