Key Takeaways

- Strong performance in Chemicals and Specialty Chemicals segments indicates potential growth, driven by new products and recovery in key agrochemical intermediates.

- Expansion in Packaging Films and favorable geopolitical factors, like a weak rupee, may bolster revenue, stabilize margins, and enhance profitability.

- Market fluctuations, geopolitical uncertainty, and competition pressures could hinder SRF's revenue growth, profit margins, and overall earnings stability.

Catalysts

About SRF- Manufactures, purchases, and sells technical textiles, chemicals, packaging films, and other polymers.

- SRF's Chemicals business is experiencing a strong performance with an upward trend in EBIT margins, driven by demand for new products and recovery in key agrochemical intermediates, signaling potential revenue and earnings growth in the upcoming quarters.

- The Specialty Chemicals segment is poised for further growth in Q4 and FY '26, with registrations for new active ingredients promising increased sales, likely enhancing revenue streams and possibly improving net margins due to higher-value products.

- The Packaging Films business is expanding its presence in value-added products, particularly in BOPP and BOPET segments, along with growing momentum in aluminum foil exports to the U.S. and Europe. This diversification and export growth could bolster revenue and stabilize margins.

- The ongoing projects, such as belting fabrics and new AI launches, along with integration of a new hot lamination machine for Laminated Fabrics, are expected to drive future growth and margin improvements from FY '26 onwards, impacting earnings positively.

- A favorable geopolitical environment, particularly a weak rupee benefiting export markets and the positive leverage from lower interest rates going forward, could enhance SRF's profitability and strengthen its earnings position.

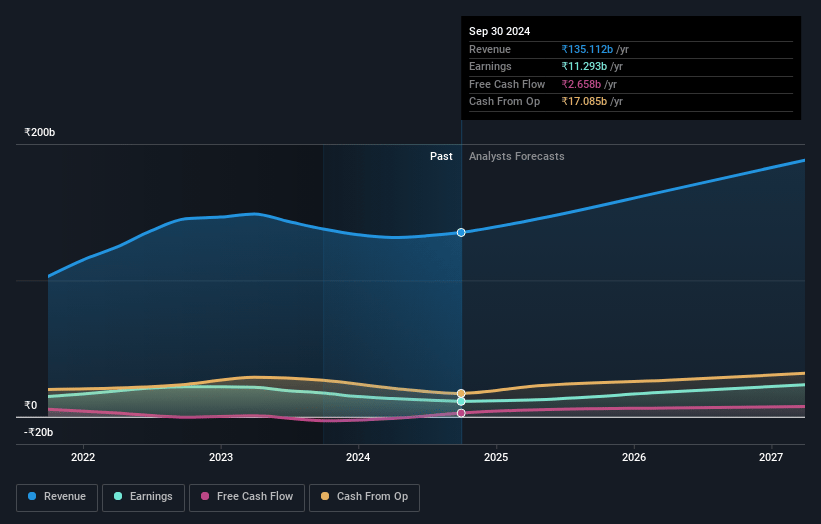

SRF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SRF's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 11.7% in 3 years time.

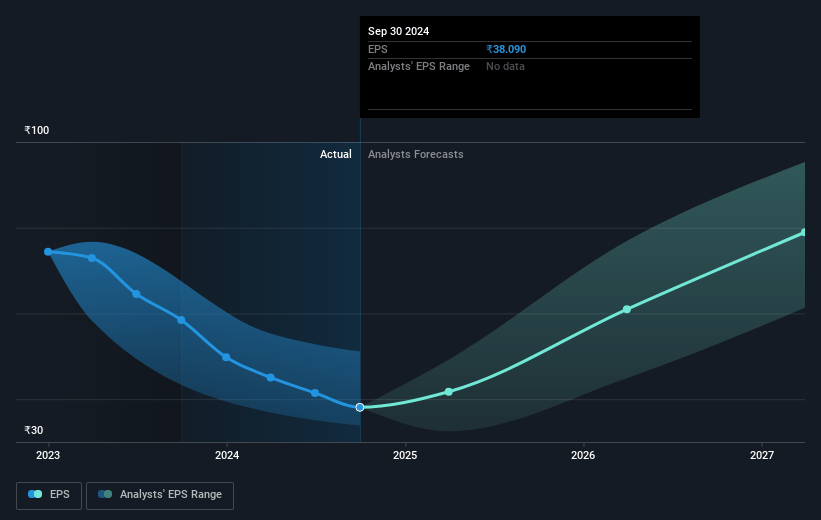

- Analysts expect earnings to reach ₹23.7 billion (and earnings per share of ₹80.03) by about April 2028, up from ₹11.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹29.9 billion in earnings, and the most bearish expecting ₹16.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.6x on those 2028 earnings, down from 77.6x today. This future PE is greater than the current PE for the IN Chemicals industry at 25.8x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.53%, as per the Simply Wall St company report.

SRF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Concerns about pricing and demand fluctuations in the refrigerant gas markets, particularly in exports, which could affect revenue growth and EBIT margins if market conditions do not improve as anticipated.

- Uncertainty in the geopolitical environment and potential for adverse currency fluctuations, including the strengthening of the U.S. dollar impacting profits by approximately ₹34 crore, which could affect earnings stability.

- The inventory buildup in the agrochemical sector presenting potential headwinds for the specialty chemicals segment, posing a risk to revenue growth and profit margins if demand does not pick up as expected.

- Pressure on margins in the domestic market for the aluminum foil segment due to lower-cost imports from China, which could impact net margins if competitive pricing pressures persist.

- The lack of clarity on potential quota systems for HFC-32 production capacity expansion, creating an uncertainty around future revenues and the ability to leverage existing capacities for maximum benefit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2726.276 for SRF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3540.0, and the most bearish reporting a price target of just ₹1500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹202.4 billion, earnings will come to ₹23.7 billion, and it would be trading on a PE ratio of 49.6x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹3001.8, the analyst price target of ₹2726.28 is 10.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.