Key Takeaways

- Expansion in production capabilities and niche products is expected to drive future revenue growth through increased capacity and product diversification.

- Renewable energy initiatives and stable cotton prices are anticipated to reduce costs, improving profit margins and earnings.

- High capacity utilization and reliance on debt for expansion pose financial risks, while geopolitical uncertainties and cotton pricing pressure margins and growth.

Catalysts

About Nitin Spinners- Manufactures and sells cotton and blended yarns, and knitted and woven fabrics in India and internationally.

- Nitin Spinners' significant CapEx plan of ₹1,100 crores to expand production capabilities in both yarn and fabrics will drive future revenue growth by increasing capacity and enhancing product value and cost efficiencies.

- The addition of 250 weaving rooms and enhanced dyeing and finishing capacity will allow for the introduction of high-value, niche products, potentially boosting revenue from higher quality and more diversified offerings.

- Expansion into renewable energy via an 11-megawatt AC solar power capacity aligns with sustainability goals and is expected to reduce operational costs, potentially improving net margins.

- Stability in cotton prices paired with an expected demand recovery in the export market are anticipated to improve profit margins, thus enhancing earnings.

- Government initiatives to boost textile manufacturing and exports can provide further growth catalysts, potentially improving both revenue and net margins through increased demand and industry support.

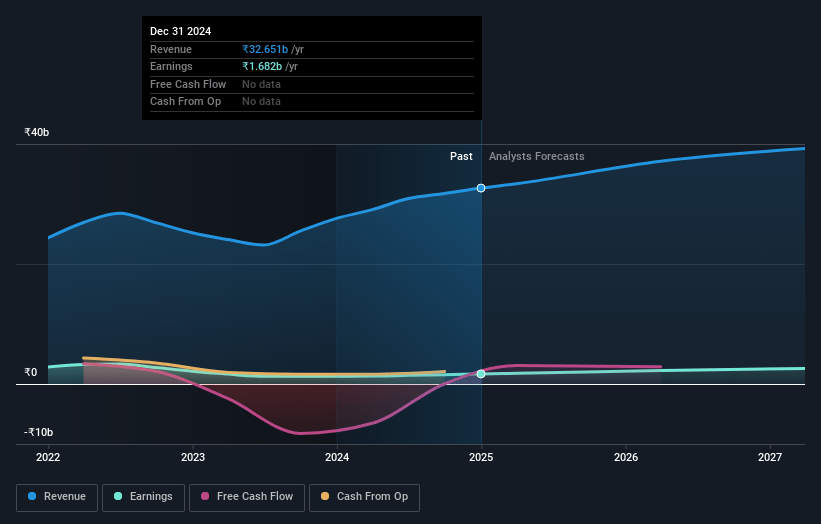

Nitin Spinners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nitin Spinners's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 7.2% in 3 years time.

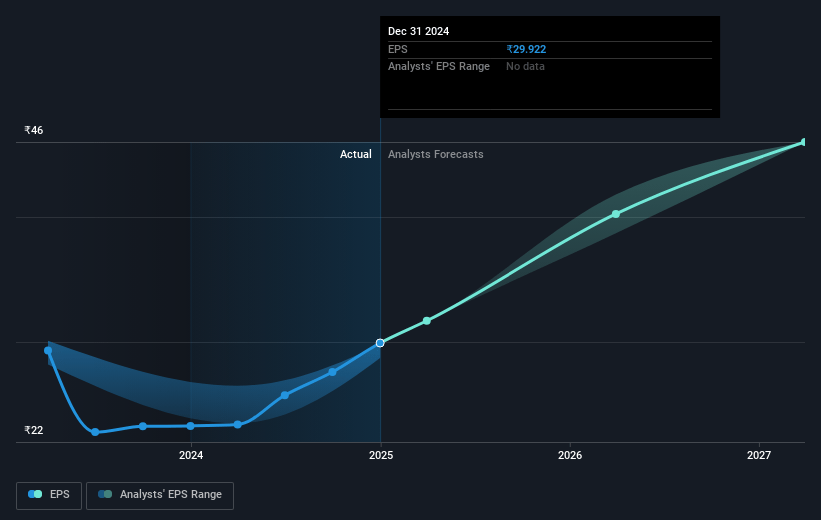

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹53.6) by about May 2028, up from ₹1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 11.5x today. This future PE is lower than the current PE for the IN Luxury industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.05%, as per the Simply Wall St company report.

Nitin Spinners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's current capacity utilization is already high in spinning (95%-97%) and fabrics (90%+), which limits the potential for significant revenue growth in the near term until new capacity comes online.

- The announced expansion will require significant capital expenditures of ₹1,100 crores, funded mostly by debt (₹800 crores), which could strain the company's financials and impact net margins if returns are not as expected.

- Domestic cotton prices remain higher than international prices, which could impact the company's raw material costs and ultimately affect profit margins negatively.

- Market conditions, including geopolitical tensions and trade disruptions, continue to present uncertainties that could affect demand, particularly in key export markets, impacting both revenues and earnings.

- The expected timeline to bring new capacity online is nearly two years, delaying any potential revenue or profit growth benefits, which exposes the company to market risk and competitive pressures in the interim.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹527.0 for Nitin Spinners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹42.1 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 17.0%.

- Given the current share price of ₹351.8, the analyst price target of ₹527.0 is 33.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.