Last Update01 May 25

Key Takeaways

- Expanding non-air segments and international operations, especially in the Middle East, could drive significant revenue and profitability growth.

- Strategic partnerships and digital initiatives, along with high-impact marketing, might enhance brand recognition and user engagement, boosting revenue and earnings.

- Increased competition and strategic challenges in expansion, management, and equity dilution could pressure Easy Trip Planners' market share, revenue, and profitability.

Catalysts

About Easy Trip Planners- Operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States.

- Expansion into non-air segments, such as hotel bookings and international operations, suggests potential growth in revenue diversification, particularly with the Dubai operations showing a 227% year-on-year growth. This could positively impact revenue and profitability.

- Strategic partnerships with platforms like OLX India and initiatives such as integrating travel services signify an expanded digital footprint, potentially leading to increased user engagement and revenue streams, thereby enhancing earnings growth.

- International expansion efforts, particularly in the Middle East, indicate a significant market opportunity due to the lack of dominant players, positioning the company for substantial revenue growth and improved profitability.

- Increased focus on marketing and brand presence through high-impact collaborations, such as sponsorships in major sports events, is likely to strengthen brand recognition and customer acquisition, supporting revenue growth and potentially improving net margins.

- Investments in new business ventures, such as entering the study tourism sector and enhancing corporate travel services, could diversify revenue streams and contribute to earnings growth by capturing new market segments.

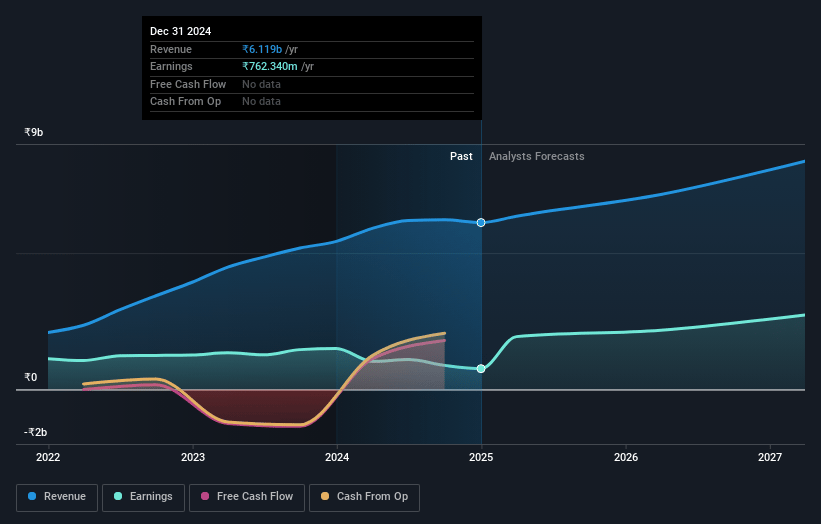

Easy Trip Planners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Easy Trip Planners's revenue will grow by 14.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 38.5% in 3 years time.

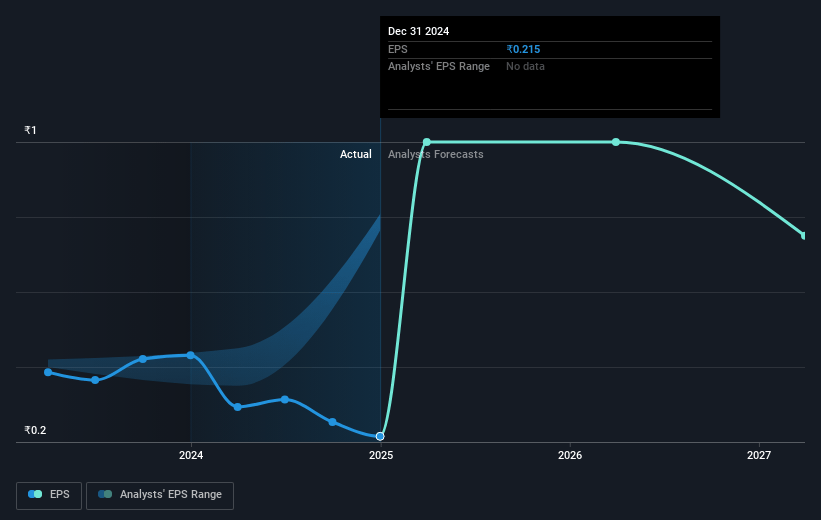

- Analysts expect earnings to reach ₹3.5 billion (and earnings per share of ₹0.95) by about May 2028, up from ₹762.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.3x on those 2028 earnings, down from 55.9x today. This future PE is greater than the current PE for the IN Hospitality industry at 33.8x.

- Analysts expect the number of shares outstanding to grow by 5.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.83%, as per the Simply Wall St company report.

Easy Trip Planners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased competition, particularly from newly listed and private companies offering discounts, may pressure Easy Trip Planners to maintain its market share, potentially impacting revenue and profitability.

- Strategic focus on expansion into segment areas like hotels has not shown consistent growth, as highlighted by flat sequential growth in hotel GBR, which could impact earnings projections if not addressed.

- The potential involvement of a promoter in the GoAir revival could divert focus and resources away from core business growth, posing a risk to future earnings.

- Frequent equity dilution through bonus issues could dilute shareholder value and create a perception of instability, affecting stock price and market perception.

- Management changes, such as the resignation of a CEO, can cause uncertainty and destabilize strategic direction, affecting the company’s overall performance and future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹21.0 for Easy Trip Planners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹9.2 billion, earnings will come to ₹3.5 billion, and it would be trading on a PE ratio of 37.3x, assuming you use a discount rate of 14.8%.

- Given the current share price of ₹12.03, the analyst price target of ₹21.0 is 42.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.