Key Takeaways

- Expansion in battery manufacturing and adoption of advanced tech in key segments position Panasonic for long-term growth, resilience, and improved margins.

- Structural reforms and portfolio optimization are expected to enhance competitiveness, boost earnings, and support higher returns over the medium term.

- Failure to execute restructuring, reliance on volatile EV batteries, global competition, regulatory risks, and sluggish legacy businesses threaten profit recovery and sustainable growth.

Catalysts

About Panasonic Holdings- Research, develops, manufactures, sells, and services various electrical and electronic products worldwide.

- Ongoing investments to scale up battery manufacturing for electric vehicles and grid storage, with new production facilities ramping up in Nevada, Kansas, and Wakayama, position Panasonic to benefit from accelerating global EV adoption and stricter decarbonization policies, driving top-line growth and margin expansion in the Energy segment.

- Structural reform and business portfolio optimization—including workforce reduction, site consolidation, and withdrawal from loss-making businesses—are expected to enhance cost competitiveness, lift margins below those of peers to industry levels, and directly support net earnings and ROE over the medium term.

- High factory utilization and strong customer demand for both in-vehicle and industrial energy storage batteries, combined with local U.S. manufacturing, help Panasonic defend and potentially increase revenue resilience despite macro uncertainty and trade barriers such as U.S. tariffs.

- Panasonic is accelerating development and integration of IoT, automation, and AI-enabled products in segments like supply chain management (via Blue Yonder), smart homes, and data centers. This focus supports higher average selling prices and long-term earnings growth through product differentiation and value-added services.

- Management is targeting cumulative profit improvement of ¥300 billion by FY '29 through these reforms, with set goals for an adjusted operating profit margin and ROE of 10%, indicating a credible trajectory for sustained earnings growth and improved returns on invested capital.

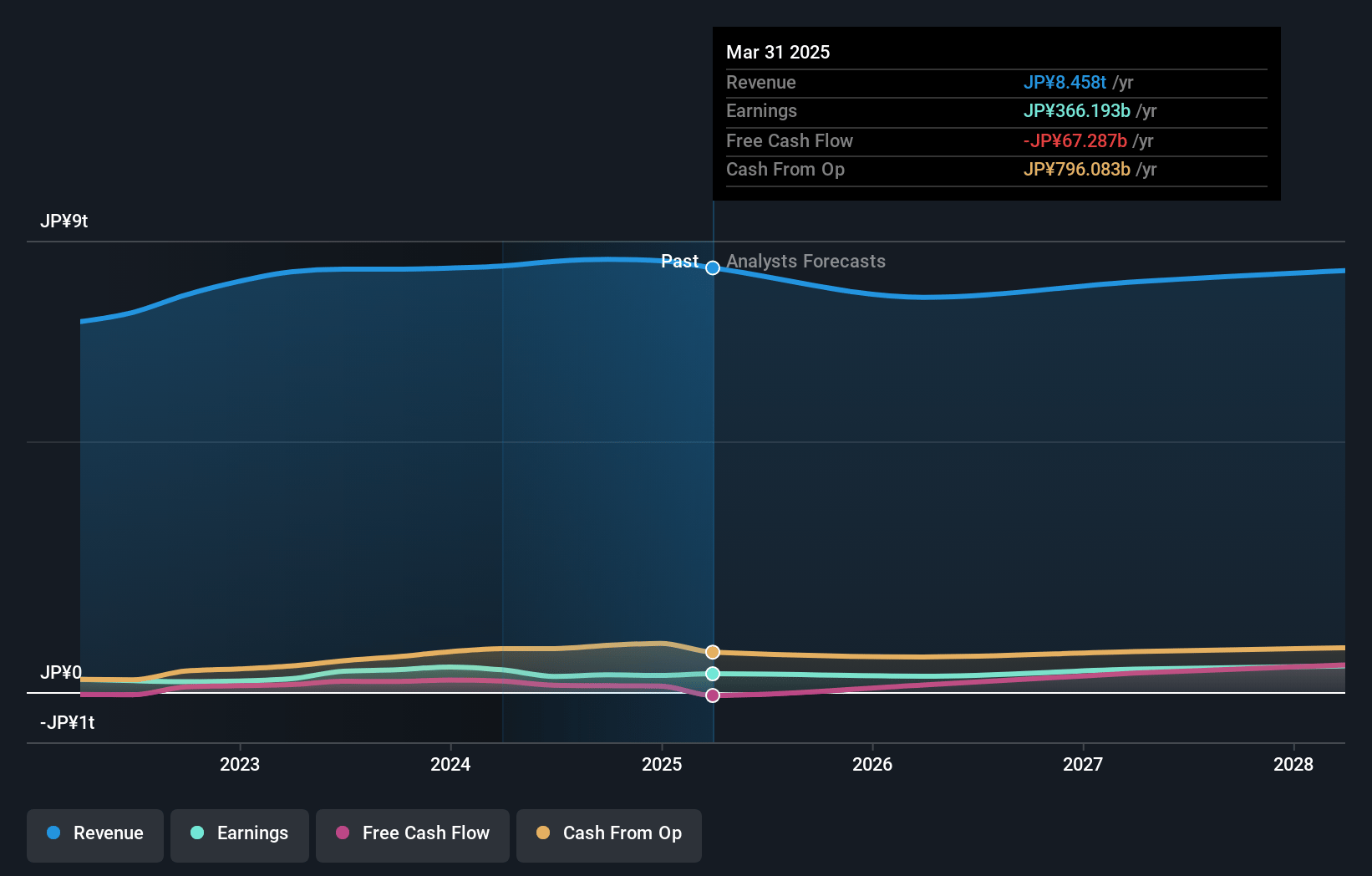

Panasonic Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Panasonic Holdings's revenue will decrease by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 6.1% in 3 years time.

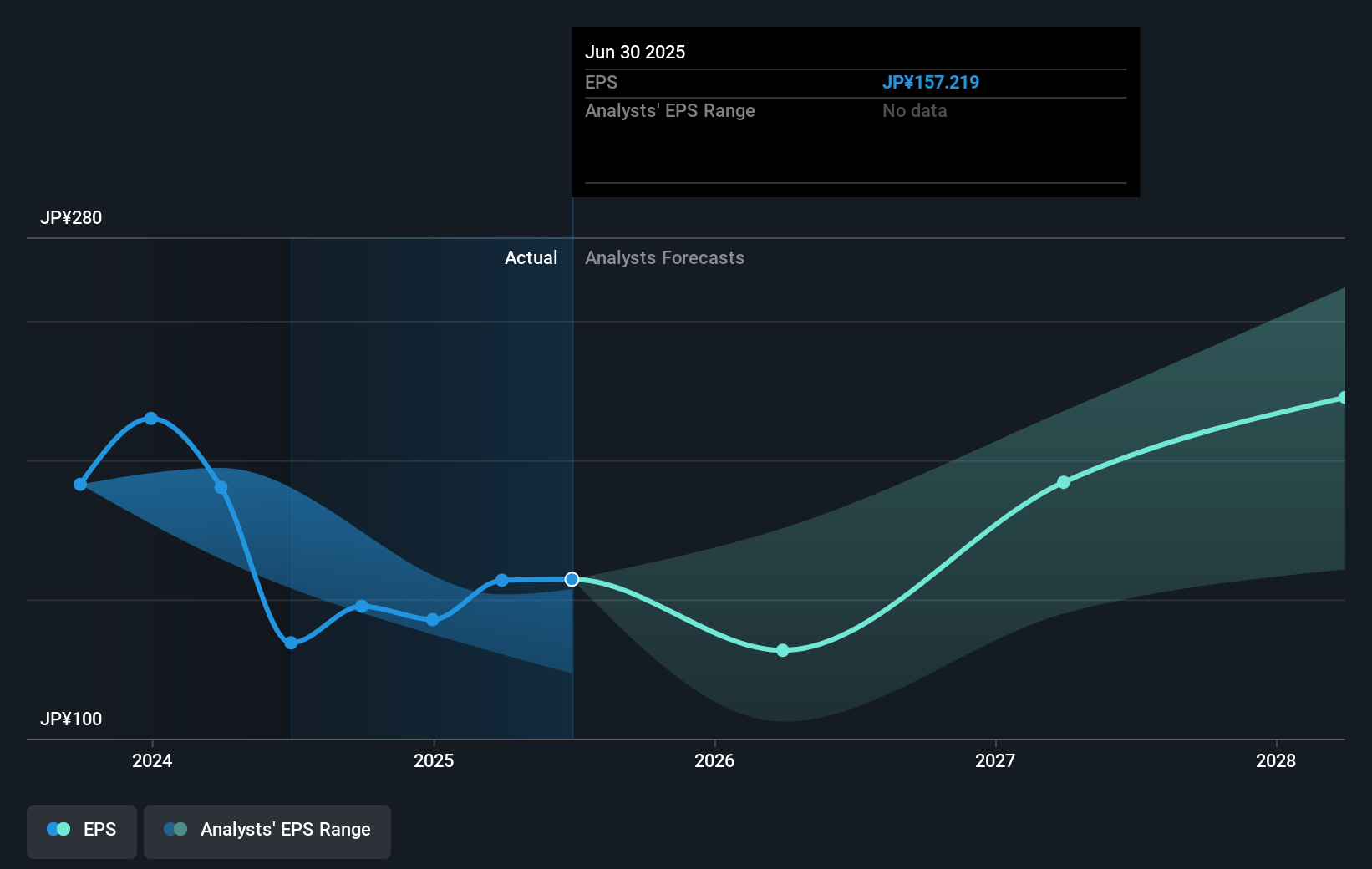

- Analysts expect earnings to reach ¥497.6 billion (and earnings per share of ¥229.0) by about May 2028, up from ¥366.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the JP Consumer Durables industry at 11.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Panasonic Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant execution risk surrounds Panasonic’s large-scale restructuring, including withdrawal from loss-making businesses, the closure or consolidation of sites, and a workforce reduction of 10,000 people. If employee morale or productivity drops, or if execution is delayed, it could undermine cost savings and the targeted +¥150 billion profit improvement, ultimately putting pressure on net margins and operating profit.

- Overreliance on the In-vehicle battery segment exposes Panasonic to the volatile and uncertain EV market—notably, its major strategic automotive customer is experiencing sales struggles, and future demand is uncertain beyond short-term supply commitments. Any negative shift in customer demand or contract renewal terms risks lower revenue and reduced earnings from a crucial growth driver.

- The ongoing commoditization and intense global competitive pressures—from Chinese competitors in consumer electronics and batteries, as well as Big Tech’s control of smart home ecosystems—threaten both volume and pricing power. This could compress gross margins, erode export revenue, and restrain Panasonic’s long-term earnings growth.

- Panasonic’s heavy investments in North American battery manufacturing and industrial/energy projects are vulnerable to policy and regulatory risks, particularly changes in U.S. tariffs, the Inflation Reduction Act, and supply chain localization requirements. Any adverse shifts could increase compliance costs or reduce subsidies, thus diminishing net margins and free cash flow.

- Persistent structural challenges remain in legacy segments like TV and consumer electronics, where demand is stagnant or declining, especially amid demographic headwinds in Japan and global aging populations. The company’s need to rapidly improve profitability in these segments via cost reduction may not offset revenue declines, posing a risk to sustainable earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2193.867 for Panasonic Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2700.0, and the most bearish reporting a price target of just ¥1500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥8192.7 billion, earnings will come to ¥497.6 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of ¥1596.0, the analyst price target of ¥2193.87 is 27.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.