Last Update 23 Dec 25

500257: Biosimilar And US Regulatory Progress Will Support Balanced Share Performance

Analysts have modestly maintained their conviction on Lupin with the analyst price target effectively unchanged at ₹2,280.84, reflecting stable assumptions on revenue growth, profitability and valuation multiples despite minor model refinements.

What's in the News

- European regulator CHMP issued a positive opinion for Lupin's biosimilar ranibizumab Ranluspec for multiple retinal indications, moving the product closer to centralized EU approval and commercialization via Sandoz and Biogaran in select markets (CHMP, EMA).

- Lupin received an Establishment Inspection Report with Voluntary Action Indicated status from the US FDA for its Nagpur injectable facility following a September 2025 inspection, supporting the plant's readiness for US supply (US FDA).

- The company obtained tentative US FDA approval for Siponimod tablets, a generic version of Mayzent, to treat relapsing forms of multiple sclerosis, with the product to be manufactured at its Pithampur site (US FDA).

- Lupin entered an exclusive licensing agreement with Valorum Biologics for its biosimilar pegfilgrastim Armlupeg in the US. Under this agreement, Lupin will manufacture and supply the product and will earn upfront and royalty payments (company announcement).

- Lupin is reported to be in early stage talks, alongside private equity firms including EQT Partners and TPG Capital, to acquire UK based vitamins maker Vitabiotics in a potential deal valued at around £1 billion (media reports).

Valuation Changes

- Consensus analyst price target remained unchanged at approximately ₹2,280.84, indicating no revision to overall fair value assumptions.

- The discount rate stayed steady at 12.76 percent, suggesting no change in the perceived risk profile or cost of capital.

- Revenue growth inched up from about 6.36 percent to 6.36 percent, reflecting a slightly more positive outlook for the top line.

- The net profit margin moved down marginally from about 14.23 percent to 14.23 percent, implying almost identical profitability expectations.

- The future P/E ratio was effectively unchanged at about 35.35 times, indicating stable valuation multiples applied to forward earnings.

Key Takeaways

- Strong demand drivers and pipeline expansion in chronic therapies, generics, and biosimilars are set to support long-term growth and broader international diversification.

- Focus on higher-margin products, operational efficiencies, and regulatory tailwinds should enhance profitability and accelerate new product approvals.

- Heavy dependence on US generics, regulatory risks, and execution challenges in R&D threaten Lupin's margins, sales growth, and long-term competitiveness amid industry shifts.

Catalysts

About Lupin- Operates as a pharmaceutical company in India, the United States, and internationally.

- The global aging population and increased prevalence of chronic diseases are expected to fuel sustained demand for Lupin's specialty and chronic care portfolios (notably cardiac, diabetes, and respiratory therapies), which, coupled with an extensive pipeline of new product launches (more than 80 launches planned in India alone over the next five years), should drive long-term revenue growth.

- Rising healthcare access and a heightened focus on affordable medicines in emerging markets are opening up new volume opportunities for generics and biosimilars, positioning Lupin to benefit from secular tailwinds in regions like India, South Africa, and Latin America-supporting both top-line expansion and broader international earnings diversification.

- Lupin's substantial investments in complex generics, biosimilars, and novel drug delivery (e.g., depot injectables, inhalation therapies, value-added brands) are expected to shift the product mix towards higher-margin segments, which should drive structural improvement in net margins and overall profitability as these launches scale.

- Margin expansion is further underpinned by ongoing cost optimization initiatives, manufacturing footprint rationalization, and digitalization programs, which the company highlighted as key contributors to recent 330 bps EBITDA margin improvement; these actions are likely to provide sustained support for future earnings growth.

- Accelerated drug patent expiries globally and increasing regulatory harmonization (with Lupin's robust compliance track record) will enlarge the addressable market for generics/specialty drugs and enable faster, more predictable product approvals, providing visible catalysts for revenue and pipeline momentum over the next several years.

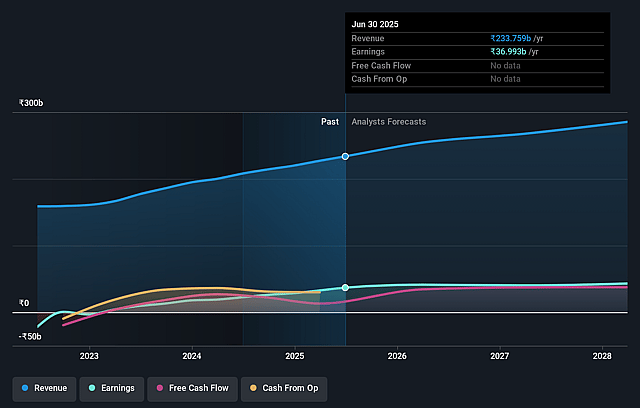

Lupin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lupin's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.8% today to 14.7% in 3 years time.

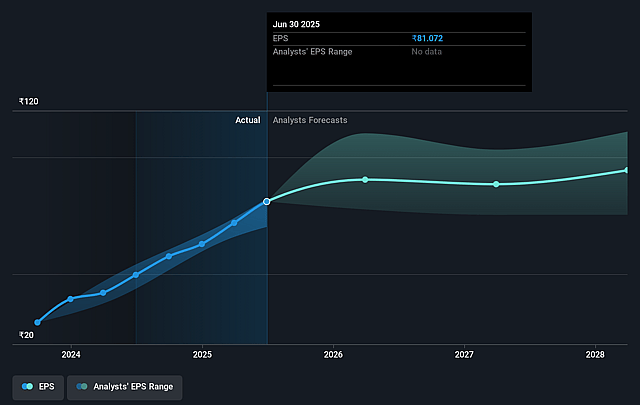

- Analysts expect earnings to reach ₹42.9 billion (and earnings per share of ₹92.98) by about September 2028, up from ₹37.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹50.9 billion in earnings, and the most bearish expecting ₹34.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.0x on those 2028 earnings, up from 24.1x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 29.9x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Lupin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition and potential "cliff" in key US specialty products like Tolvaptan and Mirabegron beyond FY26 could lead to revenue volatility or declines, especially if new generic entrants or litigation outcomes accelerate market share loss (revenue and earnings at risk).

- Persistent regulatory scrutiny and recent 483 observations at manufacturing sites pose a risk of potential import constraints, warning letters, or increased remediation costs, which could disrupt product approvals and impact net margins and sales growth (net margins, revenue at risk).

- Lupin's high dependence on US generics and specialty markets exposes it to ongoing price erosion (evidenced by low-single digit price decline in base products), payer concentration, and the risk of tariff increases or protectionist policies, threatening both margins and topline growth (EBITDA margins, revenues at risk).

- Heavy ongoing R&D investment (up to 8.5% of sales), especially in evolving areas like biosimilars and complex injectables, carries execution risk and may not deliver proportionate returns if clinical, regulatory, or competitive hurdles delay commercialization or profitability (return on capital and future earnings at risk).

- Structural industry trends toward biologics, GLP-1s, and novel therapies may outpace growth in traditional generics; if Lupin's investment in specialty and differentiated products lags or fails to achieve critical mass, long-term revenue growth and net margin expansion could stagnate (revenue, net margin, and long-term competitiveness at risk).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2224.811 for Lupin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2626.0, and the most bearish reporting a price target of just ₹1896.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹291.1 billion, earnings will come to ₹42.9 billion, and it would be trading on a PE ratio of 34.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹1951.65, the analyst price target of ₹2224.81 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lupin?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.