Key Takeaways

- Tata Power is poised for revenue growth due to high power demand and governmental support for renewable and nuclear energy initiatives.

- Strong renewable energy performance and capex plans indicate profitability, operational efficiency, and future earnings growth.

- High CapEx, significant debt, and uncertainties around nuclear policy could strain Tata Power's financials, impacting margins, earnings, and investor confidence.

Catalysts

About Tata Power- Engages in the generation, transmission, distribution, and trading of electricity in India and internationally.

- Tata Power anticipates increased demand for power in the upcoming year due to a predicted intense summer, which could drive up revenues as they fulfill higher demand for electricity.

- The company is well-positioned to capitalize on government initiatives such as the enhanced budget for the PM Surya Ghar program and potential amendments to the Nuclear Power Act, potentially leading to future revenue growth from expanded renewable energy and nuclear power developments.

- Tata Power's renewable energy business continues to perform strongly, with significant project commissioning and an increase in EBITDA by 38% for this segment, indicating improved profitability and higher margins in the renewable sector.

- The stabilization of Tata Power's manufacturing facilities for cells and modules is expected to result in production at full capacity in the next financial year, which will likely contribute to future earnings and enhanced operational efficiency.

- The ongoing capex plan, including spending on transmission, distribution, and renewable projects, is expected to lead to increased returns and improved earnings, as these investments are capitalized and begin generating revenue in the upcoming years.

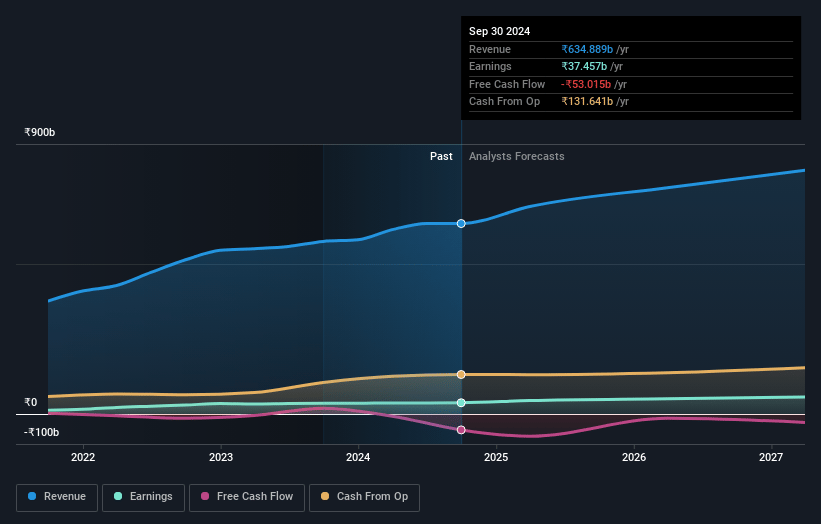

Tata Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tata Power's revenue will grow by 9.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 8.0% in 3 years time.

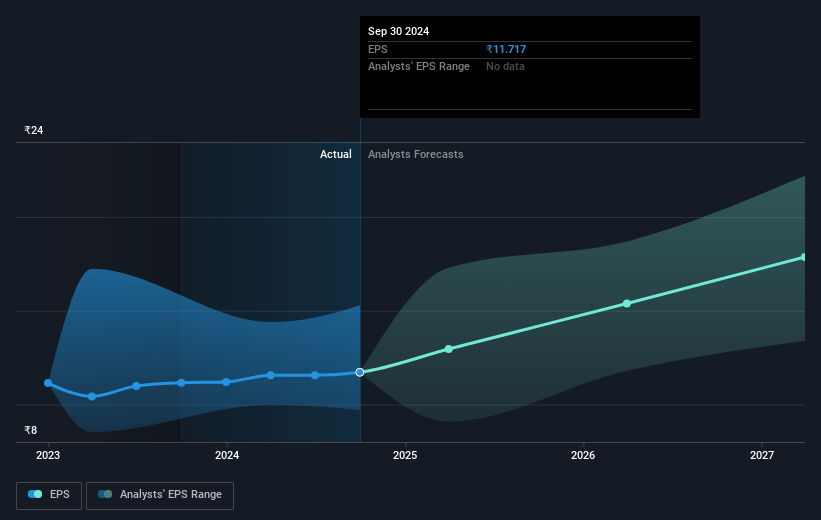

- Analysts expect earnings to reach ₹68.0 billion (and earnings per share of ₹19.1) by about March 2028, up from ₹38.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹47.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, down from 31.1x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 30.3x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Tata Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growth in power demand might not match the levels witnessed in previous years, potentially impacting future revenue projections for Tata Power.

- The amendment to the Nuclear Power Act introduces many uncertainties, including issues regarding foreign investment and fuel sourcing, which could delay benefits from this opportunity and affect future earnings.

- High CapEx spending of ₹22,000 crores planned might strain financial resources and pressure net margins in the short to medium term.

- The company’s debt remains significant at ₹44,700 crores, with potential impacts on net earnings, especially if interest rates rise or if there's volatility in cash flow.

- The volatility in intersegment eliminations and financial disclosures might hinder predictability, risking investor confidence affecting stock valuation and future profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹420.524 for Tata Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹560.0, and the most bearish reporting a price target of just ₹265.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹847.3 billion, earnings will come to ₹68.0 billion, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹371.6, the analyst price target of ₹420.52 is 11.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.