Key Takeaways

- Increasing India's renewable energy capacity and new government market models could boost IEX's trading volumes and positively impact revenue and transaction growth.

- Expansion into carbon credit trading and new contract launches could open new revenue streams and stabilize earnings through long-term engagements.

- Competition and regulatory challenges threaten IEX's market growth and revenue potential, as dynamics shift in both traditional and emerging market segments.

Catalysts

About Indian Energy Exchange- Provides automated trading platform for physical delivery of electricity, renewable energy, and certificates.

- A significant anticipated increase in India’s renewable energy capacity, with the government's target to achieve 500 gigawatts by 2030, could boost electricity trading volumes on IEX. This is likely to positively impact revenue as increased transactions lead to higher revenue from trading fees.

- Government policy initiatives, like the development of new market models, such as battery storage arbitrage, Firm and Dispatchable Renewable Energy (FDRE), and virtual power purchase agreements (VPPAs), are set to deepen India's power market. These initiatives could drive future liquidity and transaction growth on the exchange, influencing revenue positively.

- The anticipated growth of carbon credit trading on IEX following regulatory developments could open a new revenue stream for the company. The introduction of trading for carbon credit certificates is expected to significantly contribute to revenue growth.

- Expansion of lower-priced and efficient storage technologies such as Battery Energy Storage Systems (BESS) could increase participation in power exchanges by providing more stable trading conditions. This is likely to impact net margins positively by reducing operational costs and increasing transactional efficiency.

- The potential launch of new contracts, like the extension of the Term Ahead Market from 90 days to 11 months, could increase transaction volumes and stabilize revenue streams through longer-term engagements, which, in turn, would positively impact earnings.

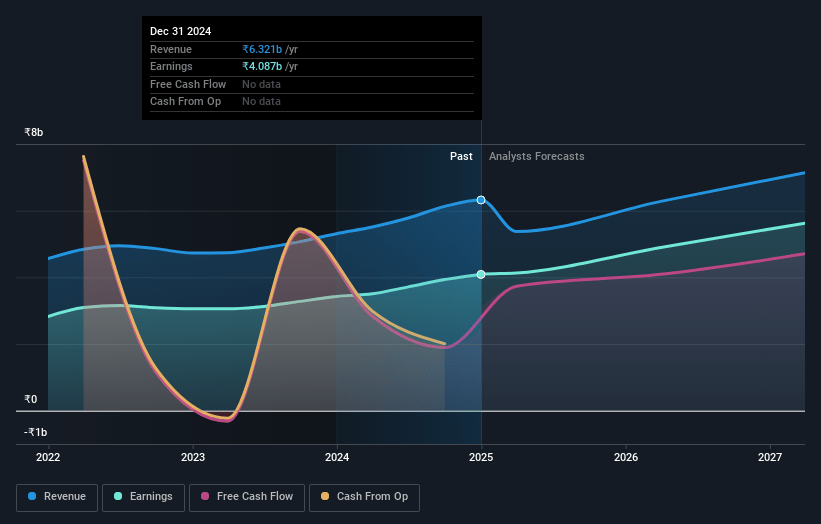

Indian Energy Exchange Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Indian Energy Exchange's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 65.3% today to 85.5% in 3 years time.

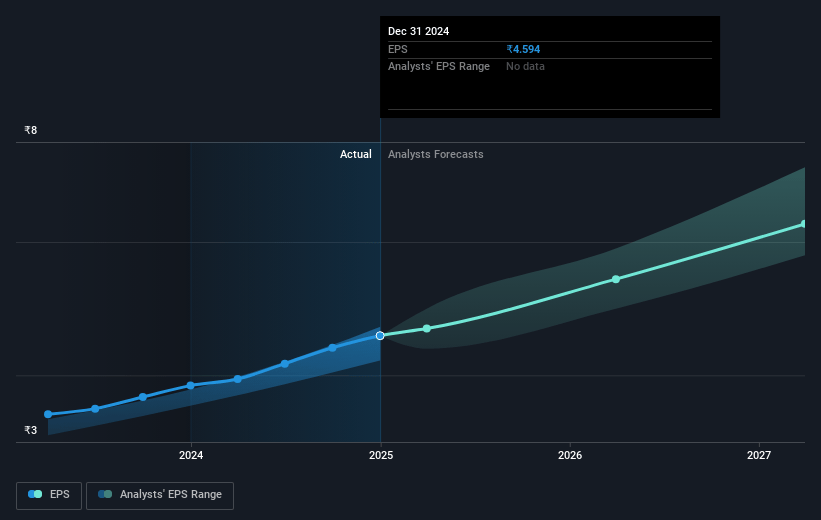

- Analysts expect earnings to reach ₹6.4 billion (and earnings per share of ₹7.5) by about May 2028, up from ₹4.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.5x on those 2028 earnings, up from 40.4x today. This future PE is greater than the current PE for the IN Capital Markets industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.0%, as per the Simply Wall St company report.

Indian Energy Exchange Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenges of enforcing Renewable Energy Certificates (REC) compliance among industries with captive generation could limit significant new market opportunities for IEX, potentially impacting future revenue growth from this sector.

- There is a risk related to power availability, especially during peak summer months, which could affect the liquidity and attractiveness of IEX’s platform, thereby impacting revenue and market share.

- IEX faces competition from the DEEP platform and other bilateral market segments for Term Ahead Market contracts, which could limit market share growth and affect future revenue projections from these segments.

- The extension of the Security Constrained Economic Dispatch (SCED) to state levels, while not directly negative, may change dynamics in the short-term trading market, potentially affecting IEX’s trading margins and market share if not beneficially integrated.

- The development of financial derivatives and potential competition from other exchanges in trading power derivatives could pose a risk to IEX’s market dominance, affecting revenue from these new financial products if IEX cannot create or leverage appropriate partnerships.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹209.0 for Indian Energy Exchange based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹285.0, and the most bearish reporting a price target of just ₹150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹7.5 billion, earnings will come to ₹6.4 billion, and it would be trading on a PE ratio of 42.5x, assuming you use a discount rate of 14.0%.

- Given the current share price of ₹195.14, the analyst price target of ₹209.0 is 6.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.