Key Takeaways

- Strategic partnerships and premium product focus are poised to boost distribution, brand engagement, and revenue growth positively.

- Diversification into EV fast chargers and AdBlue signals potential revenue boosts and earnings support beyond traditional lubricants.

- Rupee depreciation and cost pressures threaten margins, while reliance on imports and capacity constraints could hinder growth amid strong demand and competition.

Catalysts

About Gulf Oil Lubricants India- Manufactures, markets, and trades lubricating oils, greases, and other derivatives for use in the automobile and industrial sectors in India.

- Strategic partnerships, such as the expansion with Nayara's network of 6,000 outlets and the renewed exclusive partnership with Piaggio, are expected to improve distribution and sales reach, impacting revenue growth positively.

- The company's focus on premium product range and the success of marketing campaigns, like The Unstoppable, are aimed at deepening brand engagement and increasing market penetration, which could lead to higher net margins.

- The substantial growth in the AdBlue segment and its distribution through strategic partnerships could boost both volume and revenue as demand for diesel engine oils is complemented by AdBlue consumption.

- The growth trajectory in joint ventures like Tirex for EV fast chargers suggests a doubling of revenues, potentially supporting earnings by diversifying income streams beyond traditional lubricants.

- Expansion into high-performance segments, such as those associated with India Bike Week and premium motorcycle oils, combined with broader economic recovery signs, could enhance revenue and maintain robust earnings growth.

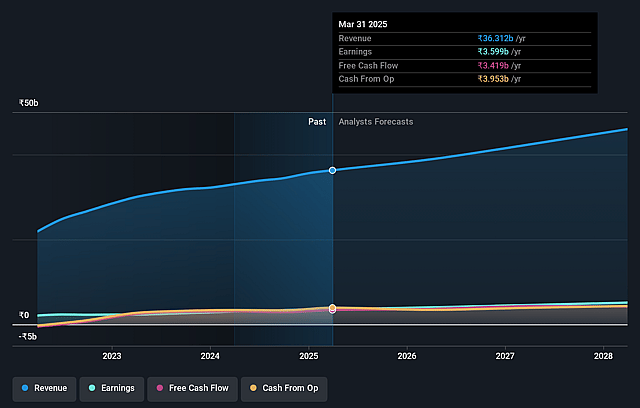

Gulf Oil Lubricants India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gulf Oil Lubricants India's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 11.2% in 3 years time.

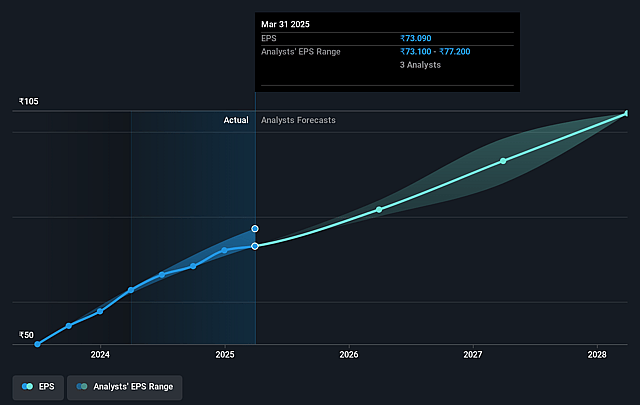

- Analysts expect earnings to reach ₹5.1 billion (and earnings per share of ₹104.35) by about July 2028, up from ₹3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, up from 16.7x today. This future PE is lower than the current PE for the IN Chemicals industry at 28.8x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.5%, as per the Simply Wall St company report.

Gulf Oil Lubricants India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rupee depreciation has led to Forex losses, which could impact net margins if not effectively managed through pricing or operational efficiencies.

- The high level of competition in the AdBlue market, although seeing volume growth, could suppress margins and affect overall earnings.

- The reliance on imported base oils means that fluctuations in the rupee exchange rate can significantly impact input costs, thereby affecting gross margins.

- Factory fill segment has shown weakness; should it not recover, it could impact overall volume growth and consequently future revenues.

- Capacity constraints at existing plants might limit the ability to increase production rapidly, potentially affecting revenue growth if demand continues at double-digit rates without timely capacity expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1669.25 for Gulf Oil Lubricants India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1800.0, and the most bearish reporting a price target of just ₹1490.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹46.0 billion, earnings will come to ₹5.1 billion, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹1218.7, the analyst price target of ₹1669.25 is 27.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.