Key Takeaways

- Diversification in growth sectors and strategic expansions are poised to drive significant future revenue and profitability.

- Strategic acquisitions and new facility initiatives aim to enhance technological capabilities and secure higher-margin contributions.

- Rapid expansion, macroeconomic uncertainties, reliance on government subsidies, and high competition pose significant risks to revenue growth, margins, and cash flows.

Catalysts

About Kaynes Technology India- Operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally.

- The company's order book has significantly increased, with large orders in sectors such as industrial, EV, aerospace, medical, and automotive. This diversification in key growth verticals is expected to drive future revenue growth.

- New initiatives, such as the OSAT facility in Gujarat and the HDI PCB factory in Tamil Nadu, are progressing well and are expected to begin generating revenue by Q4 FY '26. These projects are anticipated to improve earnings due to potentially higher margin contributions.

- The integration of Iskraemeco India along with expansions in smart meter production highlight a growing and robust order book that necessitates increased capacity, which can enhance revenues and profitability over time.

- The acquisition of a majority stake in Sensonic, an AI-based railway network safety solution company, represents a strategic move towards expanding technological capabilities and enhancing margins through higher-value offerings.

- The implementation of strategies for geographical expansion, ODM capability, and deepening technology footprints is aimed at substantial long-term revenue growth and margin improvement, targeting a high CAGR and elevated profitability.

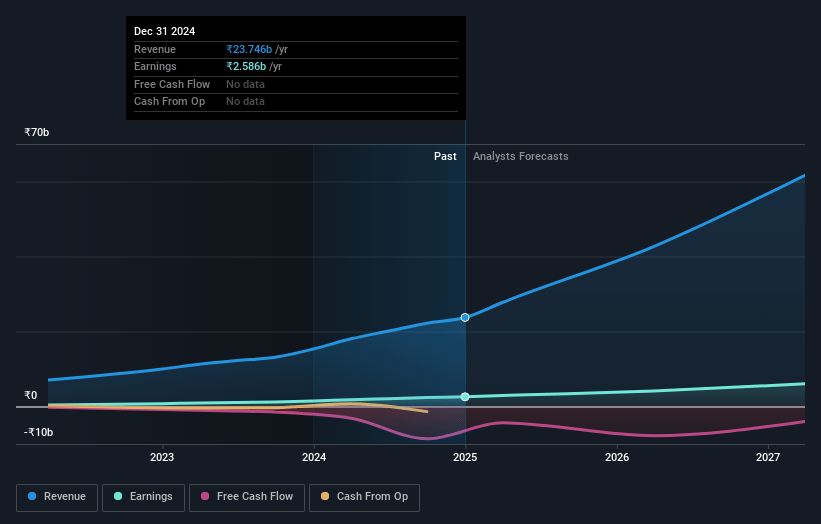

Kaynes Technology India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kaynes Technology India's revenue will grow by 45.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.9% today to 8.9% in 3 years time.

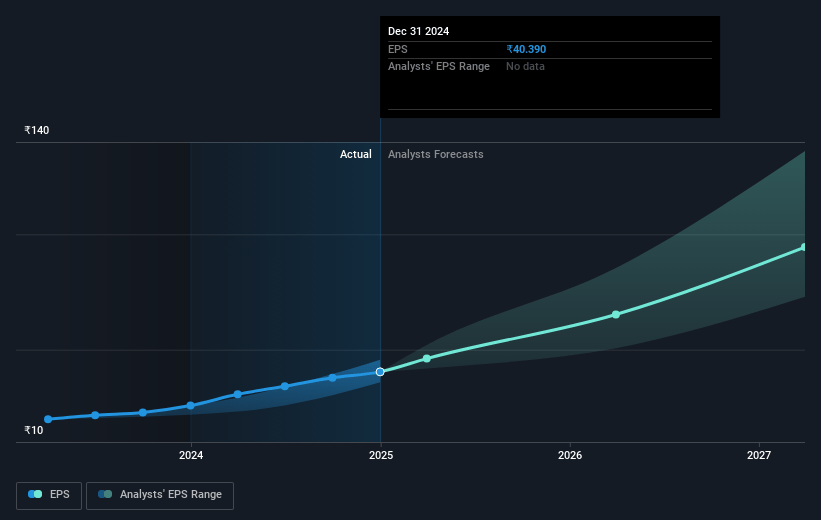

- Analysts expect earnings to reach ₹6.5 billion (and earnings per share of ₹102.09) by about April 2028, up from ₹2.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹8.7 billion in earnings, and the most bearish expecting ₹4.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 80.2x on those 2028 earnings, down from 140.2x today. This future PE is greater than the current PE for the IN Electronic industry at 38.0x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.36%, as per the Simply Wall St company report.

Kaynes Technology India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's rapid expansion, including the construction of new facilities and acquisitions, carries substantial execution risk, which could affect its ability to maintain steady revenue growth and increase margins.

- Macroeconomic uncertainties and potential government budget reallocations towards consumption rather than infrastructure investment could slow down demand in key sectors like aerospace, railways, and semiconductors, impacting future revenues and earnings growth.

- The dependence on significant government subsidies and approvals for projects like the OSAT facility and HDI PCB could introduce unpredictability in capital deployment and project timelines, potentially affecting margins and earnings if delays occur.

- High working capital requirements and the scaling of new acquisitions could strain cash flows and result in increased debt levels, which might pressure net margins and return on equity in the short to medium term.

- Intense competition and reliance on securing large orders in sectors like aerospace and smart meters mean that any project delays or client acquisition obstacles could directly impact revenue projections and profitability margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5480.105 for Kaynes Technology India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6633.0, and the most bearish reporting a price target of just ₹4365.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹73.2 billion, earnings will come to ₹6.5 billion, and it would be trading on a PE ratio of 80.2x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹5671.2, the analyst price target of ₹5480.11 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.