Key Takeaways

- Rai Way's plan focuses on diversifying services like CDN and Edge Data Centers to enhance revenue predictability and growth.

- Strong cost management and operational focus are expected to protect net margins despite higher energy costs.

- Dependence on RAI and diversification projects like data centers face uncertainties, rising costs, and operational challenges, impacting revenue growth and earnings stability.

Catalysts

About Rai Way- Owns and operates television and radio transmission and broadcasting networks in Italy and internationally.

- Rai Way's new 4-year industrial plan focuses on Media Distribution Services and Digital Infrastructure, aiming to enhance revenue predictability and profitability through diversification into new services like Content Delivery Networks and Edge Data Centers, which can boost future revenue streams.

- The extension of the DAB radio network project with RAI, involving significant capital investment to improve coverage, is expected to generate additional core revenue of approximately €0.2 million per €1 million invested, thereby enhancing future revenue and cash flow.

- Positive trends in the Digital Infrastructure segment show a gradual increase in tower hosting, supported by high single-digit growth from fixed wireless access providers and radio broadcasters, which will likely improve future revenue and margins.

- Rai Way's operational focus on cost reduction has stabilized operating expenses, which, coupled with strong cost management actions, will likely protect or enhance net margins despite anticipated higher energy tariffs.

- The emerging positive response and contracts from the launch of Edge Data Centers and Content Delivery Network services can expand Rai Way's revenue base and are reflected in a potential multiyear revenue backlog, thus offering long-term earnings potential.

Rai Way Future Earnings and Revenue Growth

Assumptions

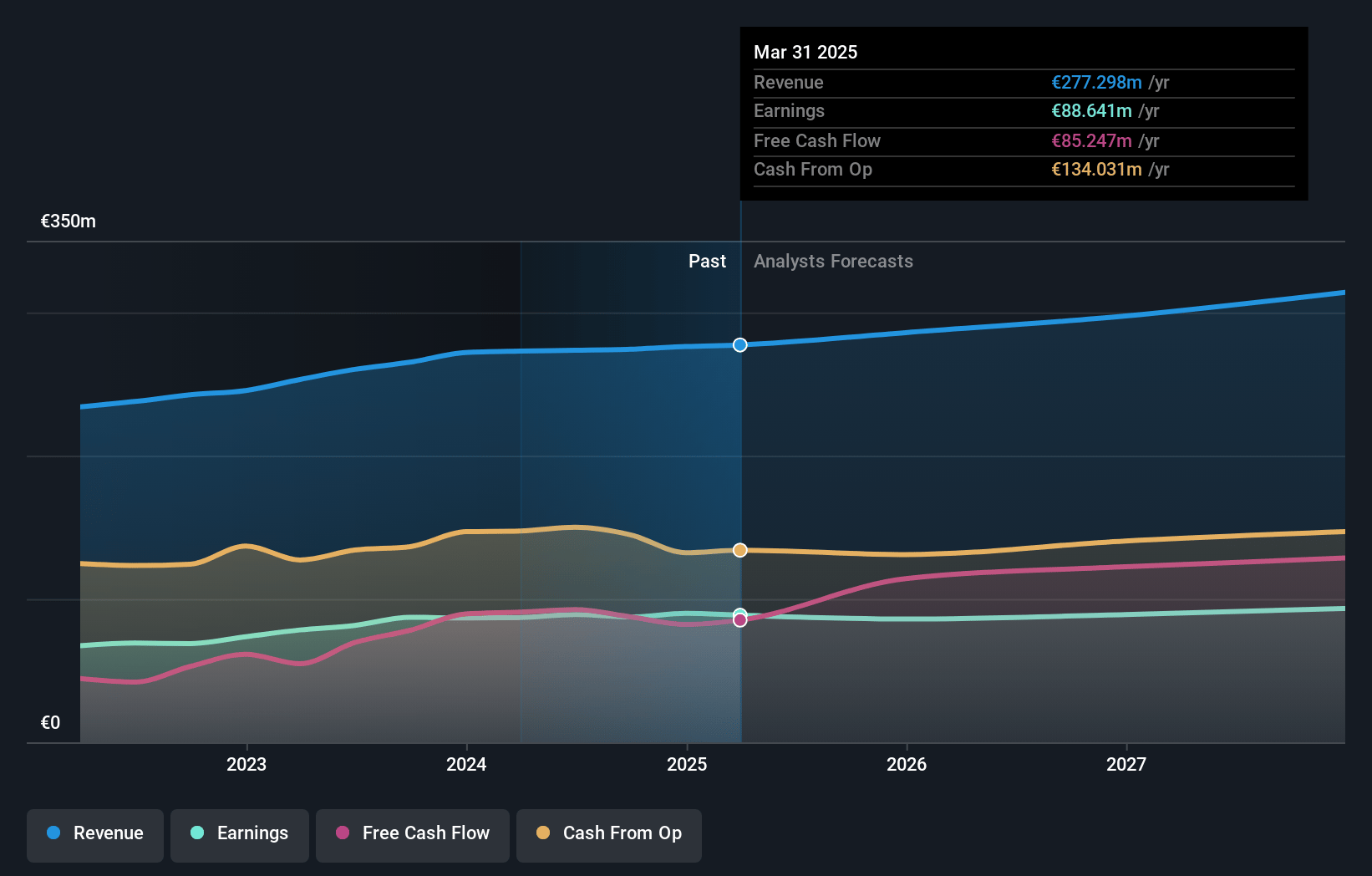

How have these above catalysts been quantified?- Analysts are assuming Rai Way's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.0% today to 29.3% in 3 years time.

- Analysts expect earnings to reach €91.9 million (and earnings per share of €0.34) by about July 2028, up from €88.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from 17.8x today. This future PE is greater than the current PE for the GB Telecom industry at 22.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.58%, as per the Simply Wall St company report.

Rai Way Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainties around the hyperscaler data center project, including potential delays and investment shifts, could affect the pace of revenue generation and growth in the diversified business segment. This impacts future revenue and earnings.

- There is a reliance on RAI for new services and revenue growth, which might not materialize as expected due to contractual delays or other factors, potentially impacting core revenue growth.

- The increasing diversification costs and the dilutive impact on EBITDA, especially with new infrastructure assets like Edge Data Centers and CDN during the initial phase, could pressure overall net margins.

- Rising energy tariffs pose a headwind, adding to operational costs and possibly squeezing net income margins if not sufficiently offset by revenue growth.

- The ongoing steps toward consolidation with 8 towers and any potential financial constraints related to integration could complicate capital expenditure plans and impact shareholder value creation, affecting earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €7.12 for Rai Way based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €314.1 million, earnings will come to €91.9 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of €5.88, the analyst price target of €7.12 is 17.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.