Key Takeaways

- Declining raw material prices and cautious inventory restocking are slowing demand and negatively impacting revenue growth and margins.

- New investments, digital platforms, and international expansion may pressure net margins and cash flows, affecting short-term earnings and growth trajectories.

- Strategic expansions and digital investments by Navneet Education are poised to boost revenue growth across publication and stationery segments, supporting overall financial performance.

Catalysts

About Navneet Education- Engages in publishing state board publication books and stationery products in India, North and Central America, Africa, Europe, and internationally.

- The domestic stationery business is facing challenges due to a continuous decline in raw material prices, leading to cautious inventory restocking by dealers and distributors. This has resulted in slower demand, impacting both revenue growth and margins negatively.

- The company's reliance on institutional orders, which contributed significantly to quarterly growth, suggests an unsustainable growth trajectory in the publication business if these orders do not recur regularly, potentially affecting future revenues.

- The introduction of new digital platforms like Navneet AI aims to leverage existing content repositories but represents additional costs in the short term without immediate revenue benefits, which could pressure net margins initially.

- The integration of new product categories and expansion into newer international markets in the export stationery segment requires substantial investment in strengthening distribution networks. This could strain operational costs in the short term, affecting net margins and potentially leading to lower earnings.

- High capital expenditure plans over the next few years, primarily for capacity expansion in the stationary segment, may pressure cash flows before any significant revenue or margin gains are realized, affecting earnings growth.

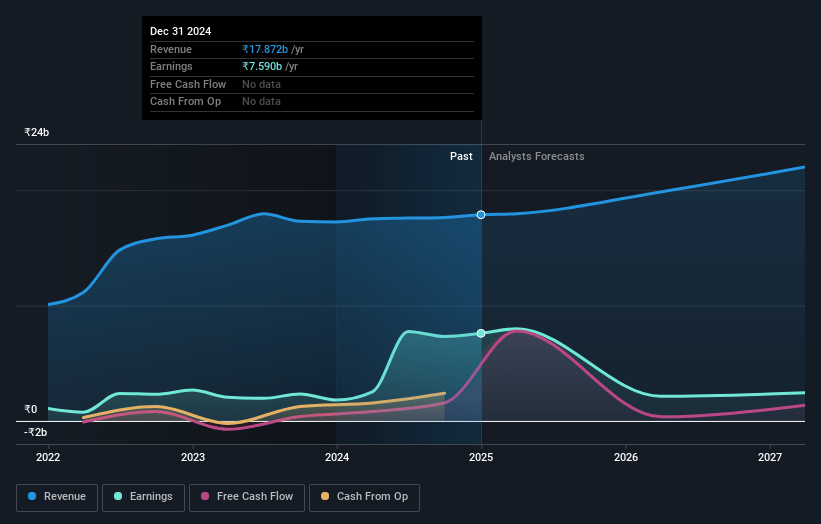

Navneet Education Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Navneet Education's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.5% today to 4.5% in 3 years time.

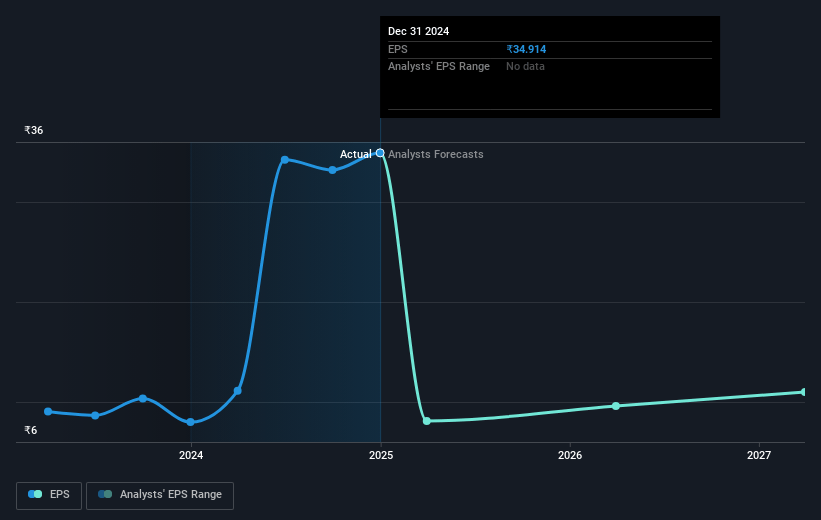

- Analysts expect earnings to reach ₹1.1 billion (and earnings per share of ₹6.25) by about March 2028, down from ₹7.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.2x on those 2028 earnings, up from 4.0x today. This future PE is greater than the current PE for the IN Media industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 2.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.9%, as per the Simply Wall St company report.

Navneet Education Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Navneet Education's strategic initiatives to expand market reach, strengthen content portfolio, and leverage digital platforms could enhance distribution and accessibility, potentially boosting revenue growth in the publication segment.

- The export stationery segment demonstrated strong performance with a 17% year-on-year increase in revenue due to new product categories and expansion into newer international markets, indicating a continued positive impact on earnings.

- Stabilizing and potentially increasing paper prices may lead to a recovery in the domestic stationery segment, supporting margin stability and revenue growth in the upcoming quarters.

- The company's focus on strengthening its distribution network and exploring product innovation for the domestic stationery market could drive sustainable growth, improving net margins over time.

- Navneet Education's investment in digital transformation, such as the launch of Navneet AI, aims to enhance customer engagement and support long-term revenue growth, contributing positively to overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹150.0 for Navneet Education based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹23.6 billion, earnings will come to ₹1.1 billion, and it would be trading on a PE ratio of 41.2x, assuming you use a discount rate of 12.9%.

- Given the current share price of ₹136.45, the analyst price target of ₹150.0 is 9.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives