Key Takeaways

- Substantial future growth expected from Revlimid allocation, semaglutide launch, and first-to-file ANDA drug launches, enhancing revenue and earnings.

- Strategic focus on cash utilization and growth in Crop Health Sciences and acquisitions may improve revenue base and long-term earnings stability.

- Dependence on non-operational income and export fluctuations cause revenue and profit concerns, while high R&D and unused cash reserves question strategic growth execution.

Catalysts

About NATCO Pharma- A pharmaceutical company, engages in the developing, manufacturing, and marketing of finished dosage formulations, active pharmaceutical ingredients (APIs), and intermediates in India, the United States, and internationally.

- The company expects a significant new allocation of Revlimid, nearly 1/3 of the total market, to commence starting in the next quarter, which could lead to substantial future revenue growth.

- NATCO Pharma is anticipating a potential launch of semaglutide in the Indian market by March 2026, subject to regulatory approvals. This could open new revenue streams and impact earnings positively due to its large market potential.

- The strong pipeline for first-to-file ANDA applications, including significant drugs like risdiplam and olaparib, may enhance future revenue and earnings as these drugs get launched over the coming years.

- The company is working towards achieving a breakeven in its Crop Health Sciences division by targeting increased revenues next year, which could positively contribute to overall net margins and earnings in the long term.

- With over ₹3,000 crores in net cash available, NATCO Pharma is exploring acquisitions to strengthen its rest-of-world (ROW) business and U.S. front-end operations. This could broaden its revenue base and enhance earnings stability.

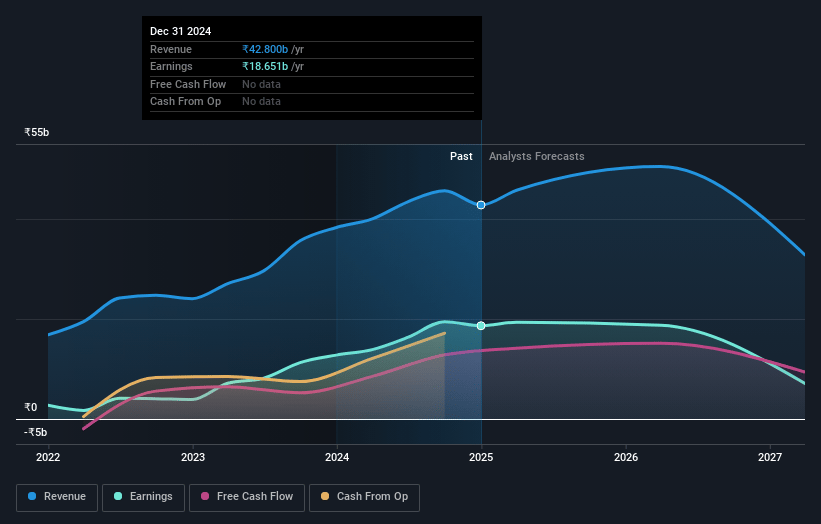

NATCO Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NATCO Pharma's revenue will decrease by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 43.6% today to 20.6% in 3 years time.

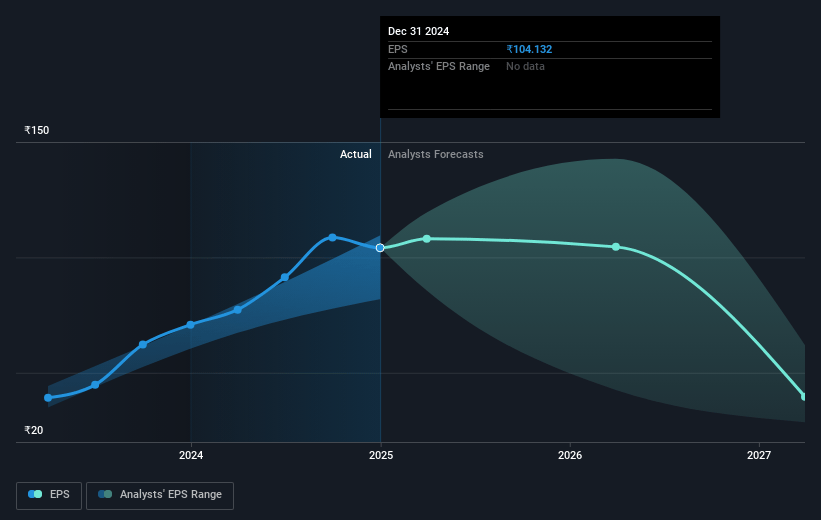

- Analysts expect earnings to reach ₹7.0 billion (and earnings per share of ₹38.79) by about May 2028, down from ₹18.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹11.1 billion in earnings, and the most bearish expecting ₹5.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.1x on those 2028 earnings, up from 8.2x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 29.8x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

NATCO Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant drop in revenue in Q3 FY '25 compared to the same period last year, primarily due to lower contributions from the export formulation business, suggests fragility in revenue dependencies. This impacts overall revenue consistency.

- The company's profits were buoyed by other income, notably a one-time gain from a land sale, raising concerns about the sustainability of earnings from core operations, which impacts net margins.

- The absence of Revlimid sales this quarter due to the exhaustion of allocation and reliance on future allocations introduces vulnerability and unpredictability in revenue forecasting.

- High R&D expenses, necessary for ongoing projects, exert pressure on cash flows and profitability. If these projects do not deliver expected payoffs, net margins could be impacted.

- The company's substantial cash reserves indicate potential for acquisitions, but the lack of execution in acquisitions to date raises questions about future growth strategies and utilization of cash to drive earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1099.333 for NATCO Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1675.0, and the most bearish reporting a price target of just ₹710.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹33.9 billion, earnings will come to ₹7.0 billion, and it would be trading on a PE ratio of 40.1x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹850.9, the analyst price target of ₹1099.33 is 22.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.