Key Takeaways

- Strategic acquisitions and capacity enhancements position Maire to capitalize on strong project pipelines, potentially boosting future revenues.

- Focus on sustainable technology and innovation supports margin enhancement and long-term growth through high-value services.

- Uncertain project timelines, ambitious expansion, and market dynamics pose risks to Maire's revenue growth and profitability due to potential financial strain and supply chain disruptions.

Catalysts

About Maire- MAIRE S.p.A. develops and implements various solutions to enable the energy transition.

- Maire's expansion of the technology portfolio through acquisitions like HyDEP and GasConTec, alongside hiring and bolstering engineering capacity, positions the company to execute its backlog effectively, likely leading to increased future revenues.

- The significant potential awards expected, valued over €6 billion in various geographies, suggest a strong pipeline that could sustain revenue growth in the coming years if these projects are secured.

- The focus on sustainable technology solutions, including advanced technology licensing, decarbonization solutions, and the development of next-generation fuels, offers opportunities to enhance net margins through high-value, high-margin services and technologies.

- The progress and investments in projects like Hail and Ghasha, which are on schedule and expected to contribute significantly to revenues in late 2024, indicate a potential rise in earnings as these projects advance.

- Maire's commitment to sustainable technologies and circular solutions, with investments in low-carbon and green technologies, fosters long-term growth potential, supporting both revenue and EBITDA margins through innovative and economically viable solutions.

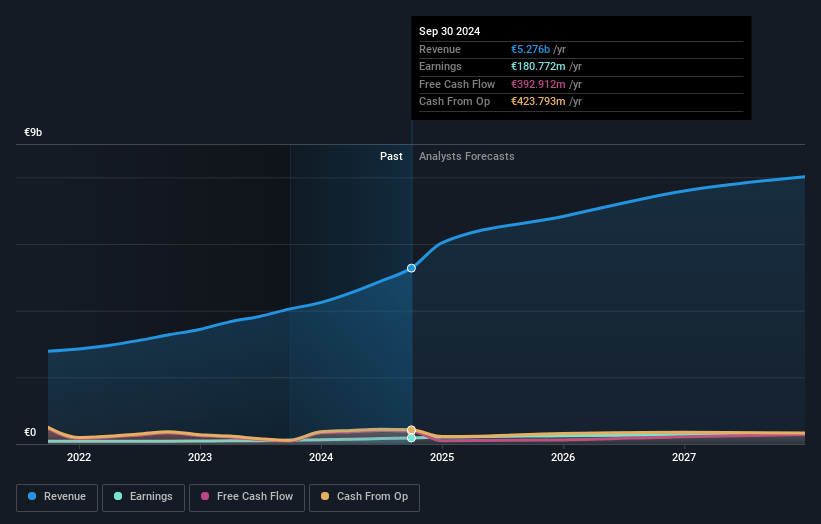

Maire Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Maire's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 4.1% in 3 years time.

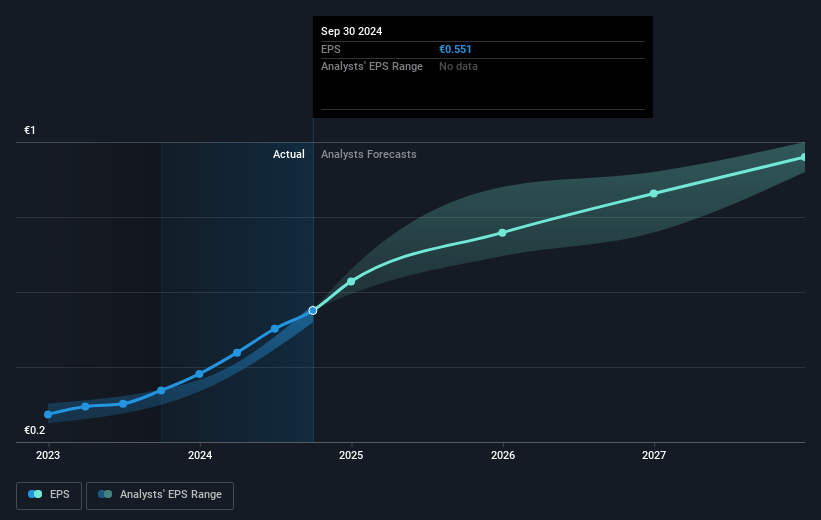

- Analysts expect earnings to reach €318.3 million (and earnings per share of €0.99) by about April 2028, up from €198.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €279 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 13.6x today. This future PE is greater than the current PE for the GB Construction industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.38%, as per the Simply Wall St company report.

Maire Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The timing of €6 billion worth of project awards is uncertain, and delays in these awards—as the timeline is in the hands of the clients—could impact future revenue growth expectations.

- The company's ambitious expansion and heavy investments in new technology could lead to increased capital expenditure and financial strain, potentially affecting net margins if the expected increase in revenues does not materialize.

- The ongoing dependence on procurement from specific geographical regions may expose the company to supply chain disruptions, potentially affecting project timelines, revenue realization, and profitability.

- Expanding into varied and new business lines, such as NextChem, presents a risk of insufficient focus or spread of resources, which might dilute the effectiveness in core profitable areas, impacting consolidated net margins and earnings.

- Market and regulatory dynamics in Europe remain unpredictable, which can slow down commercial pipeline development and present risks to meeting revenue growth targets, particularly if initiatives do not progress as quickly as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €10.825 for Maire based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €12.8, and the most bearish reporting a price target of just €10.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.7 billion, earnings will come to €318.3 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of €8.2, the analyst price target of €10.82 is 24.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.