Key Takeaways

- Government initiatives and B2B expansion in high-margin industrial sectors are expected to drive significant revenue growth and profitability.

- New product launches and distribution expansion aim to increase market share and improve market reach, enhancing earnings and valuation.

- Challenges in automotive segments, competitive pressures, and macroeconomic dependencies may impact Akzo Nobel India's revenue, margins, and profitability.

Catalysts

About Akzo Nobel India- Manufactures, distributes, and sells paints and coatings in India and internationally.

- The anticipated consumption boost from government initiatives, such as tax benefits and support for MSMEs, is expected to drive increased demand in the paints and coatings markets, particularly in the second half of the year. This could result in a significant increase in revenue as consumer spending rises.

- Akzo Nobel India's strategic focus on expanding its B2B business in infrastructure, marine, protective, and other industrial segments, where they have already seen strong performances, is expected to drive higher revenue growth and profitability in these higher-margin segments.

- The company has introduced new product launches, including the innovative Dulux Promise Freedom latex paint and advancements in the waterproofing segment. These are expected to expand market share and drive revenue growth through product differentiation and meeting emerging consumer needs.

- Investment in distribution expansion and a digital makeover to enhance customer service and market reach has led to continuous market share gains in the decorative segment for 12 quarters. This is expected to improve revenue and margins as they penetrate deeper into emerging markets and smaller towns.

- The strategic potential restructuring of the Industrial Coatings business could unlock value and focus investments or partnerships to optimize operations and enhance profitability, which could positively impact earnings and valuation.

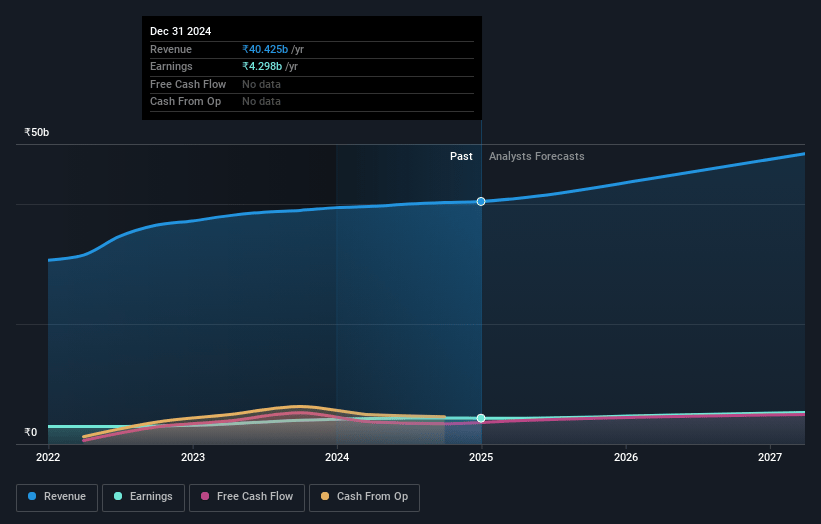

Akzo Nobel India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Akzo Nobel India's revenue will grow by 8.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 11.0% in 3 years time.

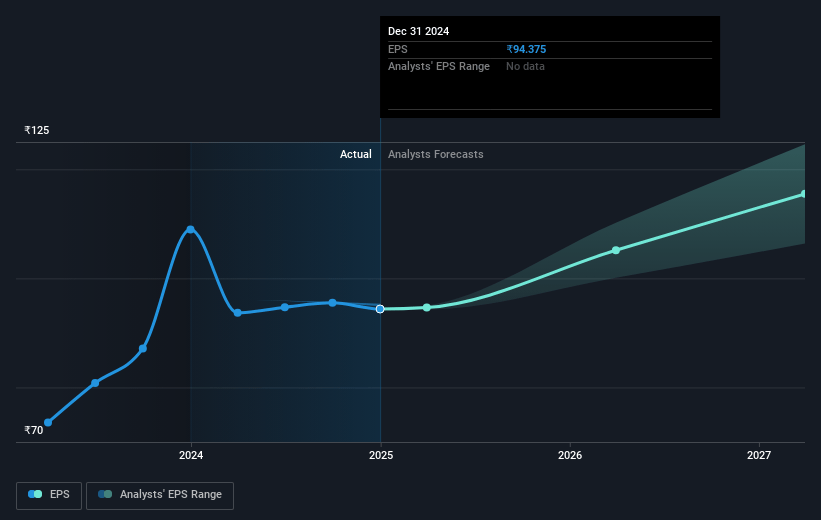

- Analysts expect earnings to reach ₹5.6 billion (and earnings per share of ₹123.71) by about March 2028, up from ₹4.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.8x on those 2028 earnings, up from 34.2x today. This future PE is greater than the current PE for the IN Chemicals industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.51%, as per the Simply Wall St company report.

Akzo Nobel India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Akzo Nobel India's profit at EBIT level was flat and profit declined by 5%, impacted by reduced income from funds due to a special dividend, potentially affecting future profitability.

- Challenges in the automotive and vehicle refinish segments, and economic issues in export markets for coil coatings, could negatively impact revenues and net margins.

- Competitive pressures, particularly in mass and economy segments, might lead to price corrections, impacting revenue and net margins if the trend continues.

- Risks associated with strategic restructuring and internal reviews could impact employee and distributor morale, affecting operational stability and future earnings.

- Dependence on macroeconomic conditions such as tax policies and state election outcomes for demand revival might pose risks to achieving targeted revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3918.5 for Akzo Nobel India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹51.4 billion, earnings will come to ₹5.6 billion, and it would be trading on a PE ratio of 45.8x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹3226.45, the analyst price target of ₹3918.5 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.