Key Takeaways

- Deeper rural distribution, premium innovation, and quick commerce expansion are set to drive long-term topline growth and greater market share.

- Cost optimization and category expansion into value-added foods position the company for sustained improvement in profitability and competitive strength.

- Mounting competition, input cost pressures, and shifting consumer preferences toward health and digital disruptions threaten sustained growth, profitability, and long-term relevance of Britannia's traditional business model.

Catalysts

About Britannia Industries- Manufactures and sells various food products in India and internationally.

- Expansion of rural distribution and transformation of rural distributors into full-scale, organized partners is expected to drive significant volume growth and deepen Britannia's penetration into under-served markets, boosting long-term revenue and market share.

- Continued product innovation in premium and healthier offerings-such as 100% millet NutriChoice, Milk Bikis Smart with DHA, and sugar/palm oil-free products-aligns with rising consumer health focus and premiumization trends, supporting higher average selling prices and expanded gross margins.

- Growing traction in e-commerce and quick commerce channels, particularly for premium and innovative launches, is increasing Britannia's access to affluent, urban consumers and enabling faster scaling of new products, driving both topline growth and profit mix improvement over time.

- Ongoing cost optimization programs-including route-to-market efficiency, automation, and supply chain reforms-alongside stabilization in input costs, are expected to structurally lift EBITDA margins and net earnings, with margin improvement likely as commodity price volatility subsides.

- The strategic move to increase salience in adjacency categories (e.g., rusk, wafers, dairy, bread) and regional expansion into the Hindi belt and under-penetrated urban outlets, positions Britannia to benefit from the broader consumer shift toward branded, packaged and value-added foods, supporting sustainable revenue and earnings growth.

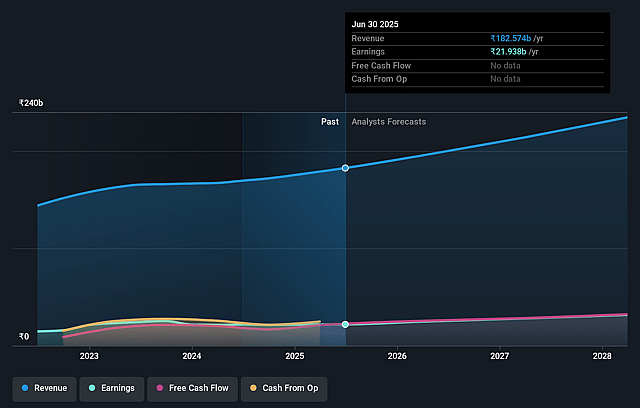

Britannia Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Britannia Industries's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.0% today to 13.3% in 3 years time.

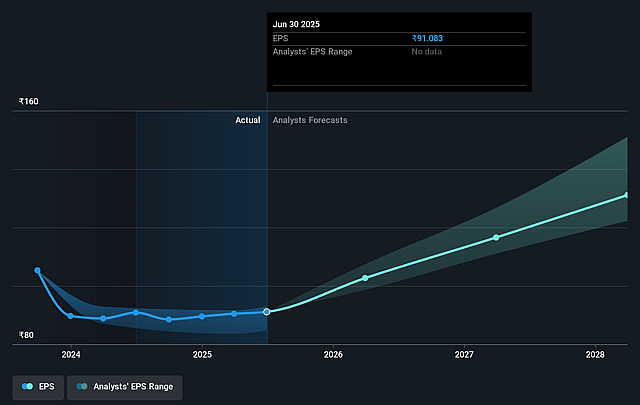

- Analysts expect earnings to reach ₹32.5 billion (and earnings per share of ₹134.54) by about August 2028, up from ₹21.9 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹36.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.4x on those 2028 earnings, down from 63.3x today. This future PE is greater than the current PE for the IN Food industry at 20.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Britannia Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regional and local competition, especially in key regions like the East where restructuring has led to market share losses, risks ongoing pressure on revenues or may force increased spending on discounts and marketing, potentially impacting both top-line growth and net margins.

- Slowing volume growth (reported at only 2%)-despite healthy transaction growth and reliance on price increases to drive revenue-raises concerns about long-term demand elasticity, putting sustained revenue and earnings growth at risk if pricing power diminishes or competition intensifies.

- Persistent volatility and inflation in critical raw materials (e.g., 45% palm oil inflation, 35% cocoa inflation, and 8% wheat inflation year-on-year), in addition to currency-linked stock appreciation rights (SAAR) related employee costs, create significant uncertainty around gross margins and operating profitability.

- The rise of health, wellness, and nutrition trends-coupled with the fast traction of digital-first, D2C, and quick commerce brands-poses a long-term risk that traditional biscuit and mass-market packaged food categories (Britannia's core portfolio) will see slowdowns, potentially reducing addressable market size and future revenue growth.

- Investment-heavy digital and quick commerce strategies, while currently growing share, are still in the scaling and investment phase with unproven profitability; this may drag on net margins and ROCE if incremental top-line gains are offset by higher distribution, promotional, and innovation costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5891.667 for Britannia Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6970.0, and the most bearish reporting a price target of just ₹4750.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹243.8 billion, earnings will come to ₹32.5 billion, and it would be trading on a PE ratio of 62.4x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹5765.5, the analyst price target of ₹5891.67 is 2.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.