Key Takeaways

- The merger with QCIL positions Aster among the top hospital chains in India, significantly boosting market penetration and future revenue.

- Initiatives in oncology and operational efficiencies, such as cost optimization, are expected to drive higher revenue and enhance profitability.

- Regulatory and competitive challenges, including merger delays and insurance changes, might impact Aster DM Healthcare's revenue growth, profit margins, and operational efficiency.

Catalysts

About Aster DM Healthcare- Provides healthcare and allied services in India, the United Arab Emirates, Qatar, Oman, Kingdom of Saudi Arabia, Jordan, Kuwait and Bahrain, and Republic of Mauritius.

- The strategic merger with Quality Care India Limited (QCIL) will create one of the top 3 hospital chains in India with a combined total of 38 hospitals and over 10,000 beds. This expansion is expected to significantly increase Aster's revenue and market penetration in India's healthcare sector.

- Aster's ongoing capacity expansion plans, including the addition of approximately 1,700 beds by FY '27, indicate a considerable increase in service capabilities, which should contribute to revenue growth and improved net margins over time.

- Initiatives in oncology, such as the launch of Precision Oncology Clinics and the Aster Cancer Grid, focus on high-value services that are likely to drive higher revenue per occupied bed (ARPOB) and enhance overall earnings.

- Operational efficiencies, including cost optimization measures and a reduction in the average length of stay (ALOS), have led to improved EBITDA margins, which are projected to continue enhancing profitability.

- The introduction of the Aster Health app and the expansion of digital initiatives are expected to enhance patient engagement and streamline operations, likely resulting in revenue growth and margin improvement through increased patient volume and operational efficiencies.

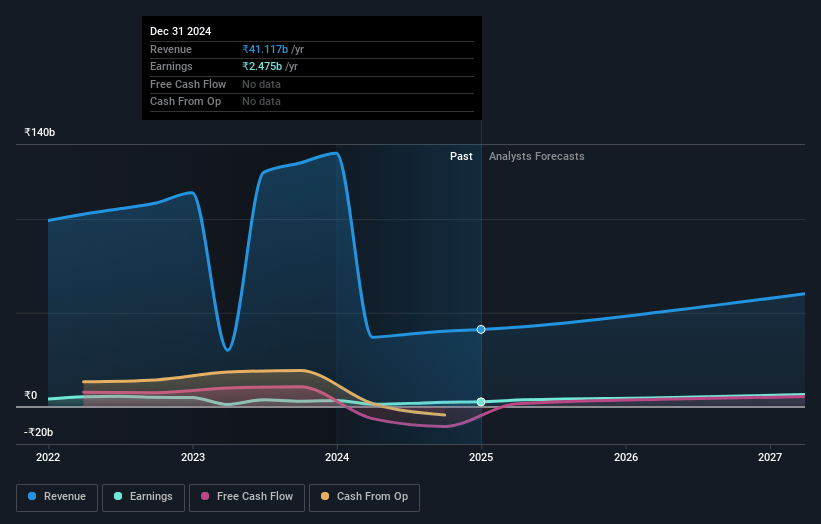

Aster DM Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aster DM Healthcare's revenue will grow by 16.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 12.8% in 3 years time.

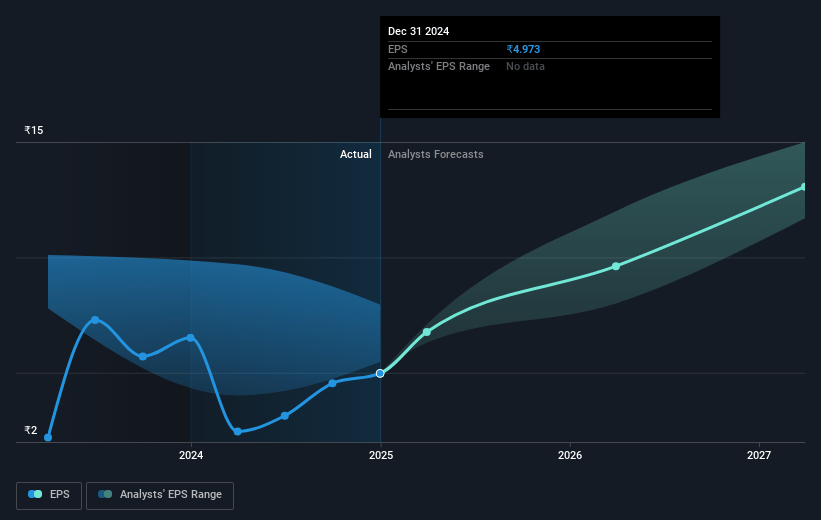

- Analysts expect earnings to reach ₹8.3 billion (and earnings per share of ₹15.88) by about May 2028, up from ₹2.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.2x on those 2028 earnings, down from 101.6x today. This future PE is greater than the current PE for the IN Healthcare industry at 39.2x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.71%, as per the Simply Wall St company report.

Aster DM Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The merger with Blackstone-backed Quality Care India Limited (QCIL) is subject to regulatory and compliance requirements, including approvals from authorities such as the Competition Commission of India, posing a risk of delays, which could affect projected revenue growth and profit synergy achievements.

- The shift towards focusing on higher-quality patients instead of pure volume growth in Kerala may impact short-term revenue if the expected increase in ARPOB (Average Revenue Per Occupied Bed) does not immediately offset reduced patient volumes.

- Increased competition in regions like Kerala from new hospitals and other healthcare providers could pressure Aster DM Healthcare to adapt its pricing strategy, potentially impacting revenue growth and margins.

- There is uncertainty related to insurance reimbursement changes due to regulatory actions like the IRDAI's directives which could pressure ARPOBs and influence negotiation dynamics with insurers, potentially affecting revenue realization.

- The transformation of certain strategic roles and leadership within key clusters, such as Kerala, carries execution risks and may lead to temporary disruptions or slower-than-expected improvements in operational efficiency and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹576.667 for Aster DM Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹729.0, and the most bearish reporting a price target of just ₹410.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹64.4 billion, earnings will come to ₹8.3 billion, and it would be trading on a PE ratio of 47.2x, assuming you use a discount rate of 10.7%.

- Given the current share price of ₹504.95, the analyst price target of ₹576.67 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.