Key Takeaways

- Strategic focus on expanding high-growth segments is expected to drive future revenue and enhance earnings stability through improved product approvals.

- Increased production capacity and quality improvements are set to enhance operational efficiency, supporting sustainable growth and better net margins.

- Regulatory issues at the key Gagillapur facility threaten revenue and earnings, while remediation costs and high inventories pressure margins and revenue growth.

Catalysts

About Granules India- Manufactures and sells active pharmaceutical ingredients (APIs), pharmaceutical formulation intermediates, and finished dosages (FDs) in India and internationlly.

- Granules India's strategic focus on expanding its product portfolio, including entering high-growth segments such as ADHD, oncology, and antidiabetic medications, is expected to drive future revenue growth.

- The commissioning of the new greenfield formulation facility at Genome Valley, which aims to increase production capacity to 10 billion doses, is likely to positively impact future earnings and revenue as it scales operations.

- The voluntary remediation plan and ongoing communication with the U.S. FDA, aimed at resolving inspection-related issues, could mitigate risks regarding new product approvals, potentially leading to improved future earnings stability.

- Despite current challenges, Granules India's efforts to maintain existing production levels and focus on quality improvements are expected to enhance operational efficiency, thereby positively impacting net margins in the long term.

- The strategic appointment of quality and manufacturing leadership roles bolsters operational robustness, supporting sustainable growth and possibly leading to improved net margins.

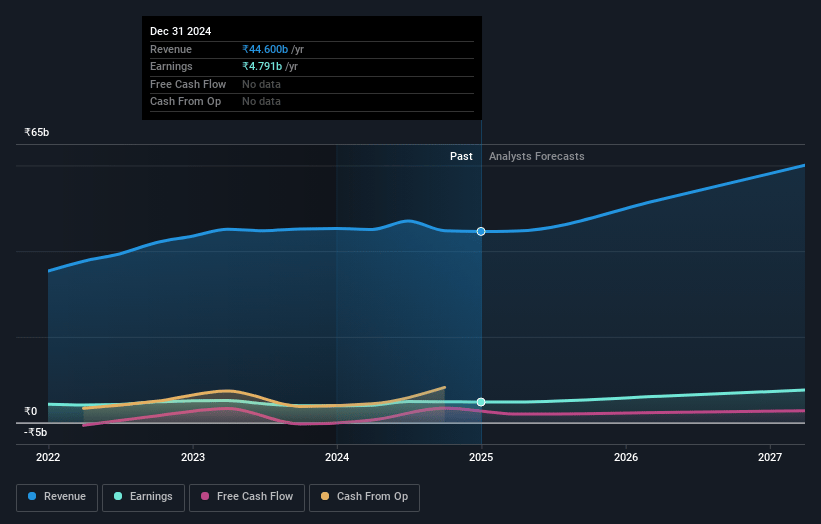

Granules India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Granules India's revenue will grow by 14.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.7% today to 13.4% in 3 years time.

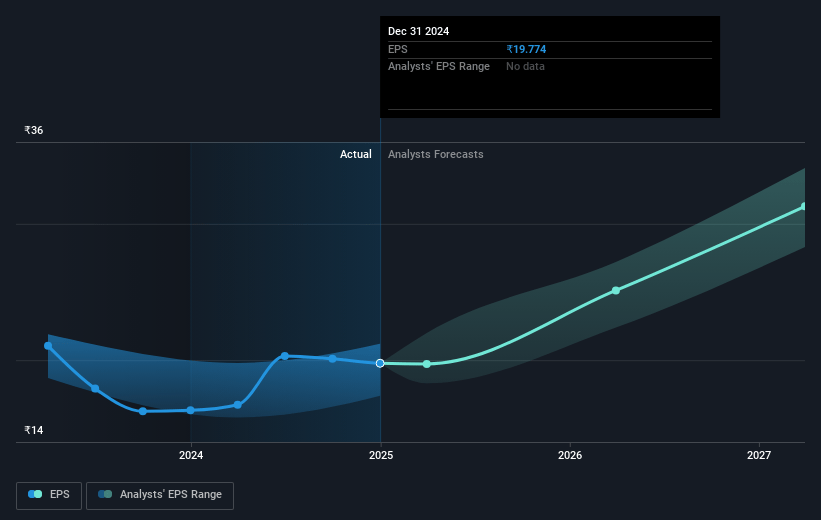

- Analysts expect earnings to reach ₹8.8 billion (and earnings per share of ₹36.32) by about April 2028, up from ₹4.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, up from 21.8x today. This future PE is lower than the current PE for the IN Pharmaceuticals industry at 27.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Granules India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Gagillapur facility received 6 Form 483 observations from the U.S. FDA, leading to an OAI classification. This could delay the approval of new products, affecting future revenue streams.

- Increased costs due to remediation and professional fees related to the FDA inspection have impacted EBITDA margins. Any continuation of these expenses could further pressure margins.

- A disruption in supply from the Gagillapur plant led to increased costs from airlifting materials, potentially affecting profit margins in the short term.

- The company's dependency on the Gagillapur plant, which contributes 60-65% of consolidated sales, poses a risk if regulatory issues persist, potentially impacting overall revenue and earnings.

- High inventory levels, particularly for paracetamol, could lead to continued flat sales in the API segment, potentially impacting revenue growth and profit margins in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹633.75 for Granules India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹700.0, and the most bearish reporting a price target of just ₹560.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹66.2 billion, earnings will come to ₹8.8 billion, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹431.2, the analyst price target of ₹633.75 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.