Key Takeaways

- Strategic emphasis on premium emulsions and new plant capacity expansion aims to enhance margins and support robust revenue growth.

- Bolstering dealer networks, digital advertising, and sustainability initiatives are designed to boost brand visibility and drive sales.

- Persistent demand slowdown, competition, and increased costs challenge Indigo Paints' potential revenue growth and profitability amid declining margins and network expansion hurdles.

Catalysts

About Indigo Paints- Engages in the manufacture and sale of decorative paints in India and internationally.

- Indigo Paints is expected to see improvement in their gross and net margins due to increased focus on premium emulsions and improved product mix, especially in the emulsion category, which has been performing better than the economy segment.

- The commissioning of new manufacturing plants, including the solvent-based and water-based paint plants in Jodhpur, is projected to increase capacity and support revenue growth starting from FY '26, which should contribute to higher sales.

- Indigo Paints has been actively expanding its dealer network and increasing the number of tinting machines, improving the throughput per active dealer, which is likely to boost future revenue performance.

- The company's strategic shift towards digital advertising along with traditional TV ads is expected to increase brand visibility and drive higher sales, translating into better revenue growth prospects.

- Sustainability initiatives like the installation of rooftop solar panels and CSR programs may enhance brand image, indirectly supporting sales growth and potentially improving net margins by appealing to environmentally conscious consumers.

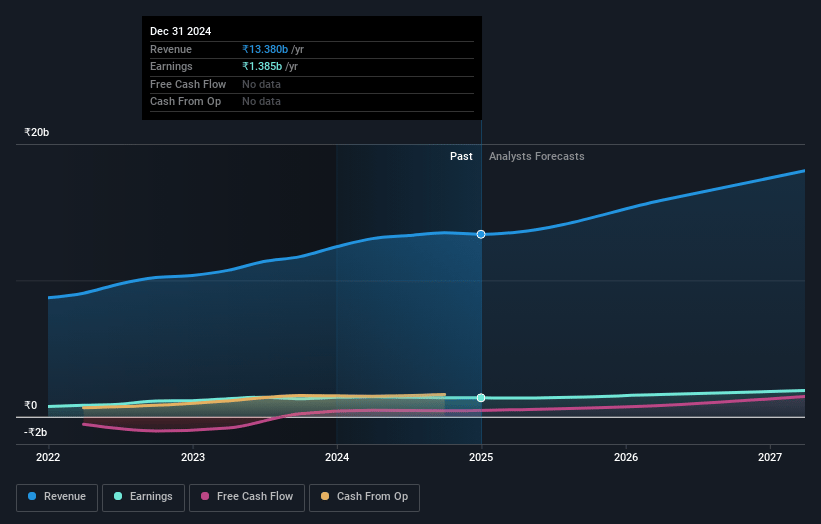

Indigo Paints Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Indigo Paints's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 11.2% in 3 years time.

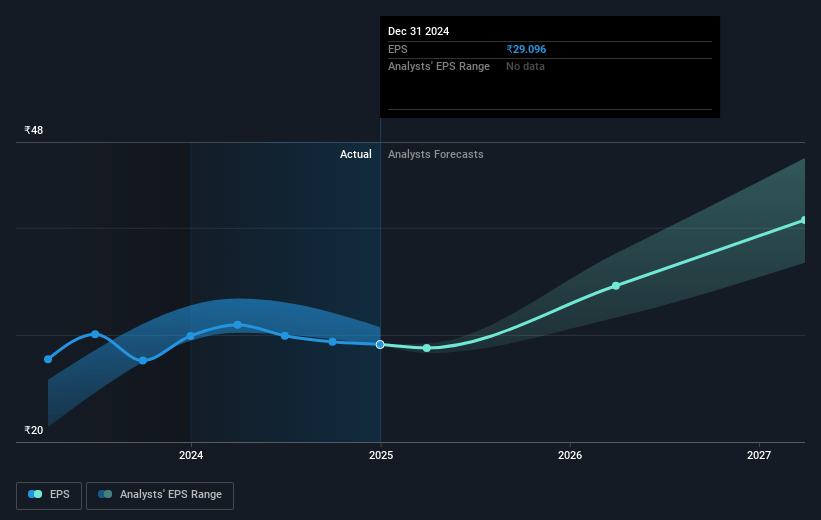

- Analysts expect earnings to reach ₹2.0 billion (and earnings per share of ₹34.7) by about July 2028, up from ₹1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.4x on those 2028 earnings, up from 40.3x today. This future PE is greater than the current PE for the IN Chemicals industry at 29.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.31%, as per the Simply Wall St company report.

Indigo Paints Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent demand slowdown and negative top-line growth signal potential challenges in boosting future revenues for Indigo Paints.

- A decrease in gross margins from 48.4% to 47.2% due to price cuts and product mix changes could continue to pressure net margins if such trends persist.

- The increased employee costs due to salesforce expansion during a demand downturn have adversely impacted EBITDA margins, indicating potential profitability challenges.

- The impact of higher depreciation from new plant commissioning has affected PAT growth, reflecting potential earnings risks if new CapEx projects face further delays or yield limited returns.

- Slow progress in network expansion and increased competition from new market entrants could hinder Indigo Paints' ability to grow revenues through market share gains.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1237.5 for Indigo Paints based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1625.0, and the most bearish reporting a price target of just ₹1000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹18.2 billion, earnings will come to ₹2.0 billion, and it would be trading on a PE ratio of 41.4x, assuming you use a discount rate of 13.3%.

- Given the current share price of ₹1200.4, the analyst price target of ₹1237.5 is 3.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.