Last Update 07 Dec 25

ANANDRATHI: Future Returns Will Likely Disappoint Despite Stable Margins And Dividend

Analysts have slightly revised their price target on Anand Rathi Wealth to ₹2,510, maintaining their prior fair value while marginally adjusting underlying assumptions such as discount rate, revenue growth, profit margin and future P E expectations to reflect updated risk and earnings profiles.

What's in the News

- The Board of Directors declared a first interim dividend of INR 6.00 per equity share, equivalent to 120 percent of the INR 5 face value, for FY 2025-26. Payment to eligible shareholders is scheduled within 30 days of the October 13, 2025 declaration, with the record date set as October 17, 2025 (company filing).

- The Board met on October 13, 2025 to review and approve unaudited standalone and consolidated financial results for the second quarter and half year ended September 30, 2025, following Audit Committee review (company filing).

- The agenda of the same Board meeting included consideration of an interim dividend for FY 2025-26 and other routine business matters (company filing).

Valuation Changes

- Fair Value: Unchanged at ₹2,510 per share, indicating no revision to the headline valuation target.

- Discount Rate: Risen slightly to approximately 14.61 percent from about 14.50 percent, reflecting a modest increase in perceived risk or required return.

- Revenue Growth: Effectively unchanged at around 21.28 percent, indicating stable medium term growth expectations.

- Net Profit Margin: Essentially flat at about 35.11 percent, suggesting no material shift in long term profitability assumptions.

- Future P E: Risen marginally to roughly 45.39x from about 45.25x, implying a slightly higher multiple applied to forward earnings.

Key Takeaways

- Expansion into the U.K. and Bahrain is expected to boost international presence by accessing new client bases and increasing revenue streams.

- Growing client acquisition and digital platform enhancements indicate scalable growth, potentially leading to higher future earnings and improved operational efficiency.

- Market volatility, regulatory risks, and competitive pressures could challenge revenue consistency and profitability despite expansions and a strong track record.

Catalysts

About Anand Rathi Wealth- Provides financial and insurance services in India.

- Anand Rathi Wealth's recent incorporation of a U.K. subsidiary and plans for expansion into Bahrain could enhance its international presence, potentially boosting revenue by tapping into new client bases offshore.

- The company's strong client acquisition strategy, with 1,821 net new client families added, indicates scalable growth potential that may lead to higher future earnings.

- Enhancements in digital and SaaS platform offerings, like the OFA business, which showed significant client and AUM growth, are likely to positively influence revenue streams through tech-enabled efficiencies.

- Proposed expansion of the Relationship Manager team by about 50-60 RMs, alongside leveraging technology, aims to improve client servicing capacity, indicating potential for increased revenue and operational efficiency.

- The company's performance and aspirational guidance of sustained 20%-25% PAT growth suggest a market-agnostic business model that could enhance profit margins in the long term.

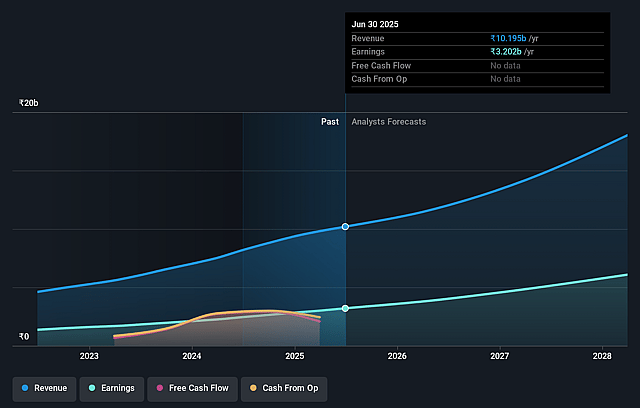

Anand Rathi Wealth Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Anand Rathi Wealth's revenue will grow by 21.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.4% today to 34.8% in 3 years time.

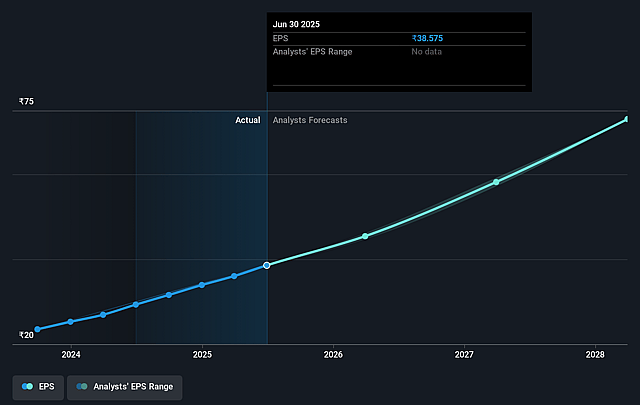

- Analysts expect earnings to reach ₹6.3 billion (and earnings per share of ₹69.27) by about September 2028, up from ₹3.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.5x on those 2028 earnings, down from 75.9x today. This future PE is greater than the current PE for the IN Capital Markets industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.66%, as per the Simply Wall St company report.

Anand Rathi Wealth Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The wealth management industry is inherently linked with capital market performance, leading to potential earnings volatility which could impact revenue consistency if market conditions falter.

- With ongoing expansions, such as the incorporation of a U.K. subsidiary and plans for Bahrain, there are risks associated with regulatory approvals and successful execution, which could affect future earnings and margins.

- Despite the company’s consistent track record, reliance on continued high growth in mutual fund distribution and net inflows might be hampered by adverse market conditions, impacting revenue growth.

- There is a focus on structured products, which rely on market conditions and internal financial engineering. Mismanagement or unforeseen market movements could negatively impact earnings.

- Competitive pressures, particularly in the digital and private wealth management sectors, might impact client acquisition costs and operating margins, affecting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2276.667 for Anand Rathi Wealth based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2580.0, and the most bearish reporting a price target of just ₹2100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹18.2 billion, earnings will come to ₹6.3 billion, and it would be trading on a PE ratio of 44.5x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹2926.9, the analyst price target of ₹2276.67 is 28.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.