Key Takeaways

- Introduction of new weedicides and expansion in CPC portfolio could drive higher revenue growth and enhance net margins.

- Focus on sustainable agricultural solutions and joint ventures in acid production may substantially increase future revenue and earnings.

- Competitor expansions and subsidy reliance pose risks to revenue, while capital-heavy projects and zero-sum trading ventures pressure earnings and financial stability.

Catalysts

About Chambal Fertilisers and Chemicals- Produces and sells fertilizers primarily in India.

- The introduction of new weedicides and continuous expansion of the CPC (Crop Protection Chemicals) portfolio, including new products with improved chemistries, could drive higher revenue growth and enhance net margins.

- The focus on biologicals and sustainable agricultural solutions, in collaboration with TERI, is likely to create new revenue streams and potentially increase margins due to higher-value products.

- Expansion of the IMACID joint venture, with plans to increase phosphoric acid and address sulfuric acid production, is expected to be completed by '27/'28, which could substantially contribute to future revenue and overall earnings.

- The ongoing Technical Ammonium Nitrate project, scheduled for completion by January '26, has significant potential to increase revenue streams and impact earnings positively, particularly given the increasing demand in infrastructure and mining sectors.

- Entry into hybrid and research variety seeds aligns with market needs, potentially driving revenue growth and improving margins by completing the agri-inputs profile and capitalizing on the agriculture sector's evolving demands.

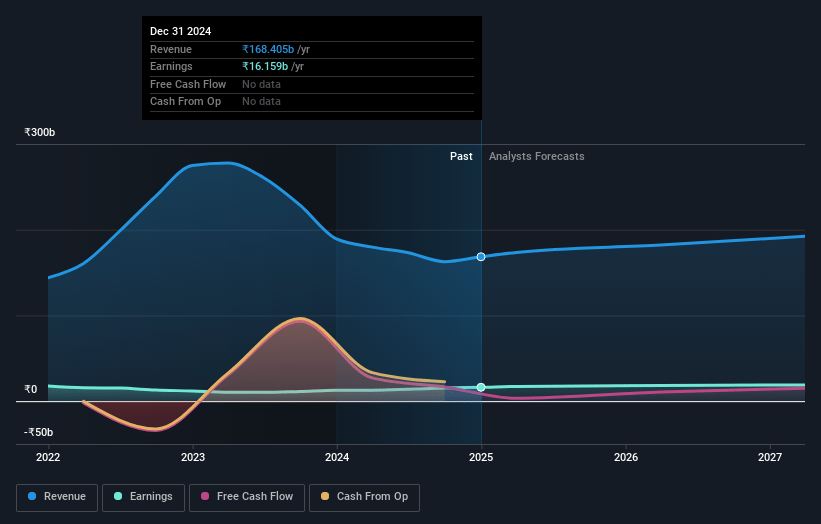

Chambal Fertilisers and Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Chambal Fertilisers and Chemicals's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 10.0% in 3 years time.

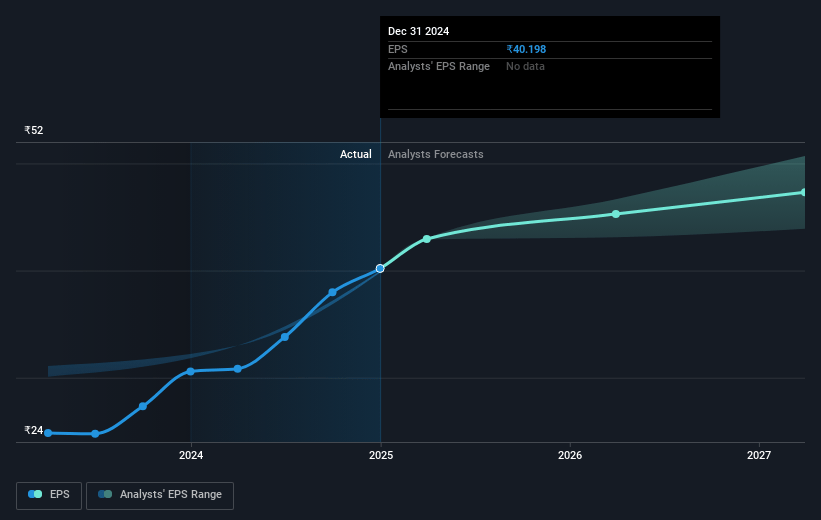

- Analysts expect earnings to reach ₹20.0 billion (and earnings per share of ₹50.0) by about March 2028, up from ₹16.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹17.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from 15.3x today. This future PE is lower than the current PE for the IN Chemicals industry at 24.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.5%, as per the Simply Wall St company report.

Chambal Fertilisers and Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is potential for an oversupply situation in the TAN market due to upcoming competitor expansions, which could pressure sales prices and affect revenue and margins.

- The trading business for DAP is currently described as a zero-sum game, indicating minimal or no profitability, which could detract from overall earnings.

- The expansion projects in IMACID require substantial capital investment (approximately $173 million), which could lead to increased financial risk if returns are delayed or below expectations.

- Uncertainties around input costs such as gas could impact profitability, as energy efficiency improvements still involve gain-sharing mechanisms that may not fully benefit the company’s bottom line.

- There is reliance on subsidy receipts for urea, and any delay or reduction in subsidies could negatively impact cash flow and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹570.0 for Chambal Fertilisers and Chemicals based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹200.5 billion, earnings will come to ₹20.0 billion, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹618.05, the analyst price target of ₹570.0 is 8.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.