Key Takeaways

- Increased refinery capacity and operational efficiencies are expected to improve profitability, boosting net margins and earnings.

- Expansion into non-fuel retail and renewable energy projects aims to diversify revenue streams and support long-term growth.

- Multiple factors, including suppressed refining and polymer prices, unsustainable discounts, and high capital expenditure, may strain HPCL's profitability and financial stability.

Catalysts

About Hindustan Petroleum- Engages in the refining and marketing of petroleum products in India and internationally.

- The commissioning of the new units at the Visakh refinery, particularly the Residue Upgradation unit, is expected to increase distillate yields and improve refining margins by $2 to $3 per barrel, likely boosting net margins and earnings.

- The upcoming completion and commissioning of the Barmer Refinery and petrochemical complex in FY '26-'27, along with the mechanical completion expected by March '25, is anticipated to enhance capacity and sales volumes, contributing to revenue growth and earnings.

- The company's increase in domestic market share and higher sales growth in key segments like motor fuels, LPG, industrial products, and aviation fuels indicates strong competitive positioning and potential for future revenue growth beyond industry averages.

- Enhanced operational efficiencies and capacity utilization above 100% in existing refineries, combined with the expansion projects, reflect potential for improved profitability and cash flow, positively impacting net margins and earnings.

- Initiatives such as the modernization and expansion of the lubricant business, the development of a non-fuel retail business, and the focus on renewable energy projects are expected to diversify revenue streams and support long-term earnings growth.

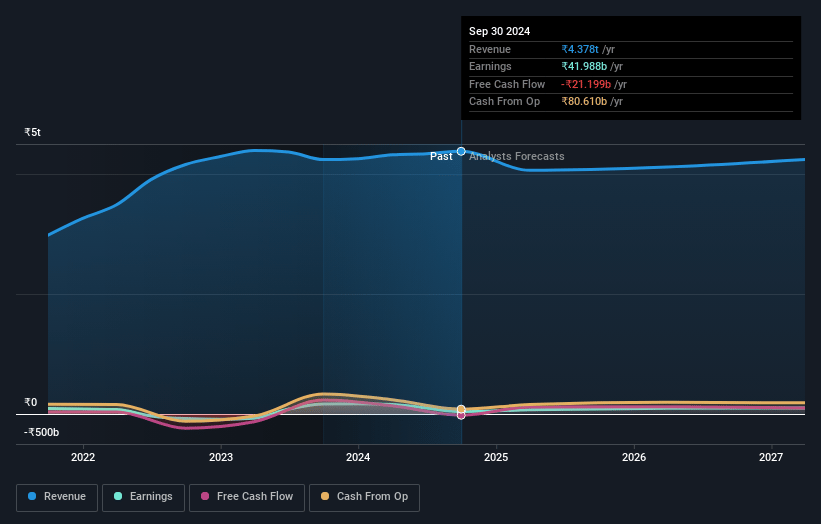

Hindustan Petroleum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hindustan Petroleum's revenue will decrease by 0.2% annually over the next 3 years.

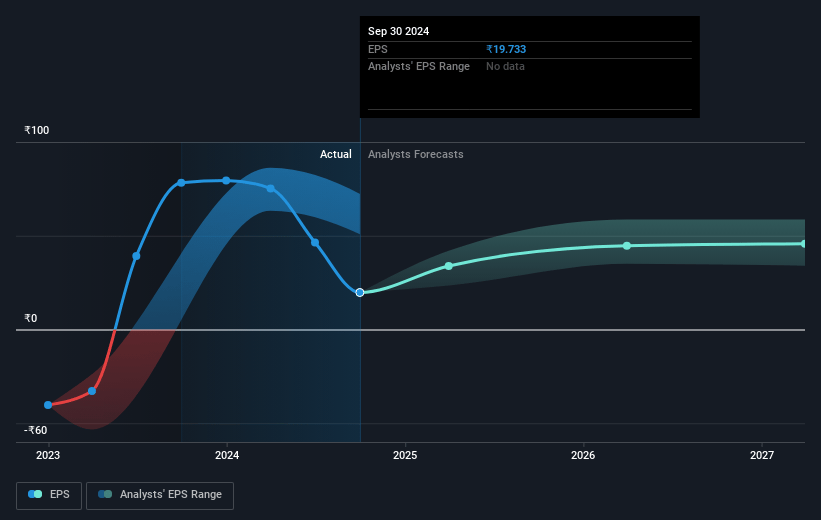

- Analysts assume that profit margins will increase from 1.4% today to 2.9% in 3 years time.

- Analysts expect earnings to reach ₹126.9 billion (and earnings per share of ₹57.76) by about May 2028, up from ₹60.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, down from 13.4x today. This future PE is lower than the current PE for the IN Oil and Gas industry at 17.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.48%, as per the Simply Wall St company report.

Hindustan Petroleum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global refining margins have been observed to be under pressure, with potential softening in gasoline and other product prices, which may impact the overall profitability and net margins of HPCL.

- HMEL, a particularly significant entity associated with HPCL, is currently facing losses due to subdued polymer prices. This can affect earnings unless there is a reversal in the product pricing trend.

- There is a substantial under-recovery on the LPG subsidy front (₹7,600 crores), which, if not addressed by the government, could significantly strain HPCL’s net earnings and cash flow.

- There is potential cost pressure due to reliance on Russian crude discounts, which may not be sustainable. Any increase in crude costs without corresponding product pricing adjustments could adversely impact net margins.

- Ongoing and high capital expenditure commitments, such as the Barmer refinery project, may increase financial risk and affect HPCL's debt levels, potentially impacting net earnings if the expected ROIs are delayed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹410.167 for Hindustan Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹565.0, and the most bearish reporting a price target of just ₹200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹4399.9 billion, earnings will come to ₹126.9 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹378.7, the analyst price target of ₹410.17 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.