Key Takeaways

- Strategic acquisitions and joint ventures at Alibaug, combined with premium pricing and resale value at Borivali and Goregaon, can boost future revenues and margins.

- Diverse project launches and developments in premium destinations are set to enhance revenue potential and drive aggressive future growth and diversification.

- Market demand softening, regulatory delays, and large upfront investments pose risks to revenue growth, cash flow, and short-term financial flexibility.

Catalysts

About Oberoi Realty- Engages in real estate development and hospitality businesses in India.

- Oberoi Realty has concluded a transaction by acquiring Nirmal Lifestyle Realty Private Limited and entered into a joint development agreement for 81 acres at Alibaug, which could substantially increase their land bank and future development pipeline, potentially boosting future revenue.

- The company’s strategic price increases at Borivali and Goregaon, coupled with high resale price premiums, indicate a pricing power that can positively impact future net margins and earnings.

- The integration of lifestyle amenities, such as the JW Marriott, a mall, and an international school at Oberoi Garden City in Thane, is likely to create a unique ecosystem, positioning the development as a premium destination, which could significantly enhance the project’s revenue potential.

- The anticipated launch of multiple projects across diverse locations in the next fiscal year, including Gurgaon, Adarsh Nagar, Pedder Road, and Tardeo, reflects an aggressive expansion strategy that may contribute to future revenue growth and diversification.

- Upcoming launch of the Borivali mall and improved connectivity due to infrastructure development are expected to enhance the attractiveness of their projects, supporting higher sales velocity and potentially better revenue realization in future quarters.

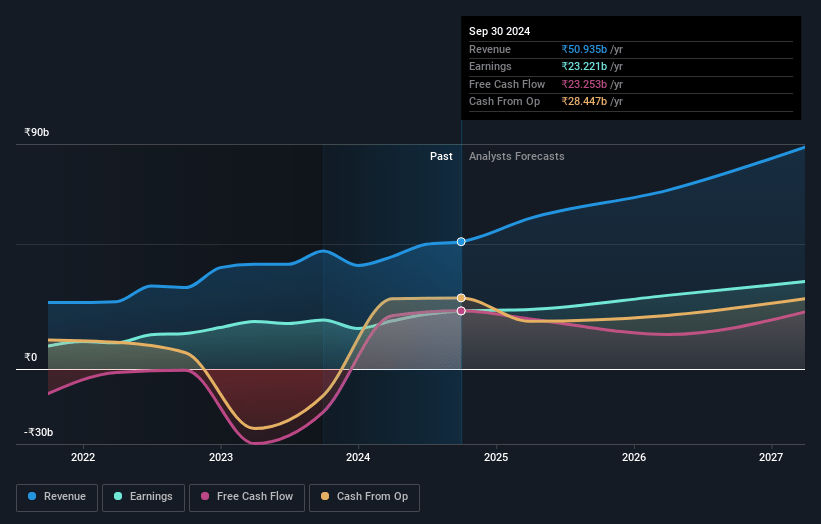

Oberoi Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oberoi Realty's revenue will grow by 20.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.3% today to 38.7% in 3 years time.

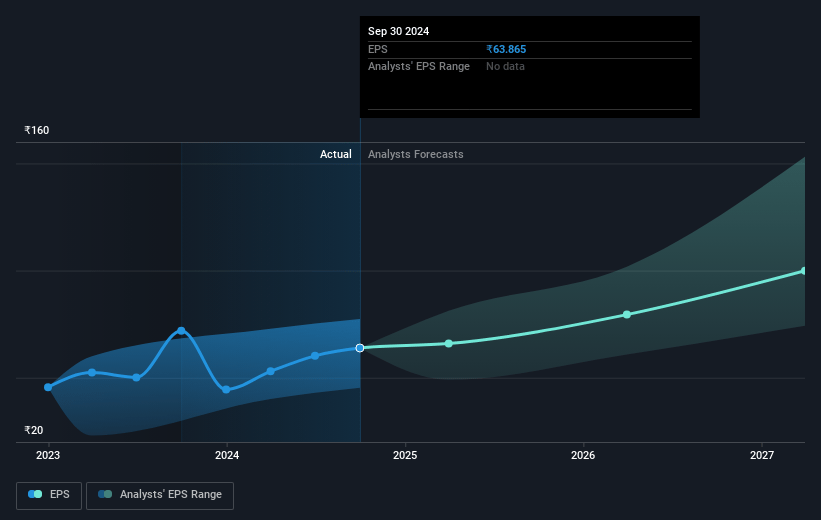

- Analysts expect earnings to reach ₹36.9 billion (and earnings per share of ₹109.24) by about April 2028, up from ₹25.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹43.6 billion in earnings, and the most bearish expecting ₹27.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, up from 23.1x today. This future PE is lower than the current PE for the IN Real Estate industry at 32.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.64%, as per the Simply Wall St company report.

Oberoi Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slow presales performance in Three Sixty West and Borivali during the past quarter indicates potential demand softening or pricing issues, which could impact revenue and cash flow expectations.

- Delayed launches, with significant reliance on timing and market readiness for large projects, pose a risk to future revenue growth if strategic launch pacing is not aligned with demand cycles.

- Completion and launch dependencies on regulatory approvals, such as the Versova land case and SRA developments, introduce execution risk that may impact timely revenue realization.

- The high upfront payments for land acquisition, like the Alibaug transaction, can strain operating cash flows and limit immediate liquidity, affecting short-term financial flexibility and investment capacity.

- Reliance on market-driven resale prices to justify higher selling prices could lead to market pushback and reduce sales velocity, impacting net margins and financial projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1990.13 for Oberoi Realty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2650.0, and the most bearish reporting a price target of just ₹1175.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹95.4 billion, earnings will come to ₹36.9 billion, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹1641.4, the analyst price target of ₹1990.13 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.