Last Update01 May 25

Key Takeaways

- Acquiring prime land and focusing on premium housing can drive future revenue growth through increased sales and higher profitability.

- Sustainability investments and strategic shifts in other segments could strengthen brand value, stabilize earnings, and improve margins.

- Weak domestic demand, litigation, execution risk, regulatory uncertainties, and financial leverage challenges may negatively impact Aditya Birla Real Estate's profitability and revenue growth.

Catalysts

About Aditya Birla Real Estate- Manufactures and sells textiles, and pulp and paper products in India and internationally.

- The acquisition of a 70-acre land parcel in Boisar for a new plotted development project indicates future revenue growth as it addresses demand for spacious homes and utilizes a prime location. This is likely to impact revenue positively.

- The significant expected increase in upcoming project launches, with Rs 8,000 crores worth of inventory to be introduced, suggests a strong pipeline that could drive future sales and revenue growth.

- The focus on premiumization in residential housing and successful sales growth, as seen with a 257% increase in booking value, indicates improved net margins and earnings as these premium projects typically have higher profitability.

- Management's investment in sustainability, such as the Net Zero Energy Existing Building certification and LEED Gold precertification for developments, is expected to strengthen brand value and customer demand, positively impacting future revenue and margins.

- Strategic shifts in the Pulp and Paper segment, such as increasing export markets and cost-reduction initiatives, could stabilize or enhance earnings in the face of domestic challenges, aiding in maintaining or improving net margins.

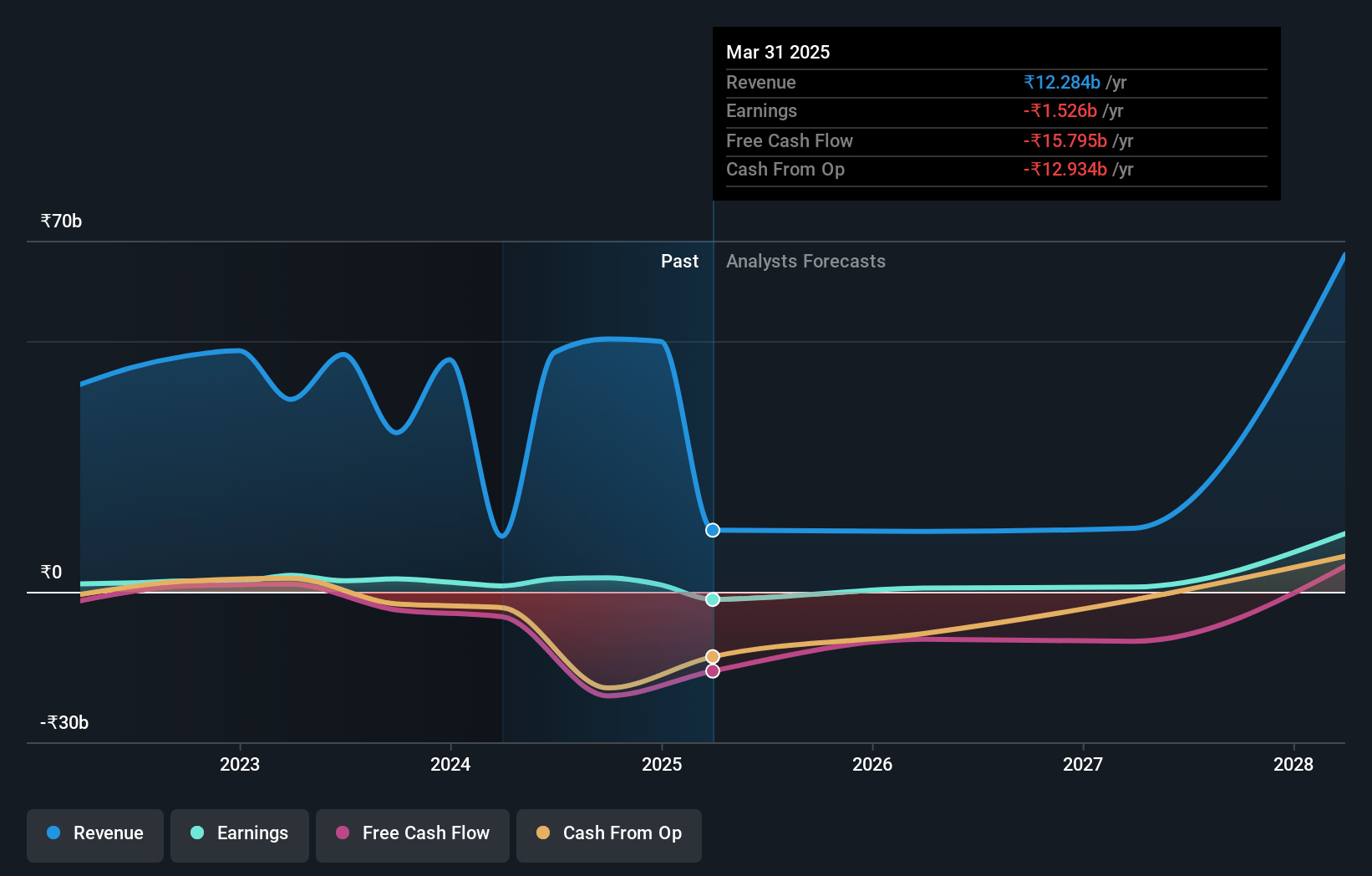

Aditya Birla Real Estate Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aditya Birla Real Estate's revenue will grow by 39.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 9.0% in 3 years time.

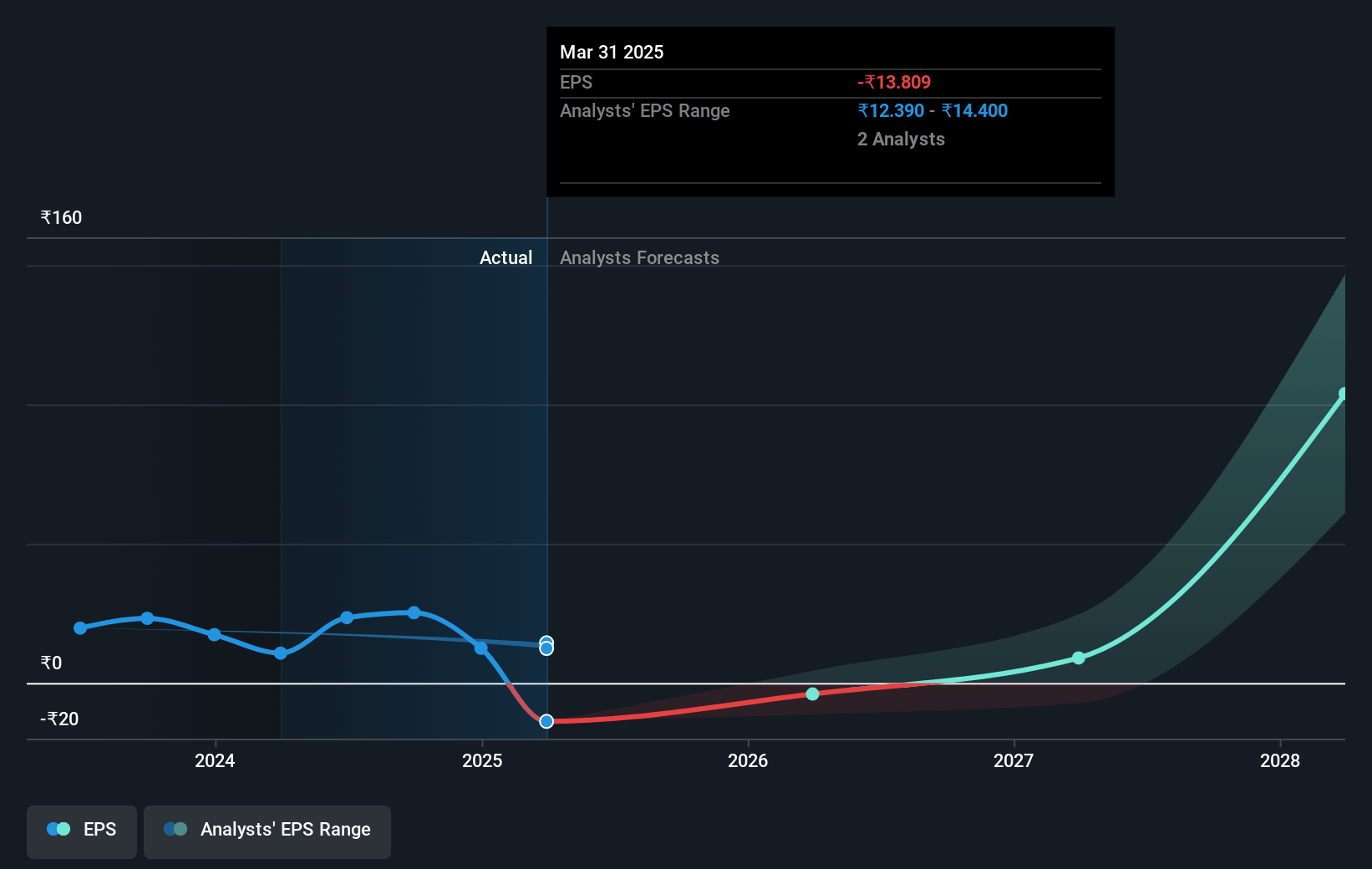

- Analysts expect earnings to reach ₹12.1 billion (and earnings per share of ₹194.71) by about May 2028, up from ₹1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, down from 154.6x today. This future PE is greater than the current PE for the IN Forestry industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.96%, as per the Simply Wall St company report.

Aditya Birla Real Estate Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Pulp and Paper segment of the company is experiencing declines due to weak domestic demand, rising finished goods inventory, and input cost pressures, leading to a 79% year-on-year decline in EBITDA. This could negatively impact the overall profitability and earnings of the company.

- The Supreme Court litigation concerning the Worli West land, which has development potential of approximately 95 lakhs square feet, creates uncertainty and risk about future developments. This could affect future revenue generation from this site.

- The company's heavy reliance on new phase launches in the fourth quarter to achieve sales targets implies execution risk. If approvals or market conditions do not support these launches, it may affect revenue and profitability.

- There are uncertainties about the regulatory environment and delays in obtaining approvals (e.g., RERA approvals for new projects), which could impact the timeline of project launches and subsequent revenue recognition.

- The existing debt levels of nearly ₹4,000 crores, which are close to a 1:1 ratio with equity, indicate potential financial leverage risks. High-interest expenses could pressure net margins if debt levels continue to rise with future investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2784.75 for Aditya Birla Real Estate based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹134.2 billion, earnings will come to ₹12.1 billion, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 17.0%.

- Given the current share price of ₹1916.85, the analyst price target of ₹2784.75 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.