Key Takeaways

- Strategic product innovation and digital investments are boosting customer engagement and are likely to increase revenue and profitability.

- Expansion and cost management initiatives are enhancing market share and margins, supporting sustained growth and improved earnings.

- Challenging market conditions and operational pressures might impede Westlife Foodworld's profitability, amid ambitious expansion plans and inflation-related margin squeezes.

Catalysts

About Westlife Foodworld- Through its subsidiary, Hardcastle Restaurants Private Limited, owns and operates a chain of McDonald's restaurants in Western and Southern India.

- Westlife Foodworld is focusing on enhancing its value proposition and driving customer excitement through product innovation, particularly with the launch of McCrispy, which is aimed at both affordability and premium market segments. This strategy is expected to enhance guest counts and same-store sales growth, potentially increasing overall revenue.

- The company is significantly investing in its digital capabilities, such as the MyMcDonald's Rewards loyalty program and self-ordering kiosks, which are resulting in increased digital sales accounting for 70% of the top line. This digital push is expected to improve customer loyalty and transaction frequency, thereby enhancing predictability and potentially increasing both revenue and net margins.

- Westlife Foodworld's supply chain and cost initiatives, coupled with strategic pricing adjustments, have helped improve gross margins to 70.1%. Continuation of these measures is expected to maintain or enhance gross margins, positively influencing earnings.

- Restaurant expansion remains a key growth lever, with 46 new restaurants opened in 2024 and plans to add 45 to 50 new restaurants in FY '25. This expansion supports revenue growth through increased market share and geographical footprint.

- The company's three pillars of driving profitable growth—accelerating the value platform, augmenting the menu with product innovation, and robust cost governance—are all contributing to improvements in breakeven sales and profitability, likely resulting in improved net margins and earnings over time.

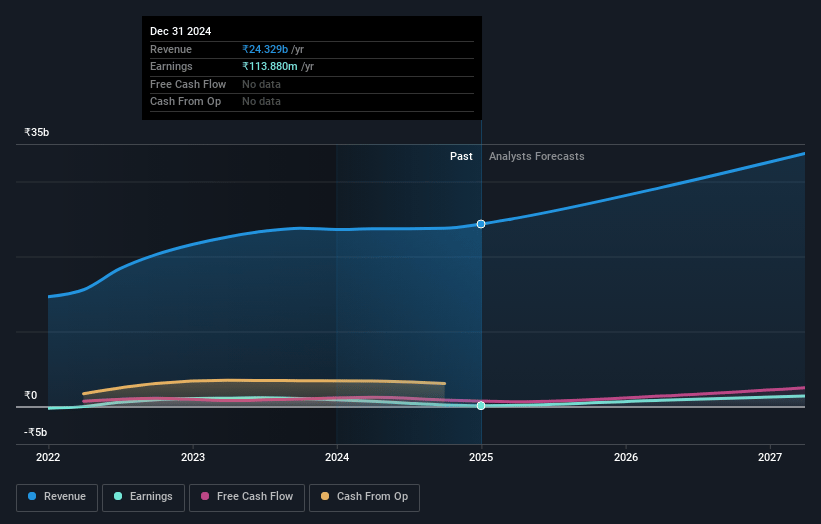

Westlife Foodworld Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Westlife Foodworld's revenue will grow by 16.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.5% today to 6.4% in 3 years time.

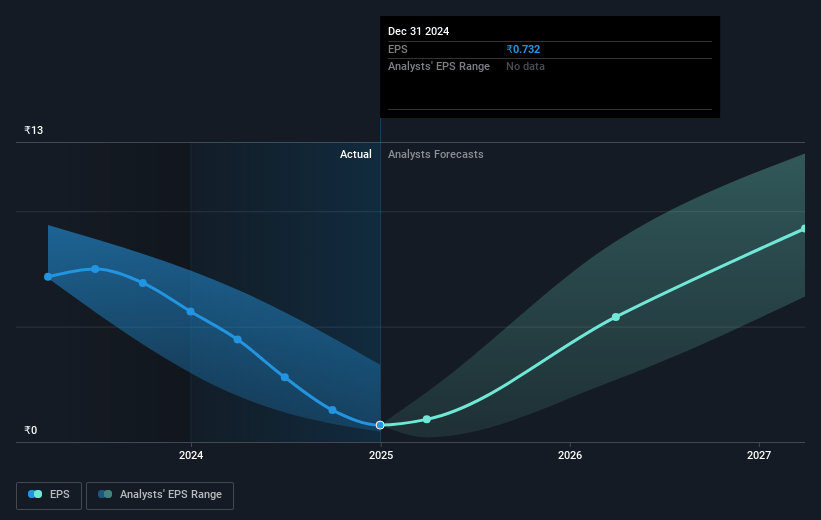

- Analysts expect earnings to reach ₹2.5 billion (and earnings per share of ₹16.28) by about March 2028, up from ₹113.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.9x on those 2028 earnings, down from 940.4x today. This future PE is greater than the current PE for the IN Hospitality industry at 32.0x.

- Analysts expect the number of shares outstanding to grow by 2.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.38%, as per the Simply Wall St company report.

Westlife Foodworld Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The operating environment remains challenging, with no significant increase in dining out trends; continued weak demand could adversely affect same-store sales growth and ultimately impact revenue.

- Despite growth in digital sales and guest count-led growth, the current momentum is only slight with same-store sales up just 3% year-on-year, which could pressure future earnings if it doesn't accelerate.

- There are concerns about operating deleverage, as evidenced by a 200 bps drop in restaurant operating margin and EBITDA year-on-year, which could adversely affect net margins.

- The company's ambitious expansion plan, projecting 45 to 50 new restaurants, may be hindered by the suppressed AUV (Average Unit Volume) of new stores compared to mature ones, which could strain future profitability and earnings.

- Persistently heightened inflation and the need for ongoing adjustments to pricing strategies, amid rising costs of key commodities, could further pressurize gross margins, impacting overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹777.857 for Westlife Foodworld based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹38.7 billion, earnings will come to ₹2.5 billion, and it would be trading on a PE ratio of 79.9x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹686.8, the analyst price target of ₹777.86 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.