Last Update01 May 25Fair value Decreased 2.67%

Key Takeaways

- Expanding into value-added and convenience seafood products in the EU and UK strengthens revenue stability, pricing power, and reduces overreliance on the U.S. market.

- Improved operational efficiency, sustainable sourcing, and compliance with strict regulations position Apex for higher margins, premium pricing, and enhanced long-term earnings quality.

- Heavy dependence on key export markets, margin pressures, low capacity use, regulatory risks, and intense global competition threaten growth and profitability.

Catalysts

About Apex Frozen Foods- Engages in the farming, processing, production, and sale of shrimps in India.

- Imminent EU regulatory approvals for Apex's ready-to-eat (RTE) processing lines are expected to unlock access to a large, higher-value segment in the European market. This could drive at least a 30–50% increase in EU sales volume in the first year post-approval, improve overall realizations by 10-15% on value-added product mix, and contribute meaningfully to gross margin and earnings growth.

- Rising global demand for protein-rich diets and seafood, especially in non-U.S. geographies, aligns with Apex's successful sales diversification into the EU and UK. This reduces company dependence on the U.S., mitigates tariff/regulatory risks, and supports more stable long-term revenues and profitability.

- Increasing consumer preference for convenience foods, including RTE and value-added shrimp products, presents a structural opportunity for Apex as it expands its product mix away from commodity offerings, boosting price realization and operating margins.

- Ongoing cost efficiency initiatives utilizing existing capacity (currently at only ~30% utilization) and incremental investments focused on improving energy and process efficiency, not capacity addition, should augment net margin expansion as fixed cost absorption improves with rising volumes.

- Heightened global focus on traceable and sustainable sourcing, coupled with tighter EU food safety compliance, positions Apex-given its robust practices and successful recent facility approvals-as a preferred supplier, potentially enabling premium pricing, greater market share, and enhanced long-term earnings quality.

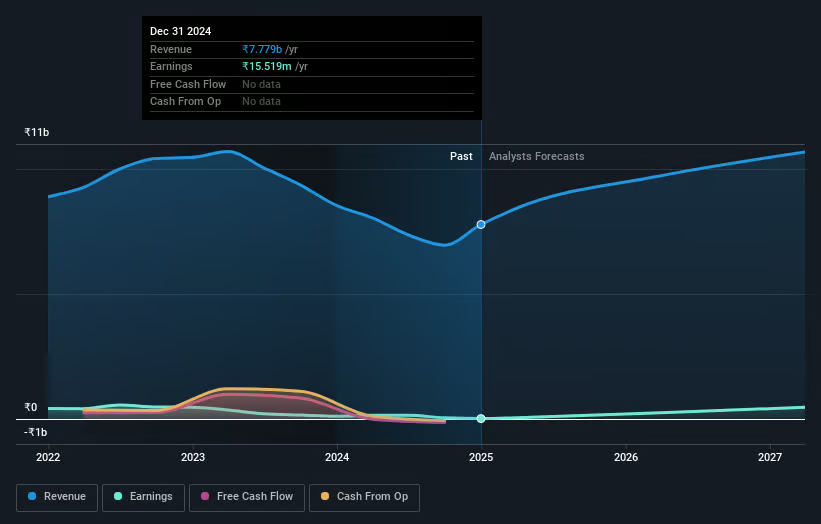

Apex Frozen Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Apex Frozen Foods's revenue will grow by 14.2% annually over the next 3 years.

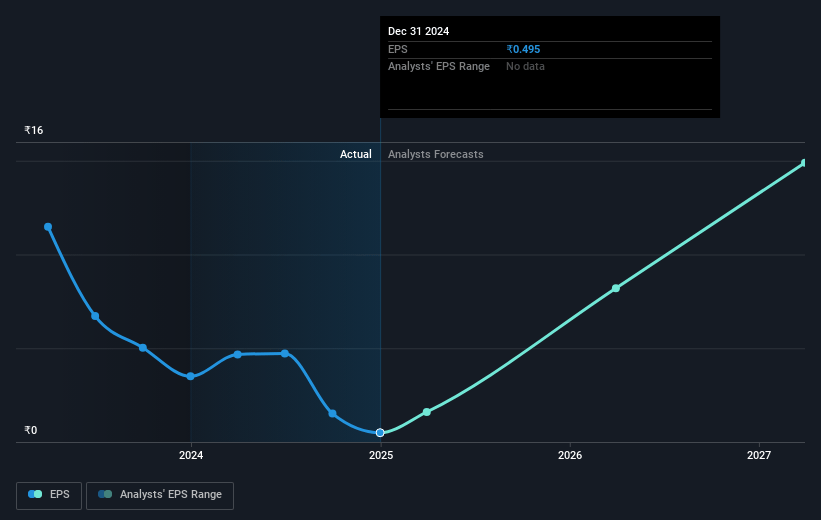

- Analysts assume that profit margins will increase from 0.5% today to 7.2% in 3 years time.

- Analysts expect earnings to reach ₹870.9 million (and earnings per share of ₹27.45) by about June 2028, up from ₹38.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, down from 189.5x today. This future PE is lower than the current PE for the IN Food industry at 21.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Apex Frozen Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing dependence on the U.S. as a major export market leaves Apex highly exposed to international trade tensions, tariff impositions, and currency fluctuations, as highlighted by recent reciprocal tariffs and the uncertainty over future trade deals; this introduces significant volatility in revenues and margins.

- Despite recent diversification into the EU, the company's ability to scale into value-added Ready-to-Eat segments depends on timely regulatory approvals and effective demand capture; delays, increased competition (especially from Vietnam and Indonesia), or failure to differentiate could limit expected margin expansion and revenue growth from these new lines.

- The multi-year stagnation and decline in EBITDA margins (historically 11%, now single digits), attributed to persistent cost escalations at the farm gate level, rising input prices, and earlier customer attrition, suggest the business may remain structurally challenged to regain prior margin profiles unless it successfully executes its value addition strategy and cost control initiatives.

- The company operates with notably low capacity utilization (30% for the full year), and absent substantial volume increases or efficiency gains, this underutilization could continue to weigh down fixed cost absorption and limit operating leverage, directly impacting net earnings growth.

- Competitive threats from Ecuador (on commodity shrimp) and Vietnam/Indonesia (on value-added products), coupled with global trends toward stricter environmental and food safety compliance, create a risk of margin erosion due to increased cost of compliance, persistent price competition, and potential erosion of Apex's global market share and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹245.0 for Apex Frozen Foods based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹12.1 billion, earnings will come to ₹870.9 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹235.01, the analyst price target of ₹245.0 is 4.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.