Key Takeaways

- Strategic shifts towards high-growth residential markets and monetization of existing assets aim to enhance market share and improve financial metrics.

- Emphasis on customer experience, fiscal prudence, and high-margin projects is expected to stabilize earnings and boost long-term profitability.

- Focus on limited cities and luxury segments, alongside exiting affordable housing, could result in revenue fluctuations amid high execution risk and stiff competition.

Catalysts

About Mahindra Lifespace Developers- Engages in the real estate and infrastructure development business in India.

- Strategic focus on high-growth residential markets in key cities like Mumbai, Pune, and Bangalore, alongside exiting less profitable segments, aims to bolster revenue growth significantly by enhancing market share in areas with robust demand and premium pricing.

- The decision to monetize existing land parcels without new acquisitions, combined with improvements in obtaining approvals, strengthens their development pipeline, potentially increasing IRRs and improving net margins.

- A conservative approach towards project cost estimation with contingencies and escalation clauses, coupled with a shift towards high-margin premium projects, is expected to stabilize or improve earnings by preventing past cost overruns from recurring.

- The ongoing focus on improving customer experience from pre-purchase to possession for premium projects, creating sustained sales momentum, is likely to enhance revenue recognition patterns and long-term profitability.

- Plans to judiciously deploy funds from rights issues and maintain fiscal prudence with a low debt-to-equity ratio while targeting strategic acquisitions will ensure improved financial efficiency, thus positively impacting net margins and overall earnings.

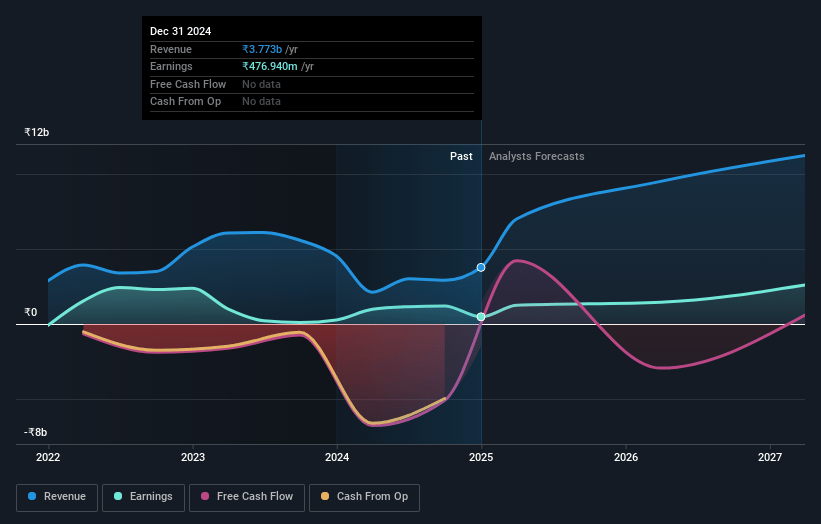

Mahindra Lifespace Developers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mahindra Lifespace Developers's revenue will grow by 50.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.5% today to 17.2% in 3 years time.

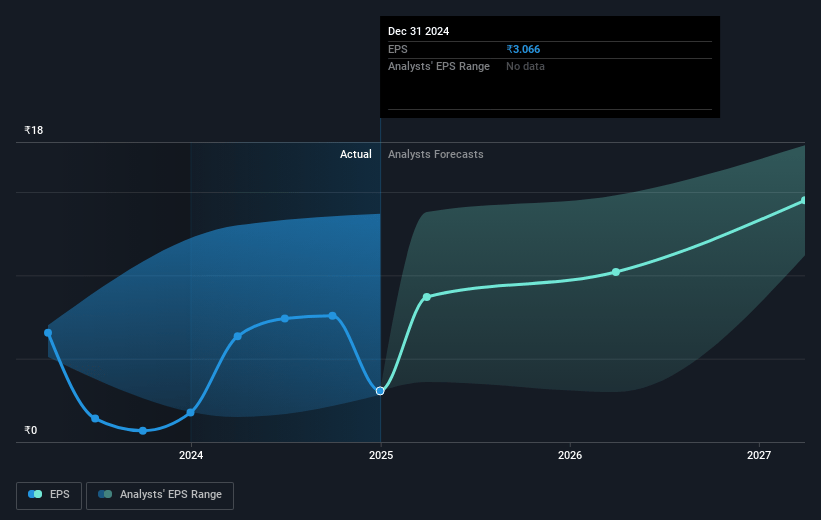

- Analysts expect earnings to reach ₹2.2 billion (and earnings per share of ₹14.1) by about July 2028, up from ₹612.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 85.2x on those 2028 earnings, down from 132.8x today. This future PE is greater than the current PE for the IN Real Estate industry at 35.3x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.43%, as per the Simply Wall St company report.

Mahindra Lifespace Developers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's withdrawal from markets like Nagpur, Hyderabad, and NCR to focus on limited cities could reduce geographical diversification, potentially impacting future revenue growth if the chosen markets face any downturns.

- Exiting the affordable housing segment, which hasn't performed well, might help streamline focus, but it also means losing out on a market segment that could provide stable revenues, thus impacting overall revenue potential.

- There is high execution risk associated with large, ambitious projects such as Bhandup, where delays or inability to meet expectations could adversely affect project IRRs and net margins.

- The significant reliance on premium and luxury segments, where the market is reportedly slowing down, could lead to revenue fluctuations if economic conditions change or customer demand decreases.

- Rising competition and aggressive bidding practices in certain markets like the Andheri Lokhandwala project could challenge the ability to maintain desired profit margins and IRRs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹567.5 for Mahindra Lifespace Developers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹700.0, and the most bearish reporting a price target of just ₹382.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹12.7 billion, earnings will come to ₹2.2 billion, and it would be trading on a PE ratio of 85.2x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹381.55, the analyst price target of ₹567.5 is 32.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.