Key Takeaways

- Successful acquisition and category focus enhance growth prospects, with promising financial returns expected from strategic diversification and leadership in personal care.

- Innovation in product offerings and digital engagement strategies aim to drive revenue, improve margins, and mitigate cost challenges despite inflationary pressures.

- Inflation and rising input costs, urban demand slowdowns, and potential difficulties with acquisitions and market saturation pose challenges to Zydus Wellness's margins and growth.

Catalysts

About Zydus Wellness- Engages in the development, production, marketing, and distribution of health and wellness products in India.

- The company's successful acquisition of Naturell (India) Private Limited is likely to enhance future revenue growth through diversification into the nutrition bar market, as noted by the inclusion of Naturell's one-month performance contributing to consolidated net sales growth. This acquisition is expected to be EPS accretive by FY '26, impacting future earnings positively.

- The strategy focused on category growth and building leadership positions—such as Everyuth in the personal care segment—shows promise for sustained revenue growth and market share expansion, which may lead to improved net margins over time due to increased scale and brand strength.

- The expansion of Nutralite into new product categories like processed cheese and the launch of AI-powered recipe engagement tools indicate a push towards innovation and leveraging digital channels, which can drive incremental revenue and improve margins through product mix optimization and customer engagement.

- Consistent gross margin improvement driven by operational efficiencies, strategic sourcing, effective pricing strategies, and favorable product mix indicates that future net margins and earnings could be bolstered as the company mitigates inflationary pressures and cost challenges.

- The anticipation of recovery in urban demand, along with steady rural consumption and supportive macroeconomic measures, sets a positive outlook for future revenue growth, suggesting potential earnings improvement as demand conditions normalize.

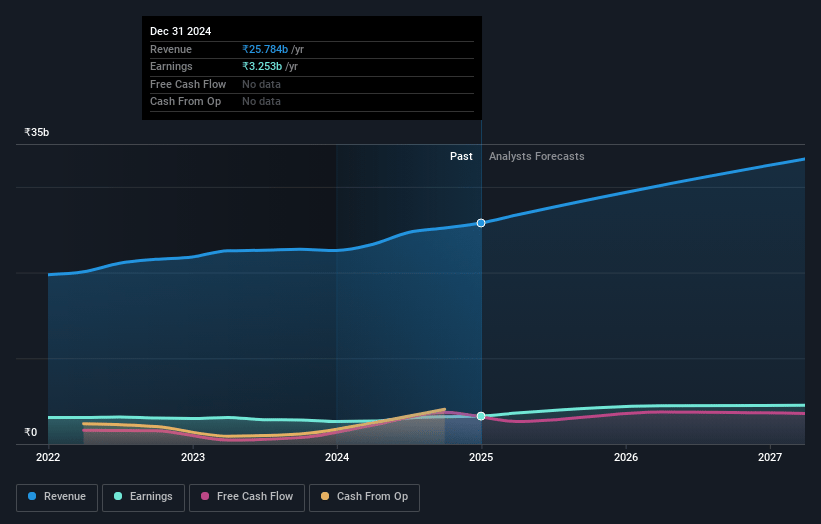

Zydus Wellness Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zydus Wellness's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.6% today to 15.8% in 3 years time.

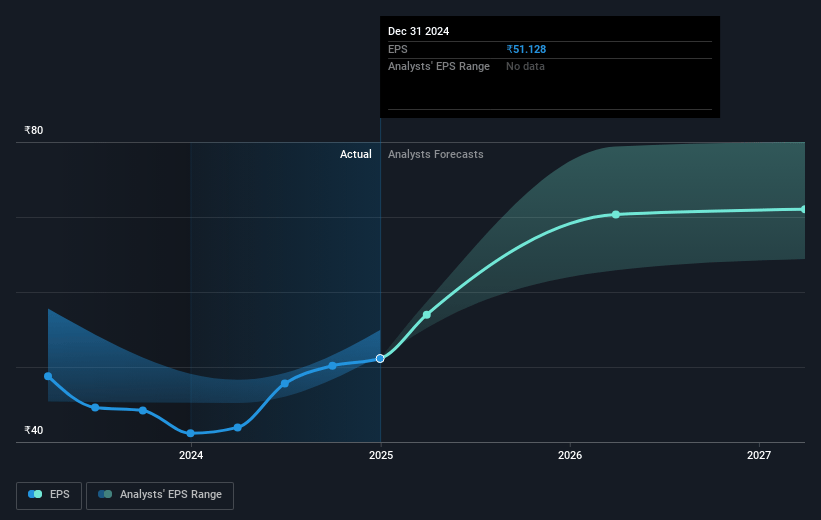

- Analysts expect earnings to reach ₹5.5 billion (and earnings per share of ₹86.78) by about May 2028, up from ₹3.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.6x on those 2028 earnings, up from 34.5x today. This future PE is greater than the current PE for the IN Food industry at 20.6x.

- Analysts expect the number of shares outstanding to decline by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Zydus Wellness Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Inflationary pressures are impacting consumption patterns and increasing input costs, which could suppress net margins despite operational efficiencies.

- The rapid growth in small unit packs, though part of a strong consumer trend, could potentially have lower margins, affecting earnings if not managed properly.

- The urban demand remains sluggish, which could impede revenue growth if the anticipated revival in demand does not materialize.

- The acquisition of Naturell (India) Private Limited adds operational complexity and financial risk, especially if Naturell's performance does not meet expectations or synergy realizations are delayed, impacting earnings.

- Heavy reliance on double-digit growth in Personal Care may not be sustainable, given the intense competition and potential market saturation, which could challenge future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2214.667 for Zydus Wellness based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2530.0, and the most bearish reporting a price target of just ₹1987.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹34.8 billion, earnings will come to ₹5.5 billion, and it would be trading on a PE ratio of 35.6x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1763.0, the analyst price target of ₹2214.67 is 20.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.