Key Takeaways

- The acquisition and strategic facility location will enhance market presence in automotive and electronics, potentially driving revenue and reducing costs.

- Financial stability through debt-free status and investable surplus positions the company well for growth, improving earnings via reduced costs and better market reach.

- Fluctuating raw material prices and heavy import reliance may challenge margins, while expanded ABS capacity's execution risks could delay revenue growth.

Catalysts

About Supreme Petrochem- Manufactures and sells polystyrene, expandable polystyrene, masterbatches and compounds of styrenics, other polymers, and extruded polystyrene insulation board in India and internationally.

- The acquisition of Masysxmold Polymers Private Limited is expected to bolster Supreme Petrochem's presence in the automotive and consumer electronics sectors, potentially driving revenue growth by introducing engineering polymer compounds.

- The completion of Phase 1 of the Mass ABS project, expected by May 2025, signifies upcoming capacity expansion that could increase production volumes and ultimately enhance future revenue.

- The debt-free status with an investable surplus of INR872 crores places the company in a strong position to fund growth initiatives, which could positively impact earnings through reduced interest costs and increased financial flexibility.

- The strategic location of the new facility near Chennai's automotive corridor provides potential logistical advantages, contributing to improved net margins due to reduced transportation costs and greater regional market penetration.

- Anticipated capacity expansion in EPS and stronger focus on export markets may foster revenue growth and higher margins, particularly given the introduction of value-added grades approved for GCC countries and Europe.

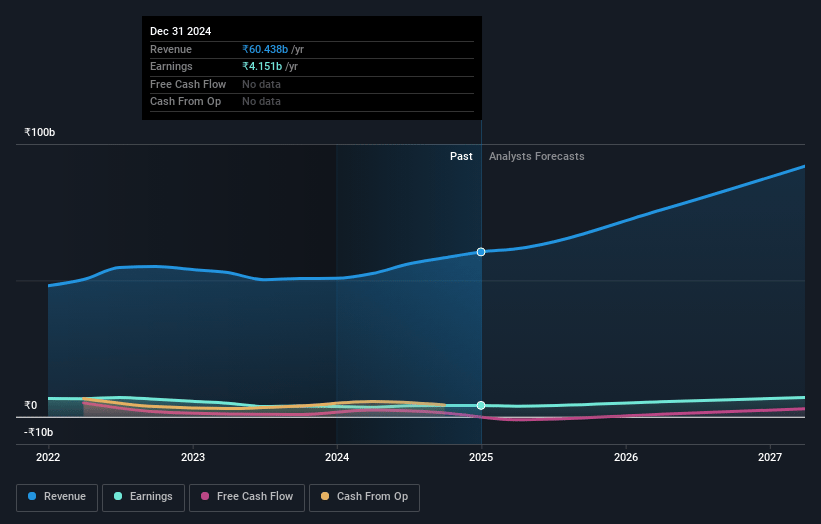

Supreme Petrochem Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Supreme Petrochem's revenue will grow by 21.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 8.0% in 3 years time.

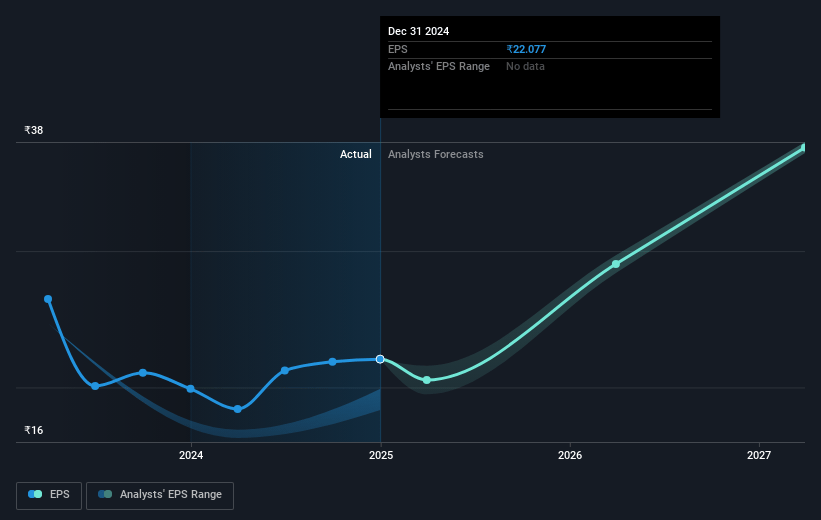

- Analysts expect earnings to reach ₹8.6 billion (and earnings per share of ₹46.16) by about May 2028, up from ₹3.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, down from 31.2x today. This future PE is lower than the current PE for the IN Chemicals industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.4%, as per the Simply Wall St company report.

Supreme Petrochem Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The fluctuating styrene monomer prices and their recent downward trend since March 2025 pose a risk to revenue stability and could lead to inventory losses if the trend continues.

- Capacity utilization was only 79% across all products, indicating inefficiencies in maximizing output, which could hinder revenue growth and profitability.

- The volatile pricing of raw materials and the heavy reliance on imports could negatively affect net margins if global trade dynamics shift unfavorably.

- A significant portion of expansions and future growth projections are reliant on the successful ramp-up of new ABS capacities, which bears execution risk and could delay earnings improvements.

- Market saturation in EPS due to competitor capacity expansions might impact the potential revenue increase from upcoming facilities, curtailing expected financial benefits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹716.5 for Supreme Petrochem based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹107.8 billion, earnings will come to ₹8.6 billion, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹649.0, the analyst price target of ₹716.5 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.