Key Takeaways

- Strategic expansion and capacity growth in India and Sri Lanka position S.P. Apparels for revenue growth amid shifting global trade dynamics.

- Operational efficiencies from integration and increased capacity utilization are expected to boost margins and drive strong demand and earnings growth.

- Heavy reliance on cotton prices and geopolitical factors poses risks to revenue stability and growth, while struggling divisions may hinder overall profitability.

Catalysts

About S.P. Apparels- Engages in manufacturing and exporting of knitted garments for infants and children in India and internationally.

- The company is poised to benefit from the shift in global trade dynamics, particularly the China Plus One strategy and political instability in Bangladesh, which positions India as a preferred destination for apparel manufacturing. This is expected to drive future revenue growth as S.P. Apparels expands its customer base and capacity.

- The newly operational Sivakasi project and increasing capacity utilization in the Garment division, growing from 78% to 85%, indicate enhanced production capabilities that can lead to increased revenues and improved net margins as efficiencies are realized.

- Significant growth potential in Sri Lanka operations, with plans to increase capacity to 2,000 machines in two years. This expansion is expected to strengthen the order book and drive revenue growth, contributing positively to earnings and margins.

- Integration of Young Brand Apparel has facilitated cross-selling and expanded customer relationships, resulting in a vigorous demand that is expected to lead to revenue growth and potentially improved EBITDA margins as operational efficiencies are realized.

- SPUK's successful customer base expansion and a robust order book with new clients indicate positive momentum, suggesting future revenue growth. The business model transition and team restructuring are expected to enhance earnings once new customer orders are fully operational.

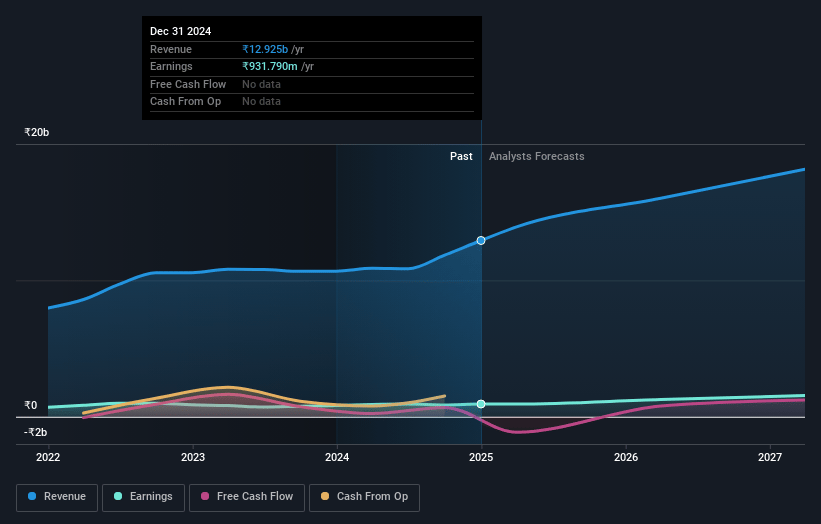

S.P. Apparels Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming S.P. Apparels's revenue will grow by 18.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 8.0% in 3 years time.

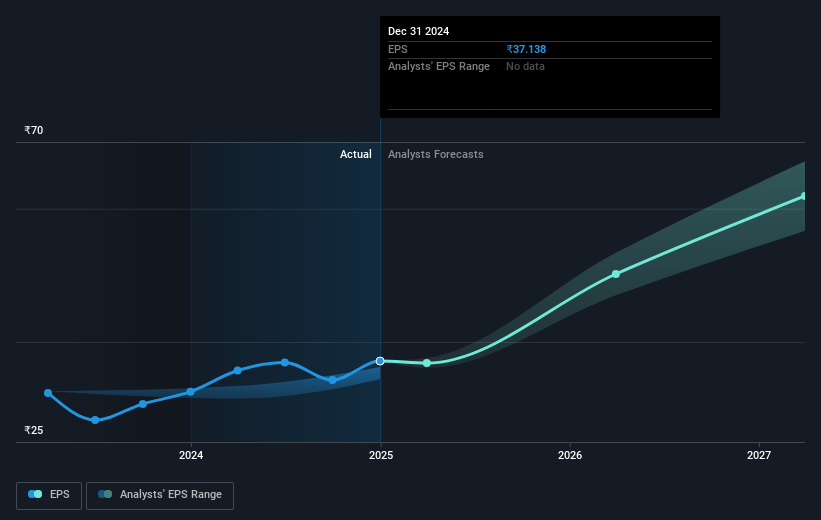

- Analysts expect earnings to reach ₹1.7 billion (and earnings per share of ₹68.21) by about April 2028, up from ₹931.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from 19.8x today. This future PE is lower than the current PE for the IN Luxury industry at 23.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.31%, as per the Simply Wall St company report.

S.P. Apparels Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The heavy reliance on cotton prices and currency volatility poses a risk as fluctuations could affect raw material costs and revenue stability.

- The Spinning division's profitability is sensitive to cotton and yarn price changes, potentially impacting net margins.

- Slow capacity ramp-up in Sivakasi and dependence on Sri Lanka's geopolitical stability could impede immediate revenue growth.

- The Retail division remains EBITDA negative, which might affect overall earnings if turnaround strategies fail to yield results soon.

- Potential competition for acquisitions in Tamil Nadu and strategic focus elsewhere could limit organic growth opportunities, impacting future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹987.0 for S.P. Apparels based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹21.3 billion, earnings will come to ₹1.7 billion, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹734.35, the analyst price target of ₹987.0 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.