Last Update 26 Nov 25

Fair value Decreased 1.48%KALYANKJIL: Stake Sale Will Support Expansion Through New Franchise Model Next Year

Analysts have slightly lowered their price target for Kalyan Jewellers India from ₹692.50 to ₹682.22, citing a marginally higher discount rate, which offsets stable growth and profitability estimates.

What's in the News

- Kalyan Jewellers India Limited will hold a Board Meeting on November 7, 2025 at 14:00 IST to approve unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025. The Board will also consider amendments to the Employee Stock Option Plan 2020 (Key Developments).

- A final dividend of INR 1.50 per equity share for the financial year ended March 31, 2025 was declared at the Annual General Meeting held on September 12, 2025 (Key Developments).

- Warburg Pincus LLC is in talks to acquire about 10% stake in Kalyan Jewellers' lifestyle brand Candere for INR 8,000 million to INR 8,500 million. The proceeds will support Candere's expansion and store growth through a franchise-led model (Key Developments).

- A Special and Extraordinary Shareholders Meeting is scheduled for December 14, 2025 and will be conducted via postal ballot in India (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased slightly from ₹692.50 to ₹682.22 per share.

- Discount Rate has risen marginally from 15.65% to 15.75%.

- Revenue Growth estimates remain unchanged at approximately 24.01%.

- Net Profit Margin outlook is steady at around 3.73%.

- Future P/E multiple has fallen from 55.35x to 54.04x.

Key Takeaways

- Expansion into new regions and retail formats, along with brand diversification, positions Kalyan Jewellers to capture greater market share from unorganized players.

- Operational efficiencies and regulatory trends support ongoing margin improvement and robust earnings growth through premiumisation and consumer trust in organized retail.

- Overdependence on a core regional market, execution risks, competition, rapid expansion, and shifting consumer preferences threaten Kalyan Jewellers' revenue growth, margins, and brand strength.

Catalysts

About Kalyan Jewellers India- Manufactures and retails various gold and precious stone studded jewelry products.

- Accelerated retail network expansion into underpenetrated Tier 2/3 cities, ongoing rollout of the FOCO model, and newly launched regional brands are likely to sustain strong revenue growth by capturing shifting consumer preferences toward branded jewellery in emerging markets.

- Proven ability to meaningfully improve operational efficiencies (e.g., implementation of a leaner vendor credit cycle and plans for a South India contract manufacturing hub) is expected to drive gross margin accretion and higher ROCE, supporting robust earnings growth over time.

- Continued investment in new retail formats (such as Candere with a focus on lightweight, lifestyle-oriented jewellery and an omnichannel approach) positions Kalyan to benefit from the rising middle class, urbanization and digital adoption, supporting incremental top-line growth and capturing market share from unorganized players.

- Brand building campaigns and category diversification (expansion into platinum, silver, and non-traditional gold jewellery) have already supported higher margins and ticket sizes, and are expected to enable further margin expansion and long-term revenue uplift as premiumisation trends unfold.

- Market consolidation trends and regulatory support for organized retail (like hallmarking and GST) enhance the trust factor with consumers, positioning Kalyan to win greater share from the ongoing consumer shift to organized players-driving both revenue scale and better net margins versus competitors.

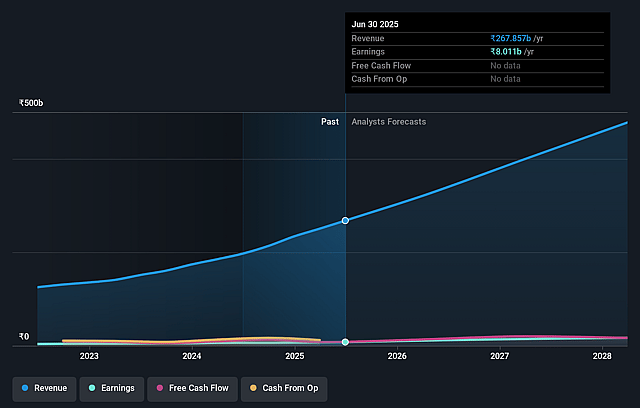

Kalyan Jewellers India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kalyan Jewellers India's revenue will grow by 23.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.8% in 3 years time.

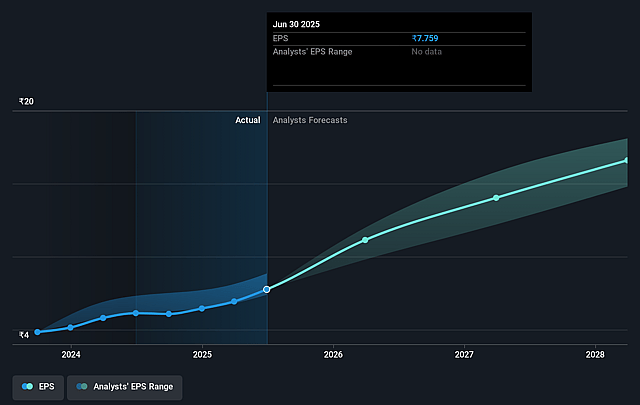

- Analysts expect earnings to reach ₹19.1 billion (and earnings per share of ₹15.95) by about September 2028, up from ₹8.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.2x on those 2028 earnings, down from 66.3x today. This future PE is greater than the current PE for the IN Luxury industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.58%, as per the Simply Wall St company report.

Kalyan Jewellers India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on South Indian markets leaves Kalyan Jewellers exposed to regional demand volatility and concentration risk, which could negatively impact revenue and earnings if underlying market dynamics or economic conditions change in these key areas.

- Delay or execution risk in expanding the leaner credit procurement strategy company-wide could limit expected gross margin and ROCE improvements, tying up significant incremental capital (₹1,500–2,000 crore) and pressuring net margins if rollout is slower than anticipated or cost savings are less robust than projected.

- Intensifying competition in both organized and unorganized jewellery sectors-including the proliferation of regional brands and expansion of pan-India incumbents-could increase perpetual pricing pressures and compress same-store sales growth, adversely affecting revenue and profitability.

- High pace of new store openings and aggressive expansion into new geographies and retail formats may lead to operating inefficiencies or diluted brand identity, potentially straining net margins via increased fixed costs and promotional expenditures outpacing revenue growth.

- Consumer shifts toward digital assets, alternative investments, or changing tastes favoring lower-gram, lightweight, or non-gold jewellery could reduce average transaction values and long-term demand for Kalyan's traditional product mix, ultimately impacting top-line revenue and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹678.75 for Kalyan Jewellers India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹770.0, and the most bearish reporting a price target of just ₹610.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹506.5 billion, earnings will come to ₹19.1 billion, and it would be trading on a PE ratio of 57.2x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹514.1, the analyst price target of ₹678.75 is 24.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.