Key Takeaways

- Progress on renewable and hydroelectric projects positions NHPC for future revenue growth through energy diversification and expanded portfolio.

- Strategic mergers aim to enhance operational efficiencies and potentially improve net margins.

- Operational setbacks, including plant shutdowns and project delays, threaten NHPC's revenue, profitability, and efforts to diversify through renewable energy projects.

Catalysts

About NHPC- Engages in the generation, sale, and trading of electricity through hydro, wind, and solar power stations in India.

- Significant progress and anticipated commissioning of the Subansiri Lower Project by May 2026, which is expected to contribute to revenue growth once operational.

- Upcoming completion of the Parbati-II HE project by February 2025, which should enhance revenue streams due to its 98% physical progress.

- Execution of several renewable energy projects, including solar and floating solar power projects in states like Kerala and Gujarat, expected to be commissioned by August 2025, positioning the company for future increases in revenue from diversification into solar energy.

- Ongoing and planned large-capacity hydroelectric projects such as Dibang and Teesta-VI, expected to be completed by 2032 and 2027 respectively, potentially boosting long-term revenue and expanding NHPC's energy portfolio.

- The merger of subsidiaries like Lanco Teesta Hydro Power Limited and Jal Power Corporation, expected to enhance operational efficiencies and potentially increase net margins upon completion.

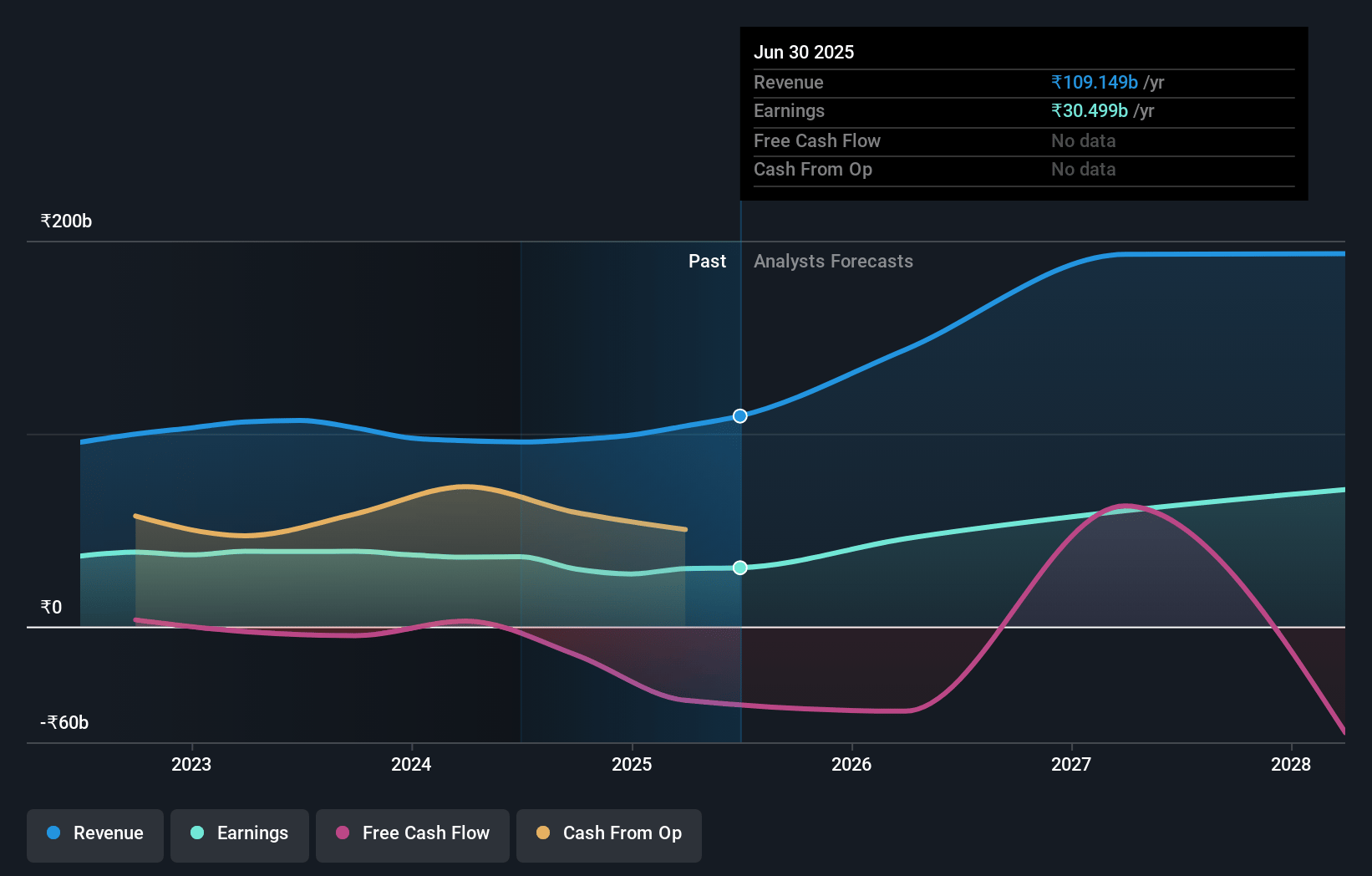

NHPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NHPC's revenue will grow by 32.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.5% today to 33.4% in 3 years time.

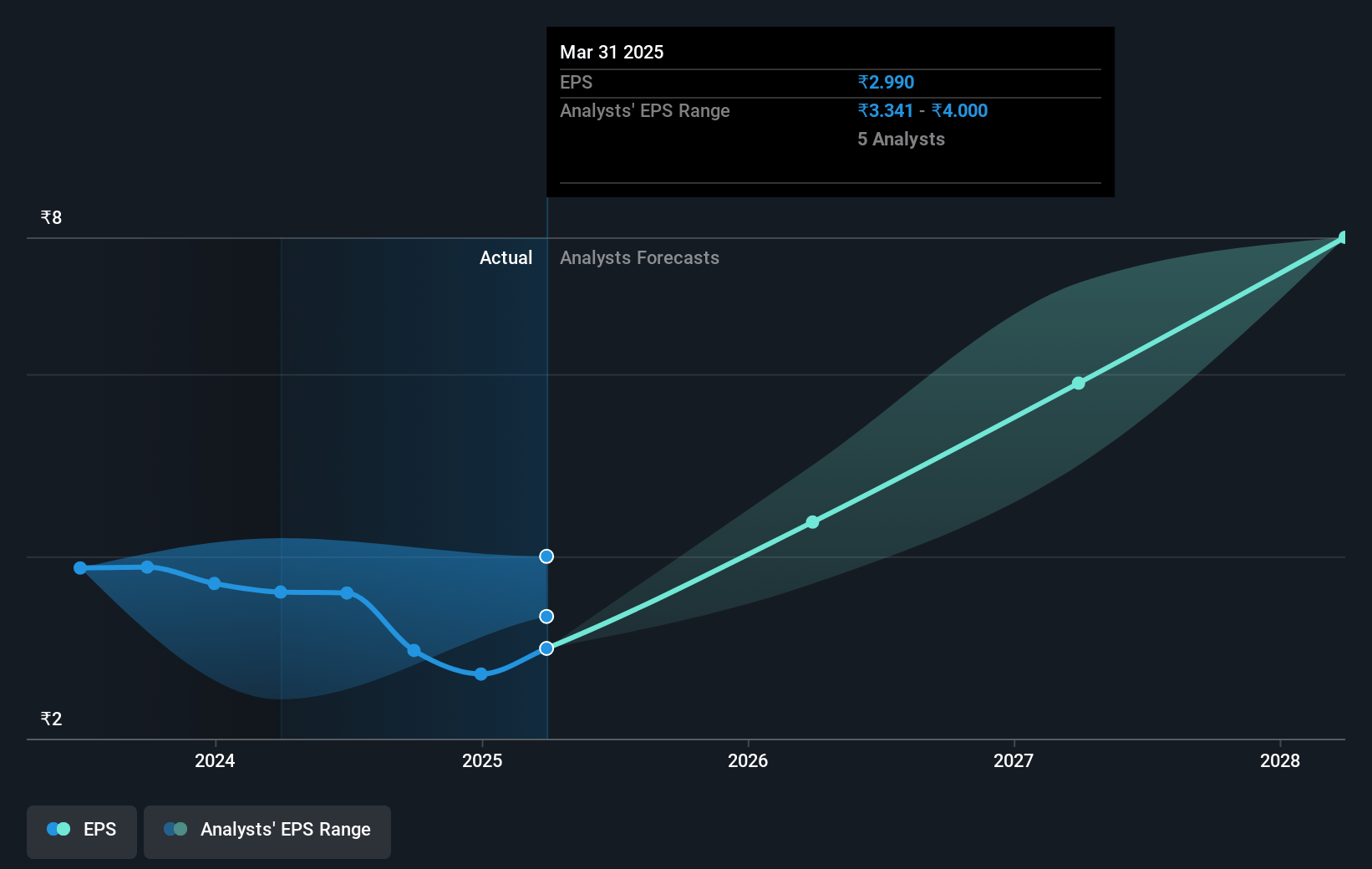

- Analysts expect earnings to reach ₹77.7 billion (and earnings per share of ₹7.53) by about April 2028, up from ₹27.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, down from 33.3x today. This future PE is lower than the current PE for the IN Renewable Energy industry at 28.8x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.89%, as per the Simply Wall St company report.

NHPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The flash floods and subsequent landslide in the Teesta Basin have severely impacted the Teesta-V power station, leading to a complete shutdown. The plant is expected to resume operations only by December 2025, resulting in significant under-recovery and potential loss of revenue amounting to ₹450 crores annually beyond the 12-month insurance coverage period. This adversely affects the revenue and net margins.

- NHPC's plant availability factor has decreased significantly from 91.93% to 82.68% due to several operational challenges, including the complete shutdown of Teesta-V and issues at TLDP-III and Uri-I power stations. This decline in operational efficiency can negatively impact revenue and earnings.

- The company has experienced a notable drop in profit after tax by 23% during half-year financial year '25 compared to the previous year. This decline is linked to reduced power generation and increased finance costs, primarily influenced by higher interest from arbitration and court cases. Both factors could depress net margins.

- There are delays and cost overruns in several key projects, such as Parbati-II HE, with anticipated costs and completion dates being pushed further. These delays can increase financial burdens and result in higher levelized tariffs, impacting future revenue streams and profitability.

- The company faces challenges in signing power purchase agreements (PPAs) for renewable projects at higher tariffs, which could limit the growth and profitability of its renewable energy segment. This poses a risk to the company's ability to diversify and stabilize its long-term revenue sources.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹91.571 for NHPC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹124.0, and the most bearish reporting a price target of just ₹65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹232.5 billion, earnings will come to ₹77.7 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 12.9%.

- Given the current share price of ₹90.37, the analyst price target of ₹91.57 is 1.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.