Key Takeaways

- Expanding digital platforms and strategic partnerships are integral to growing Navneet Education’s publication business and adapting to educational market changes.

- Navneet Education is enhancing its product innovation and international expansion efforts to drive export stationery revenue, particularly targeting Central America.

- Reliance on export markets and cautious inventory approaches alongside investments in digital platforms impact Navneet Education's short-term earnings and revenue growth sustainability.

Catalysts

About Navneet Education- Engages in publishing state board publication books and stationery products in India, North and Central America, Africa, Europe, and internationally.

- Navneet Education plans to expand its publication business by leveraging digital platforms and strengthening strategic partnerships. This initiative is expected to bolster revenue growth in the coming years as the company adapts to emerging educational demands.

- The company anticipates a recovery in its domestic stationery segment with the stabilization of paper prices and a regained confidence among distributors and retailers. This stabilization is expected to improve both revenue and margins in the forthcoming quarters.

- Navneet Education is focusing on product innovation and strategic expansion into new international markets, particularly in Central America, to drive export stationery revenue growth. This robust growth strategy is supported by a 17% year-on-year increase in export revenue, potentially enhancing earnings.

- The introduction of Navneet AI aims to augment the demand for both physical books and digital content. The platform's successful adoption by educators is expected to enhance revenue streams and support long-term growth in the publication segment.

- Navneet Education’s strategic investments in infrastructure and technology are expected to enhance operational efficiencies, which could lead to improved net margins and competitiveness. A three-year CapEx plan highlights a commitment to scaling operations to meet future demand.

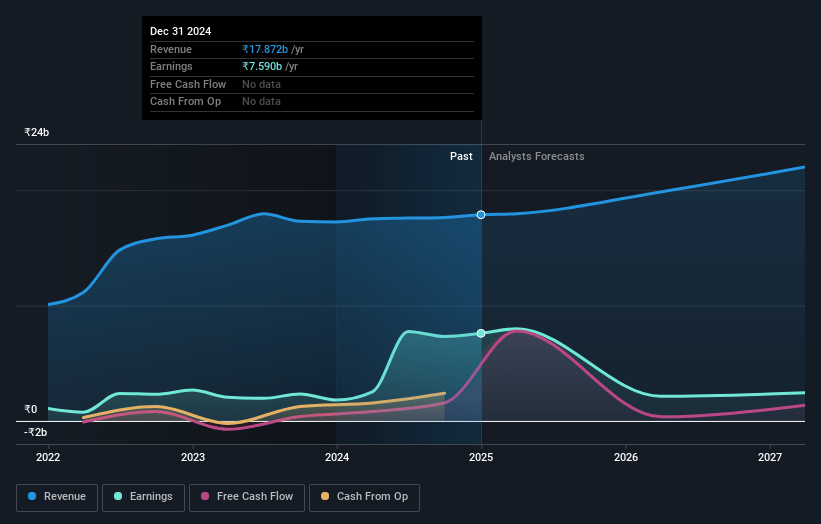

Navneet Education Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Navneet Education's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.5% today to 4.5% in 3 years time.

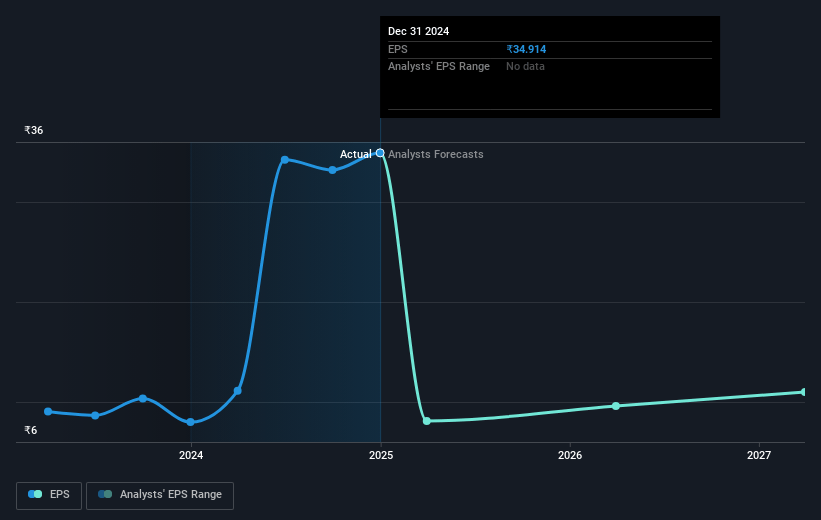

- Analysts expect earnings to reach ₹1.1 billion (and earnings per share of ₹6.25) by about April 2028, down from ₹7.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.7x on those 2028 earnings, up from 4.0x today. This future PE is greater than the current PE for the IN Media industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 2.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Navneet Education Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The domestic stationery business faced a decline in raw material prices, leading to a cautious inventory approach from dealers, which resulted in slower demand and a 24% year-on-year revenue decline, impacting revenue growth and margins.

- The publication business saw growth primarily due to institutional orders rather than consistent customer demand, raising concerns about the sustainability of revenue growth if such orders do not recur consistently.

- Indiannica Learning, a subsidiary, is projecting a minimal profit despite previous losses, indicating limited contribution to overall profitability, which could affect the company's earnings until further growth or integration strategies are realized.

- Heavy reliance on export markets, particularly the U.S., for 80% of export revenue exposes the company to potential geopolitical and trade tensions, which may impact future export revenues and currency-related earnings.

- Continued investment in AI and digital platforms for long-term publication margin improvement could pressure short-term profits without immediate returns, potentially affecting overall earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹150.0 for Navneet Education based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹23.6 billion, earnings will come to ₹1.1 billion, and it would be trading on a PE ratio of 40.7x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹135.81, the analyst price target of ₹150.0 is 9.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.