Key Takeaways

- Strategic GLP-1 market entry and Bhopal facility ramp-up are expected to boost revenue and margins through innovation and operational efficiency.

- Cost structure optimization and debt reduction enhance financial leverage, improving net and EBITDA margins while reducing interest expenses.

- Underutilized units, competitive pressure, and slow regulatory processes may hinder margin improvement, growth, and earnings, while high debt limits financial flexibility.

Catalysts

About Eris Lifesciences- Provides domestic branded formulations for chronic and sub-chronic therapies in India.

- The company is preparing for a strategic entry into the GLP-1 market with Semaglutide, leveraging its partnership and pre-manufacturing capabilities. This move is anticipated to drive significant revenue growth as the company aims to be among the first to launch in India.

- Eris Lifesciences is actively reducing its cost structure by integrating businesses and achieving synergies, as evidenced by the 460 basis points decline in fixed expense ratio. This is expected to impact net margins positively.

- A focused reduction in net debt from ₹2,600 crores to ₹2,100 crores ahead of target is set to improve the company’s financial leverage and lower interest expenses, thereby boosting earnings.

- The company's robust R&D pipeline is expected to fuel organic growth through innovative product launches, particularly in the diabetes segment with new combinations like Dapagliflozin. This innovation is aimed at increasing revenue.

- The operational ramp-up of the Bhopal facility for in-sourcing insulin operations is projected to enhance gross margins substantially, which will further improve EBITDA margins in the forthcoming fiscal periods.

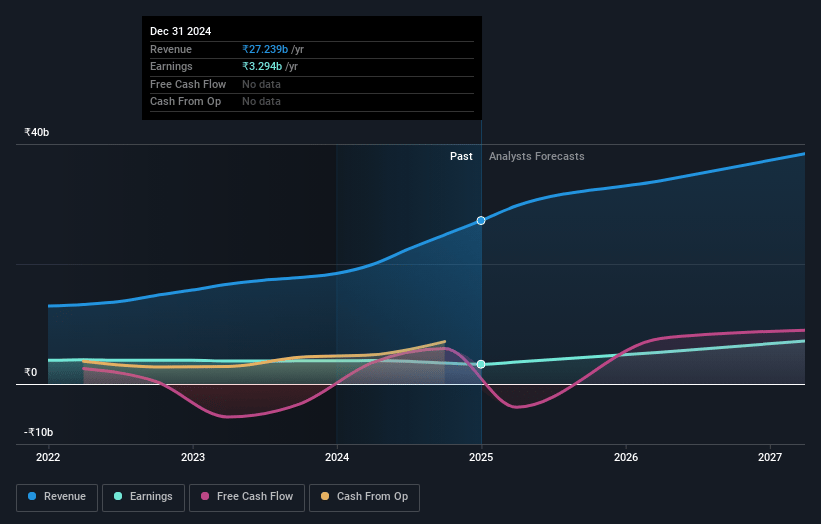

Eris Lifesciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eris Lifesciences's revenue will grow by 16.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.1% today to 21.3% in 3 years time.

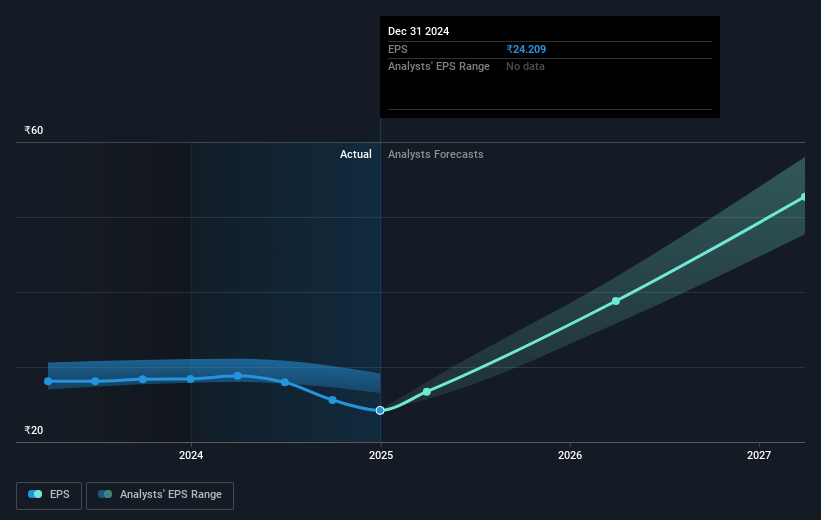

- Analysts expect earnings to reach ₹9.1 billion (and earnings per share of ₹66.88) by about March 2028, up from ₹3.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, down from 55.4x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 28.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Eris Lifesciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decline in gross margin by 518 bps over the 9-month period due to changes in business mix, particularly in the Biocon segments, which could negatively impact profitability despite efforts to offset with reduced fixed expenses. [Net Margins]

- The Bhopal and Ahmedabad manufacturing units are currently a drag on EBITDA due to underutilization, and although expected benefits are anticipated, delays in operationalizing insourcing could postpone margin improvements. [EBITDA]

- Competitive pressures and the potential impact of underperformance in sales from recently acquired businesses or new product lines could constrain the expected organic growth of 14%-15%, limiting revenue expansion. [Revenue]

- Prolonged regulatory and market acceptance processes for new product launches, like recombinant Semaglutide, pose a risk to anticipated timelines and financial outcomes, which may affect future earnings. [Earnings]

- The ongoing debt level, although reducing, could still limit financial flexibility. While the company anticipates reaching a sustainable debt-to-EBITDA ratio, any market or operational setbacks could hinder progress. [Capital Structure]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1509.222 for Eris Lifesciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1700.0, and the most bearish reporting a price target of just ₹1270.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹42.7 billion, earnings will come to ₹9.1 billion, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1340.7, the analyst price target of ₹1509.22 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.