Key Takeaways

- Expansion of hospitals and specialized services is set to drive occupancy and boost revenue growth as patient volumes increase.

- New initiatives in fertility and retail services aim to capture larger market shares and enhance patient experience, raising revenue prospects.

- Geopolitical challenges, project delays, low hospital occupancy, and cash dependence may strain financial flexibility and impact Rainbow Children's Medicare's revenue and margin growth.

Catalysts

About Rainbow Children's Medicare- Operates a multi-specialty paediatric and obstetrics, and gynaecology hospital chain in India.

- The integration of new hospitals in Hyderabad, Bangalore, and Chennai into Rainbow's hub-and-spoke model is expected to drive occupancy and revenue growth as these facilities mature and patient volumes increase.

- Expansion of IVF services, with a recent addition of a new clinic in Bangalore and a total of 12 IVF clinics, positions Rainbow to capture a larger market share in fertility services, thereby boosting revenues.

- The launch of Butterfly Essentials retail stores in all 15 hospitals, offering a range of baby and women care products, aims to enhance patient experience and contribute to revenue growth through complementary sales.

- Development of a state-of-the-art Child Development Center in Hyderabad marks an increase in specialized services, potentially contributing to higher ARPOB (average revenue per occupied bed) and revenue per patient (ARPP).

- New projects, such as the upcoming regional hub hospital in Rajahmundry and planned facilities in Bangalore and Coimbatore, are expected to expand Rainbow’s capacity and geographical reach, likely impacting future revenue and occupancy rates positively.

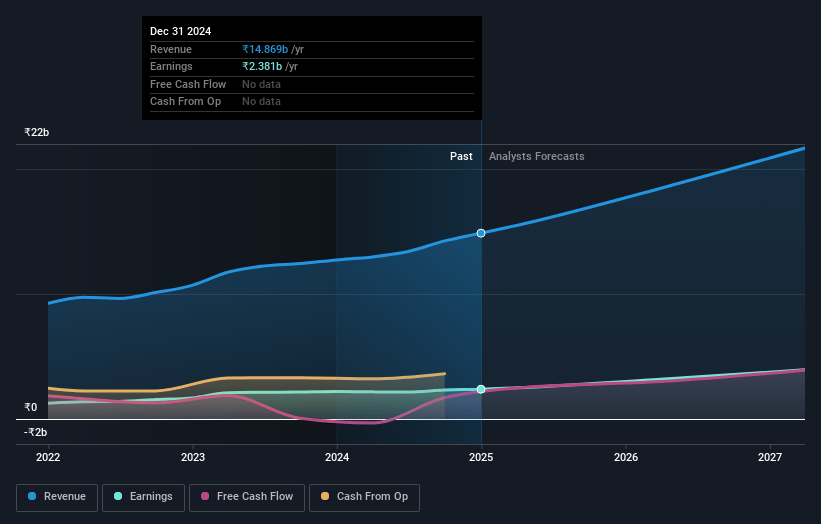

Rainbow Children's Medicare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rainbow Children's Medicare's revenue will grow by 17.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 19.1% in 3 years time.

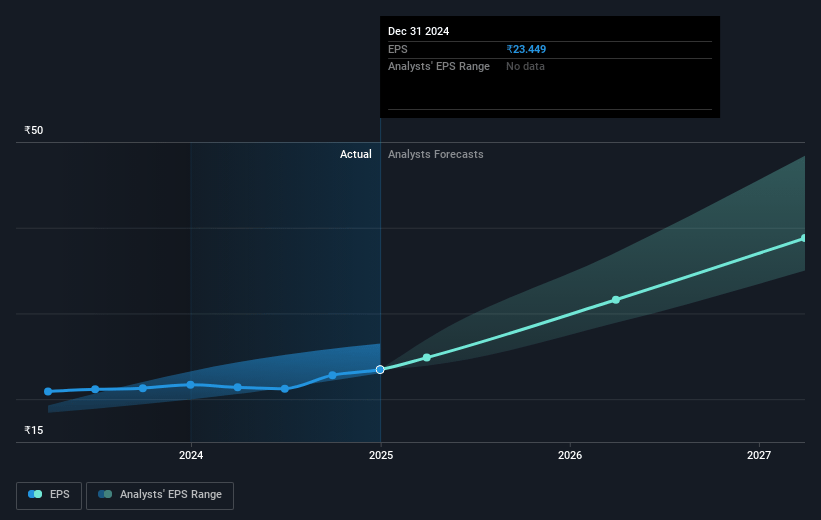

- Analysts expect earnings to reach ₹4.6 billion (and earnings per share of ₹45.56) by about May 2028, up from ₹2.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.8x on those 2028 earnings, down from 58.9x today. This future PE is greater than the current PE for the IN Healthcare industry at 39.2x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Rainbow Children's Medicare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The international business is facing significant challenges due to geopolitical issues and a reduction in healthcare permits in countries like Bangladesh, Oman, Kenya, and Sudan, affecting future revenue growth prospects.

- Delay in the completion of new projects, such as the regional hub hospital in Coimbatore and potentially others, could impact the timeline for revenue contributions from these facilities and escalate capital expenditure.

- The new hospitals have reported an occupancy rate of only 39.6%, below the mature hospitals' 60.2%, suggesting a slower-than-expected ramp-up which could impact overall earnings and margins.

- The one-off expenses related to the 25th-anniversary celebrations slightly impacted EBITDA, indicating that similar future events could affect net margin stability.

- Dependence on cash and internal accruals for capital expenditures without resorting to debt financing may strain financial flexibility, potentially impacting long-term financial health and investment capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1636.9 for Rainbow Children's Medicare based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹24.3 billion, earnings will come to ₹4.6 billion, and it would be trading on a PE ratio of 50.8x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1381.7, the analyst price target of ₹1636.9 is 15.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.