Key Takeaways

- Proactive leasing strategy and development pipeline suggest potential revenue and earnings growth through increased occupancy and stabilized NOI yields.

- Strong hospitality sector performance and acquisition plans could drive revenue growth, despite anticipated interest cost increases.

- Exposure to sector-specific risks and variable interest rates could pressure revenue stability and net margins amidst global trade uncertainties and potential project delays.

Catalysts

About Embassy Office Parks REIT- Owns, operates, and invests in real estate and related assets in India.

- Embassy Office Parks REIT's proactive leasing strategy, with 6.6 million square feet leased in FY 2025, exceeding guidance by 22%, and expected occupancy growth to 90-91% by FY 2026, suggests potential for future revenue increases.

- Significant development pipeline with 6.1 million square feet, of which 3.2 million square feet is scheduled for delivery in FY 2026 and already 68% pre-leased, is poised to bolster future revenue and earnings growth through stabilized NOI yields of 18%.

- Hospitality sector performance with a significant year-on-year EBITDA increase of 25% and RevPAR growth of 26% paves the way for continued revenue and earnings enhancements.

- Plans to explore sponsor and third-party acquisition opportunities, along with a stable growth outlook in India's GCC demand, could potentially accelerate revenue growth and improve earnings.

- Expectation of FY '26 NOI growth of 13% alongside a corresponding 10% DPU growth indicates robust operating cash flow prospects, despite projected interest cost increases.

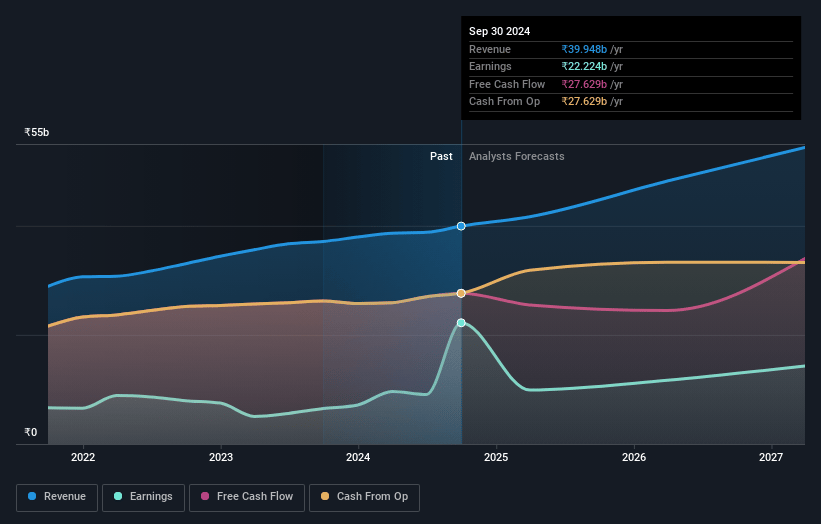

Embassy Office Parks REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Embassy Office Parks REIT's revenue will grow by 14.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.8% today to 20.9% in 3 years time.

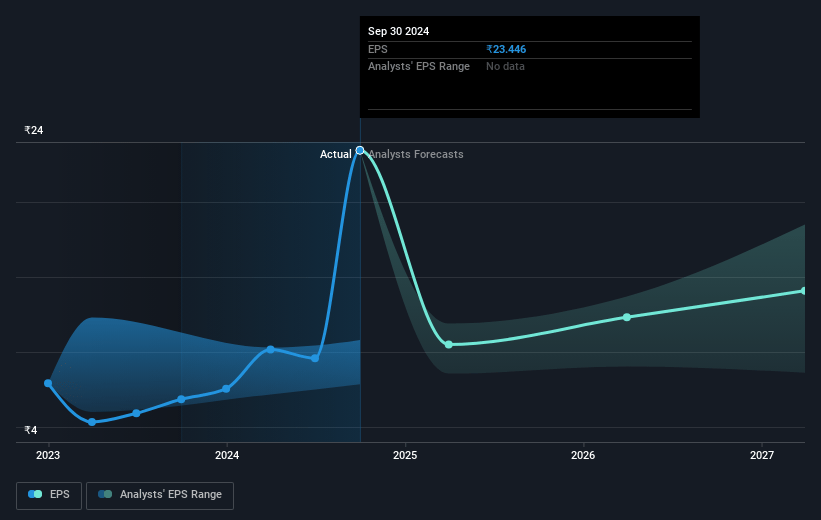

- Analysts expect earnings to reach ₹13.0 billion (and earnings per share of ₹13.58) by about May 2028, down from ₹16.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.2x on those 2028 earnings, up from 22.3x today. This future PE is lower than the current PE for the IN Office REITs industry at 46.0x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.11%, as per the Simply Wall St company report.

Embassy Office Parks REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty around tariffs and their potential impact on global trade could be a risk, as management remains cautious despite believing there will be no long-term impact on demand for Indian office space. This uncertainty could impact leasing revenue.

- A significant portion of the debt is at floating interest rates, and an increase in interest rates beyond expectations could lead to higher interest expenses, affecting net margins and earnings.

- The continued softness in occupancy at properties like Quadron could impact total occupancy rates and revenue growth, especially if market conditions do not improve in that region.

- Any significant delays or cost overruns in the development pipeline of 6.1 million square feet could impact projected NOI (Net Operating Income) growth and earnings.

- The reliance on GCCs (Global Capability Centers) for occupancy, mainly in sectors like technology and financial services, exposes the company to sector-specific risks which could impact occupancy rates and, by extension, revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹420.25 for Embassy Office Parks REIT based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹62.2 billion, earnings will come to ₹13.0 billion, and it would be trading on a PE ratio of 44.2x, assuming you use a discount rate of 13.1%.

- Given the current share price of ₹381.77, the analyst price target of ₹420.25 is 9.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.