Key Takeaways

- Strategic focus on key segments and government spending initiatives are poised to drive significant revenue growth and earnings enhancement.

- Antidumping duties and expansion into new markets aim to improve market pricing, demand, and profitability.

- Market sluggishness, pricing struggles, and lower infrastructure spending, combined with raw material volatility, pose risks to HIL's revenue, margins, and growth.

Catalysts

About HIL- Produces and distributes building materials and other solutions in India and internationally.

- HIL's strategic focus on gaining market share in priority segments such as Pipes, Construction Chemicals, and Panels and Boards, despite a challenging market environment, is expected to drive future revenue growth.

- The integration of Crestia and anticipated revival of government spending on JJM (Jal Jeevan Mission) and AMRUT 2.0 programs are likely to boost B2G sales and positively impact earnings in coming quarters.

- The proposed antidumping duty on PVC and engineered wood flooring imports could improve market pricing and demand, thereby enhancing revenue and overall profitability.

- Expanding Parador's geographical reach into new markets such as the Americas and Asia, along with improvements in product mix and cost optimization, is anticipated to drive revenue growth and improve margins.

- The brand refresh initiative and new product launches across key segments are expected to bolster marketing activities and strengthen HIL's market position, contributing to revenue and margin improvements.

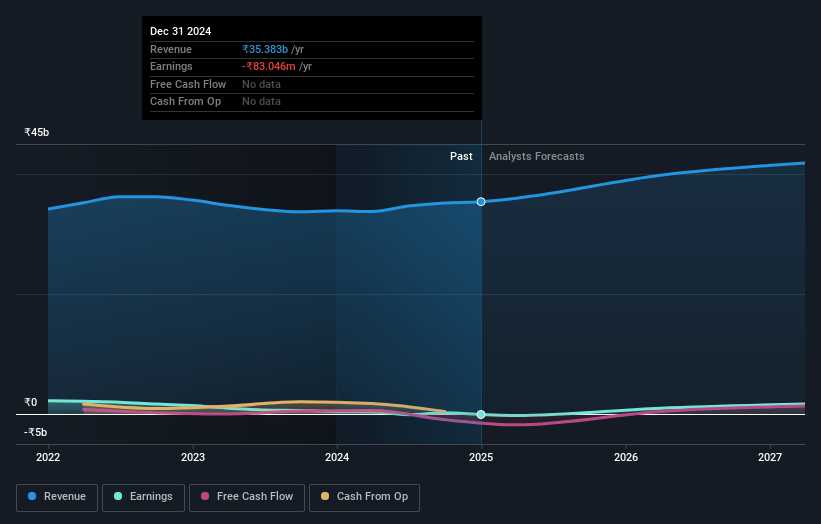

HIL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HIL's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.2% today to 7.2% in 3 years time.

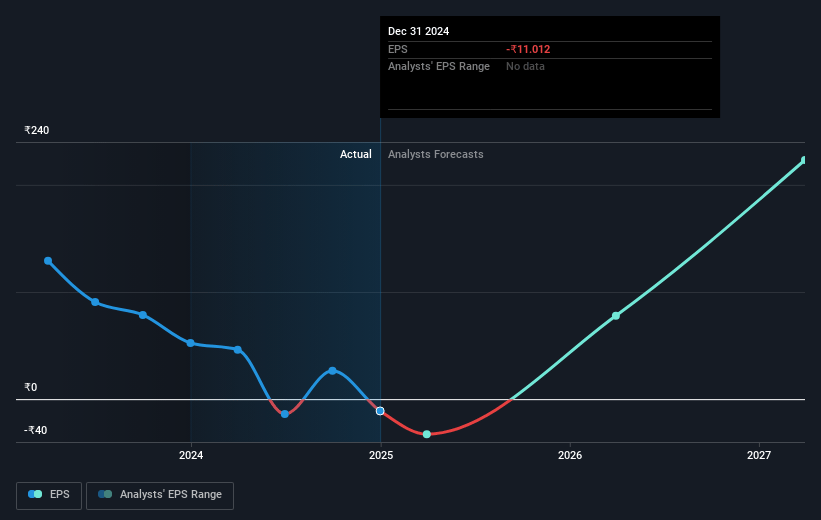

- Analysts expect earnings to reach ₹3.2 billion (and earnings per share of ₹427.76) by about March 2028, up from ₹-83.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.1x on those 2028 earnings, up from -159.9x today. This future PE is lower than the current PE for the IN Basic Materials industry at 30.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.05%, as per the Simply Wall St company report.

HIL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HIL's revenues grew by only 3% in a challenging market environment, indicating potential risks to future revenue due to continued market sluggishness and weak demand in both India and Europe.

- The Building Solutions segment faced significant challenges from lower infrastructure spending and increased competitive intensity with new capacities, risking further pressure on revenue and margins.

- The decline in government expenditure on the JJM program significantly impacted the growth prospects of their Pipes segment, highlighting potential risks to future volumes and revenues if government spending does not recover as anticipated.

- Continued price realization drops, ranging from 4% to 13% across various segments, indicate pricing struggles that could continue to erode net margins and overall earnings.

- Volatility in raw material prices such as PVC resin and potential forex risks could adversely impact cost structures and net profit margins, especially if cost optimization efforts do not mitigate these effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2678.0 for HIL based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹44.6 billion, earnings will come to ₹3.2 billion, and it would be trading on a PE ratio of 9.1x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹1760.4, the analyst price target of ₹2678.0 is 34.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives