Key Takeaways

- Strategic positioning in defense indigenization and innovative product development promises robust revenue growth and new revenue streams.

- Strong order books and focus on export and domestic contracts ensure sustained high EBITDA margins and potential earnings from joint ventures.

- Heavy domestic defense reliance and limited export diversification pose risks to Astra Microwave's revenue stability amid potential government policy changes and supply chain disruptions.

Catalysts

About Astra Microwave Products- Designs, develops, manufactures, and sells sub-systems for radio frequency and microwave systems used in defense, space, meteorology, civil, and telecommunication applications in India.

- Astra Microwave Products is strategically positioned to benefit from the push towards defense indigenization, and aims for 15-20% top line growth in the coming year, which may positively impact future revenue.

- Significant growth potential in the radar and electronic warfare domains, with expected future orders delivery contributing to revenue growth for FY '26 and '27.

- The company is developing innovative products like ground penetration radars and scalable anti-drone technology, which can lead to additional revenue streams.

- The joint venture, Astra Rafael, has outperformed with an ₹475 crores order book, indicating potential for increased earnings contribution from associates.

- The company's focus on build-to-spec contracts for exports and significant domestic orders, like from the Indian Army, promises to sustain high EBITDA margins of 25-30% moving forward.

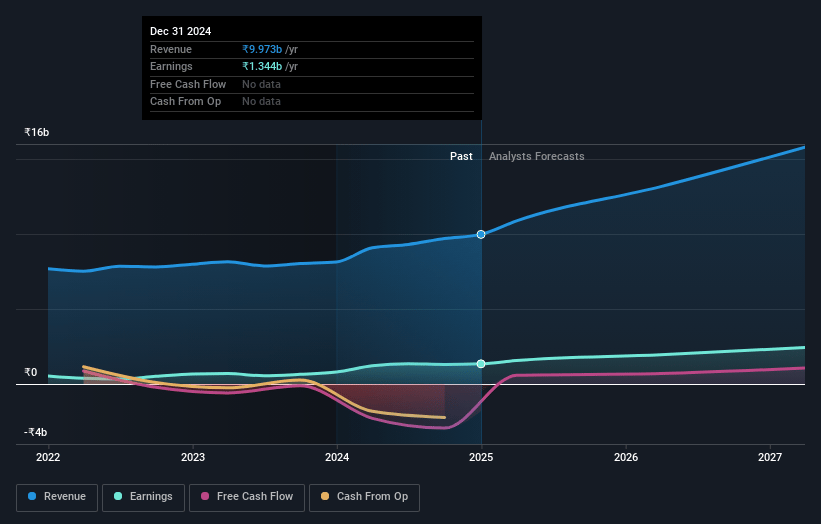

Astra Microwave Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Astra Microwave Products's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.5% today to 16.1% in 3 years time.

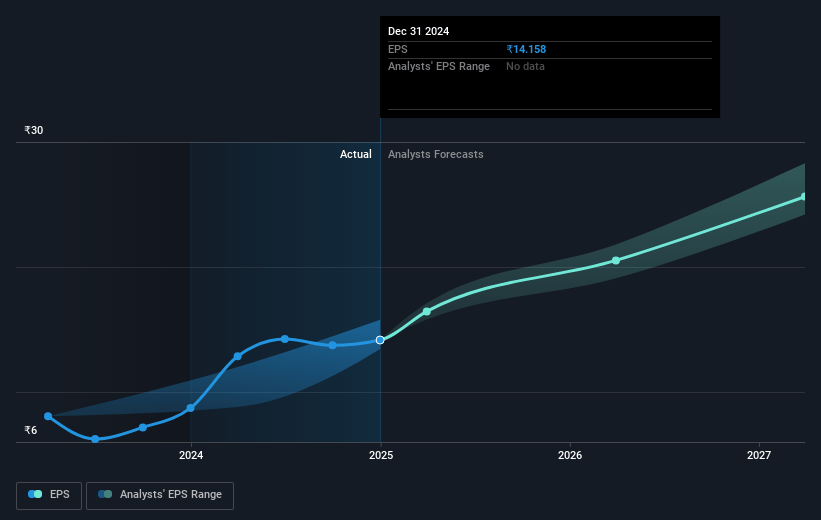

- Analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹30.87) by about May 2028, up from ₹1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.3x on those 2028 earnings, down from 58.4x today. This future PE is greater than the current PE for the IN Communications industry at 32.9x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.85%, as per the Simply Wall St company report.

Astra Microwave Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant reliance on the domestic defense market, with 85% of revenue coming from domestic orders, exposes Astra Microwave to risks associated with changes in government defense budgets or policies, which could affect future revenue stability.

- The increase in interest costs, partly due to higher working capital borrowings, suggests potential cash flow pressures that could affect net margins if the company cannot manage its financing costs effectively.

- The company heavily depends on a few segments like radar and EW for substantial portions of its order book. Any disruptions or delays in these segments, such as the delayed Uttam AESA radar orders for the Tejas Mk1A program, may impact revenue growth projections.

- Despite efforts to shift towards high-margin build-to-spec export opportunities, current export orders are limited to a small percentage (8.4% of total revenue), indicating potential vulnerability if domestic opportunities diminish, potentially impacting long-term earnings growth.

- Risks in supply chain disruptions, as noted in past quarters, and geo-political tensions in regions like Israel and Ukraine could exacerbate procurement challenges, thereby affecting order fulfillment and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹913.25 for Astra Microwave Products based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹980.0, and the most bearish reporting a price target of just ₹768.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹18.2 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 43.3x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹827.4, the analyst price target of ₹913.25 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.