Key Takeaways

- Investments in grid modernization, digitalization, and interconnections underpin steady revenue growth and reinforce Terna's strategic role in the energy transition.

- Favorable regulations and strong project execution drive predictable earnings, offsetting concerns over debt levels and financing costs.

- Heavy capital expenditures, regulatory dependence, and rising grid decentralization risks could constrain Terna's long-term revenue growth, profit margins, and dividend flexibility.

Catalysts

About Terna- Provides electricity transmission and dispatching services in Italy, other Euro-area countries, and internationally.

- Ongoing and accelerating investments in grid modernization, digitalization, and resilience-including AI adoption and smart technologies-position Terna to capture regulated asset base growth and higher-efficiency operations, supporting long-term revenue and margin expansion.

- A sharply rising pipeline of renewables (solar/wind) installations and fast-growing high-voltage grid connections (especially from data centers) is set to drive greater electricity demand and create continuous need for infrastructure upgrades, underpinning stable and rising regulated revenues.

- New cross-border interconnection projects, like the Italy-Greece HVDC link and the Adriatic Link, deliver both diversification and additional revenue streams while reinforcing Terna's role in European energy transition, supporting future consolidated earnings growth.

- Favorable regulatory developments, including the implementation of output-based and performance incentives (OBI and ROSS Integral) and early recognition of capex in tariffs, enhance returns on investment and increase visibility of future cash flows and earnings.

- Robust execution of an expanded multi-year capex plan-with most projects approved and procurement risks largely mitigated-reduces the risk of delays or cost overruns and supports predictable growth in EBITDA, despite current market concerns around debt load and financing costs.

Terna Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Terna's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.3% today to 24.0% in 3 years time.

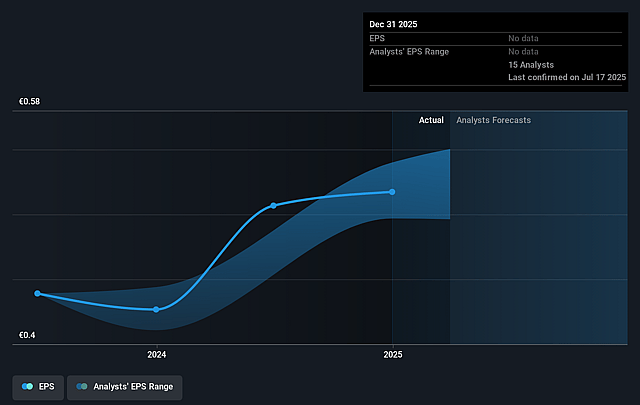

- Analysts expect earnings to reach €1.2 billion (and earnings per share of €0.58) by about September 2028, up from €1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from 16.3x today. This future PE is greater than the current PE for the GB Electric Utilities industry at 14.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

Terna Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant CapEx acceleration-€1.3 billion in the first half of 2025, with net debt rising to €12 billion-raises concerns about increasing leverage; if infrastructure returns lag or project delays occur, higher interest expenses could pressure future net earnings and constrain dividend capacity.

- Heavy reliance on regulated revenues (€1,594 million out of €1,894 million total revenues in H1 2025) makes Terna vulnerable to future regulatory changes, including potential reductions in allowed WACC or stricter tariff recognition, which could negatively impact revenue growth and net margins.

- While large investment plans are in place, any slowdown or plateau in long-term national electricity demand-as hinted by stable national demand year-on-year (153 TWh vs. 152 TWh)-could limit organic revenue growth and undermine the case for return on expanded transmission capacity.

- Technological advancements accelerating the adoption of distributed energy resources (DERs), behind-the-meter solutions, and energy storage have the potential to reduce the critical role of centralized TSOs like Terna, threatening long-term revenue streams as grid decentralization increases.

- Persistent regulatory and political uncertainties (e.g., pending ARERA incentive designs and consultations, and uncertainty around WACC updates) may increase compliance costs, delay project approvals, and add unpredictability to future earnings, particularly affecting long-term revenue visibility and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €8.871 for Terna based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.0, and the most bearish reporting a price target of just €8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.9 billion, earnings will come to €1.2 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of €8.37, the analyst price target of €8.87 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Terna?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.