Last Update 14 Dec 25

Fair value Decreased 0.15%PST: Market Will Focus On Interest Income And Dividend Payout Stability

Analysts have nudged their consolidated price target for Poste Italiane slightly higher to about EUR 23, reflecting broadly supportive views on valuation and earnings quality despite only modest tweaks to growth and profitability assumptions.

Analyst Commentary

Recent Street research continues to frame Poste Italiane as a relatively resilient income and rate sensitive name, with most targets clustering just above EUR 21 and moving toward the EUR 23 level. While opinions diverge on upside from here, the latest moves show a gradual upward creep in fair value estimates.

Bullish Takeaways

- Bullish analysts see the step up in price targets toward the EUR 23 to EUR 23.15 range as confirmation that earnings visibility and capital generation support a premium to the historical trading range.

- Stable profitability across postal, financial and insurance activities underpins the case that the group can sustain attractive dividends without stretching solvency metrics.

- JPMorgan's incremental target increase to EUR 21.50 signals confidence in management execution on the current plan, even without assuming aggressive macro or rate upside.

- Supportive views on balance sheet strength suggest that any improvement in interest rate conditions or cross selling could translate efficiently into higher returns on equity, which would justify the higher valuation band.

Bearish Takeaways

- Bearish analysts highlight that, at current levels, the share price already discounts much of the near term earnings growth. This limits scope for multiple expansion despite recent target upgrades.

- Neutral ratings paired with EUR 23 targets from major houses such as Goldman Sachs underscore a view that the stock is fairly valued unless interest income or solvency ratios surprise positively.

- Recent target reductions toward the low EUR 20s and the shift to more cautious ratings indicate concern that execution risk in mail, parcels and financial services could cap upside if economic momentum slows.

- Cautious commentators also point to payout expectations, warning that without a clearly higher and sustainable distribution profile, investors may be reluctant to re rate the shares above the mid EUR 20s.

What's in the News

- Poste Italiane S.p.A. (BIT:PST) was added to the S&P International 700 index, enhancing its visibility among global equity investors (Key Developments).

- The company joined the S&P Europe 350 index, positioning it within a broader benchmark of leading European corporates (Key Developments).

- Poste Italiane was included in the S&P Europe 350 Financials and S&P Europe 350 Financial Services industry group indices, underscoring its role in the regional financial sector (Key Developments).

- The stock was added to the S&P Global 1200 index, further integrating Poste Italiane into major global equity benchmarks (Key Developments).

- Management confirmed guidance for 2025 and reiterated confidence in achieving approximately EUR 2.2 billion net profit for the year (Key Developments).

Valuation Changes

- Fair Value: edged down slightly from about €21.21 to €21.18, indicating a marginally lower intrinsic value estimate.

- Discount Rate: effectively unchanged at around 17.9 percent, implying a stable risk and cost of capital assessment.

- Revenue Growth: reduced significantly from roughly 0.42 percent to about 0.27 percent, reflecting a more conservative top line outlook.

- Net Profit Margin: eased marginally from about 19.16 percent to 19.14 percent, pointing to a nearly stable profitability profile.

- Future P/E: ticked up slightly from around 16.7x to 16.8x, suggesting a modestly higher valuation multiple on forward earnings.

Key Takeaways

- Expansion in e-commerce logistics and digital delivery is driving market share gains and supporting future revenue and margin growth amid declining mail volumes.

- Digital payments, insurance, and omnichannel strategies are boosting profitability, recurring fee income, and customer retention, enhancing long-term earnings resilience.

- Ongoing declines in core mail volumes, rising costs, regulatory and competitive pressures, and interest rate risks threaten profitability and sustainable revenue growth across Poste Italiane's businesses.

Catalysts

About Poste Italiane- Provides postal, logistics, and financial and insurance products and services in Italy.

- Growing parcel volumes, driven by e-commerce and secondhand market acceleration, are enabling Poste Italiane to gain market share in logistics while partially offsetting structural mail declines; continued expansion in last-mile and digital-enabled delivery is likely to support future revenue and margin growth.

- Increasing shift toward digital payments and integrated financial services is strengthening Postepay's performance, with double-digit transaction value growth, higher card usage, and successful cross-selling through the digital ecosystem, supporting higher net margins and recurring fee income.

- Robust growth in insurance, life, and pension products-supported by aging demographics and proactive portfolio rebalancing-indicates a sustainable increase in fee-based revenues and enhanced profitability due to higher-margin multi-class and protection products.

- Execution of Poste Italiane's omnichannel strategy, marked by integration of digital apps (with millions of active users) and physical branches, is driving customer engagement and higher product penetration per client, which is likely to underpin higher retention rates, customer lifetime value, and improved net margins over the long term.

- Strong underlying momentum in financial services-especially record net interest income, resilient retail deposits, and disciplined cost management-combined with an extremely robust solvency ratio and upgraded guidance, points to greater earnings resilience and the capacity for continued dividend growth.

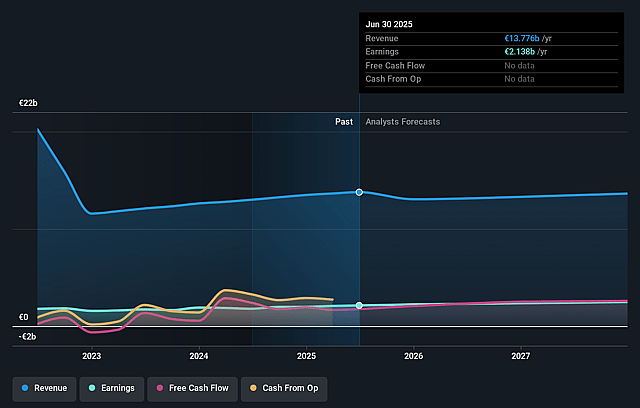

Poste Italiane Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Poste Italiane's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.5% today to 18.7% in 3 years time.

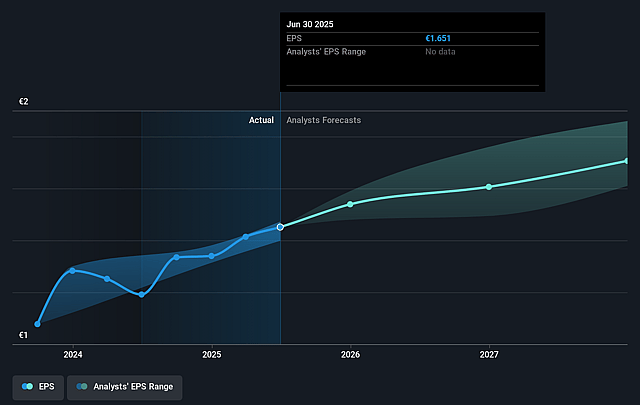

- Analysts expect earnings to reach €2.6 billion (and earnings per share of €1.98) by about September 2028, up from €2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from 11.8x today. This future PE is greater than the current PE for the GB Insurance industry at 12.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.4%, as per the Simply Wall St company report.

Poste Italiane Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing secular decline in traditional mail volumes, only partially offset by repricing, remains a structural headwind; if parcel growth slows or repricing loses effectiveness, core revenues and margins from the Mail, Parcel & Distribution segment will face continued downward pressure, impacting overall group revenue and profitability.

- Poste Italiane's high fixed cost base, including rising HR costs tied to new labor agreements, union-negotiated annual increases, and increased headcount to support business growth, risks margin compression if topline growth stalls or operational leverage does not materialize as planned, weighing on net margins and earnings.

- The company faces potential long-term regulatory and industry risks-such as stricter data privacy, ESG, and financial compliance rules-which could drive up compliance and operational costs, squeezing margins and threatening earnings growth if not managed efficiently.

- Competition from expanding fintechs and global e-commerce/logistics firms, coupled with rapid digitalization in payments and financial services, could erode Poste Italiane's market share and limit its ability to sustain strong growth, directly impacting net margin and asset management fee-based revenue streams.

- Interest rate normalization or a return to a lower rate environment, as well as maturing postal savings products resulting in net outflows, could depress net interest income (NII) and limit investment portfolio returns, thus constraining future revenue growth potential and weakening overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €19.433 for Poste Italiane based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €21.0, and the most bearish reporting a price target of just €16.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €13.9 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 15.4%.

- Given the current share price of €19.45, the analyst price target of €19.43 is 0.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Poste Italiane?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.