Key Takeaways

- Expansion into retail, alternative fuels, and renewables enhances growth potential and diversifies revenue streams, strengthening margin resilience and valuation prospects.

- Strategic capacity projects and digital initiatives improve operational efficiency, customer experience, and position the company for sustained multi-year earnings growth.

- Rapid EV adoption, regulatory risks, project uncertainties, and high capital commitments threaten BPCL’s revenue stability, market share, and long-term profitability.

Catalysts

About Bharat Petroleum- Primarily engages in refining crude oil and marketing petroleum products in India and internationally.

- Robust long-term growth in Indian transport fuel demand—driven by a rising urban population, economic expansion, and government infrastructure pushes—is expected to sustain volume and revenue growth for Bharat Petroleum, which may not be fully reflected in current valuations.

- Accelerated expansion of retail, CNG, and LNG infrastructure—including 1,805 new retail outlets, 340 CNG stations this year and a rapid scale-up of EV charging and solarized outlets—positions BPCL to capitalize on both traditional and alternative energy demand, with forward benefits to topline growth and net margins as these investments mature.

- Strategic project pipeline—such as capacity expansions at Bina refinery, the greenfield Andhra Pradesh refinery-cum-petchem complex, and global gas developments in Mozambique and Brazil—creates a diversified base for future higher-margin petrochemicals and gas revenue, supporting multi-year earnings growth and margin resilience.

- Digital initiatives and customer-focused network enhancements, including investments in wayside amenities and digital solutions, are expected to improve operating efficiencies, enhance the customer experience, and widen gross margins over time.

- Early investments in renewable energy (green hydrogen JVs, biogas plants) and non-fuel services add resilience and option value to BPCL’s earnings mix, potentially enabling higher valuation multiples as revenue streams diversify and ESG profile improves.

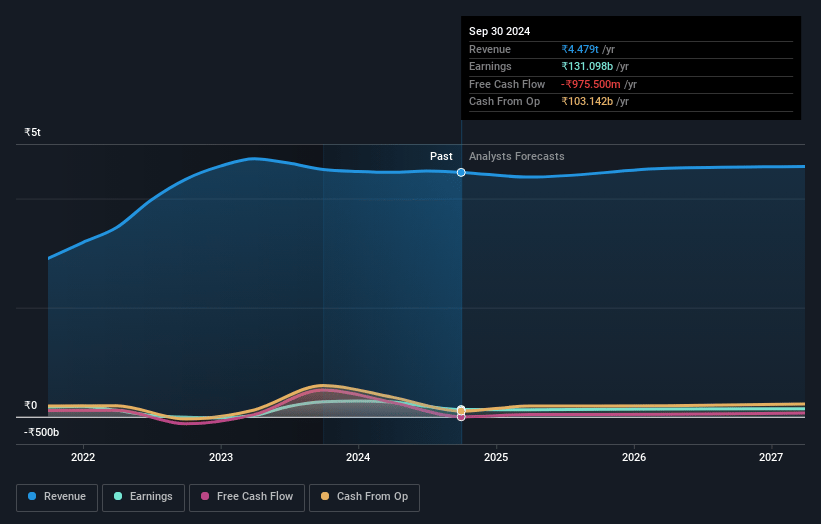

Bharat Petroleum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bharat Petroleum's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.8% in 3 years time.

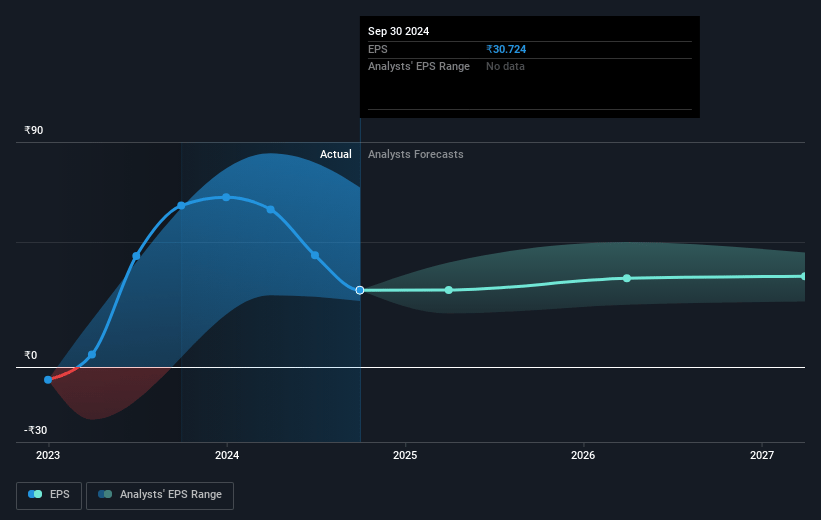

- Analysts expect earnings to reach ₹166.0 billion (and earnings per share of ₹41.94) by about May 2028, up from ₹133.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹196.1 billion in earnings, and the most bearish expecting ₹144.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 10.3x today. This future PE is lower than the current PE for the IN Oil and Gas industry at 15.2x.

- Analysts expect the number of shares outstanding to decline by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.2%, as per the Simply Wall St company report.

Bharat Petroleum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Acceleration of electric vehicle (EV) adoption and alternative mobility solutions, along with gradual loss of market share in traditional fuels as indicated by recent declines in BPCL’s retail fuel volume, could structurally erode long-term revenues and constrain top-line growth.

- Greater regulatory and ESG pressures on carbon-intensive companies, coupled with ongoing under-recoveries in controlled products like LPG and volatility in government compensation, risk persistent margin compression and increased earnings uncertainty over the long term.

- Delays, cost escalations, or impairments in major overseas projects (e.g., Mozambique LNG), as evidenced by significant past impairments and large outstanding commitment of $2.1 billion, may lead to lower return on capital, asset write-downs, and future earnings drag.

- Sustained high capital expenditure commitments for refinery expansions and diversification (₹20,000–30,000 crore annually over coming years), especially if diversification into higher-margin non-fuel/green segments underperforms, pose risks to balance sheet strength and future profitability.

- Increasing competition from private sector players and new energy entrants—combined with industry transition toward renewables—can erode BPCL’s market share and compress pricing power, threatening both revenue and net margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹350.188 for Bharat Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹481.0, and the most bearish reporting a price target of just ₹220.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹4416.8 billion, earnings will come to ₹166.0 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 13.2%.

- Given the current share price of ₹317.0, the analyst price target of ₹350.19 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.