Key Takeaways

- Key acquisitions and expansions in infrastructure and energy sectors are expected to drive revenue growth and improve capital efficiencies.

- Strategic investments in consumer and agriculture segments, alongside share buybacks, are set to boost profitability and shareholder returns.

- Decline in coal prices and cost pressures from a weaker yen and inflation could hamper Sojitz's revenue and margin growth across key segments.

Catalysts

About Sojitz- Operates as a general trading company that engages in various business activities worldwide.

- The acquisition of Capella Capital Partnership in Australia is a key forward-looking catalyst. By integrating Capella’s significant infrastructure expertise, Sojitz plans to grow its revenue through large-scale infrastructure projects in the growing Australian market. This could enhance profitability and capital efficiencies through asset recycling. (Likely to impact: Revenue, Earnings)

- Expansion and continued investment in the energy solutions and healthcare sectors, particularly through the expansion of renewable energy and energy-saving services in Europe and the U.S. This is expected to drive revenue growth and improve operating margins over time. (Likely to impact: Revenue, Net Margins)

- The development of Vietnam's largest beef processing plant in collaboration with Vinamilk Group aims to tap into the growing demand for high-quality refrigerated beef. This venture could lead to substantial growth in the consumer industry and agriculture segments in Vietnam's evolving food market. (Likely to impact: Revenue)

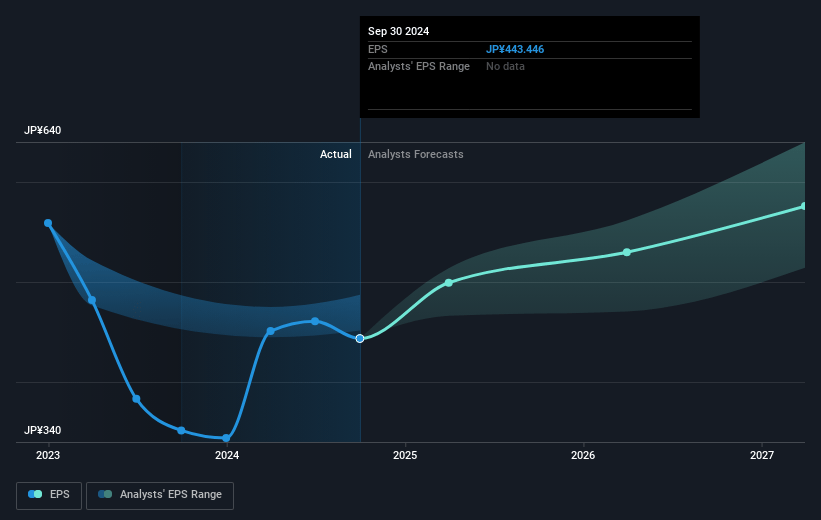

- Ongoing share buybacks and a clear dividend policy are expected to enhance earnings per share (EPS) and appeal to investors by promising predictability in shareholder returns, particularly with the progress shown toward fulfilling medium-term plans and enhancing their PER. (Likely to impact: Earnings per Share)

- Increased transaction volumes and operational improvements in existing businesses within the chemicals and consumer industries, alongside the pursuit of synergies and new business models, indicate strong potential for further revenue growth and profitability improvements. (Likely to impact: Revenue, Net Margins)

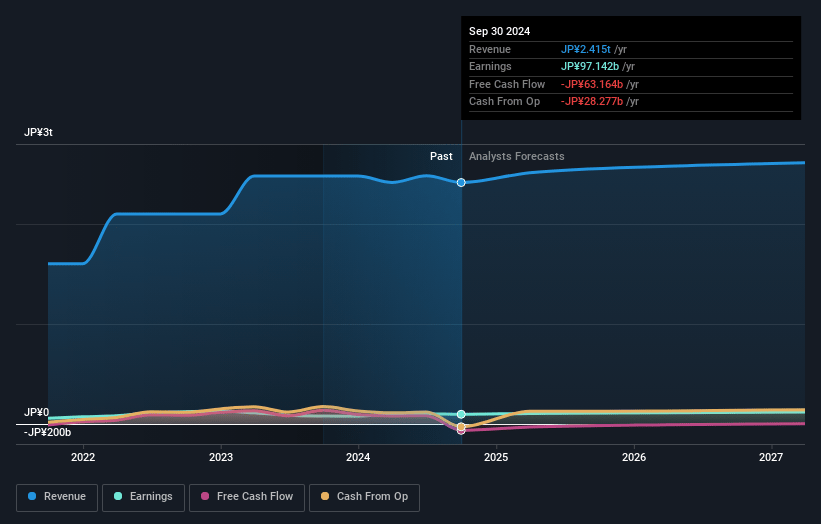

Sojitz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sojitz's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.1% today to 4.6% in 3 years time.

- Analysts expect earnings to reach ¥126.3 billion (and earnings per share of ¥602.09) by about May 2028, up from ¥101.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, up from 7.0x today. This future PE is lower than the current PE for the JP Trade Distributors industry at 9.3x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.68%, as per the Simply Wall St company report.

Sojitz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decline in coal prices and delays in the recovery of production and sales volumes could negatively impact the metals, mineral resources, and recycling segment, affecting overall revenues and net margins.

- Increasing costs due to a weaker yen, increased personnel expenses, business development costs, and inflation could put pressure on net margins despite revenue growth in various segments.

- Risks associated with the automotive sector, such as slow improvement in used car sales in Australia and recovery challenges in the Americas, might hinder the achievement of revenue and profit targets in this segment.

- High levels of investment, such as the ¥47 billion investment in Capella Capital, could initially result in negative free cash flow, impacting short-term earnings and financial flexibility.

- The external environment, including commodity price volatility, foreign exchange fluctuations, and potential interest rate hikes, introduces uncertainties that could impact revenue, cost structures, and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥3980.0 for Sojitz based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5000.0, and the most bearish reporting a price target of just ¥3610.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥2758.7 billion, earnings will come to ¥126.3 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 9.7%.

- Given the current share price of ¥3371.0, the analyst price target of ¥3980.0 is 15.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.