Key Takeaways

- Strategic expansion and investments in new facilities will boost production capacity, fulfilling more orders and driving revenue growth.

- Benefiting from global sourcing shifts and backward integration efforts, the company expects enhanced efficiency and long-term growth.

- Expansion efforts and regional dependence pose short-term risks to margins and revenue stability amidst geopolitical and operational challenges.

Catalysts

About Gokaldas Exports- Designs, manufactures, and sells a range of garments in India.

- Gokaldas Exports is expanding its production capacity with ongoing investments in three facilities, which are expected to commence operations in FY '26. This expansion should drive revenue growth as it allows the company to fulfill more orders and serve a growing clientele.

- The company is benefiting from a shift in global sourcing away from China, Vietnam, and Bangladesh, driven by factors such as geopolitical tensions and cost advantages in India. This trend is expected to enhance revenue and support long-term growth.

- There is a strong order book for fall/winter and early indications for spring/summer collections. This robust demand is likely to contribute to stable revenue growth and potential improvement in earnings in the near term.

- The company is working on improving margins through better pricing and stronger operations management, which could positively impact net margins.

- Gokaldas Exports' strategy includes backward integration with the acquisition of Bombay Rayon, which, once fully operational, is expected to enhance efficiency and potentially reduce reliance on imported materials, supporting both revenue and earnings growth.

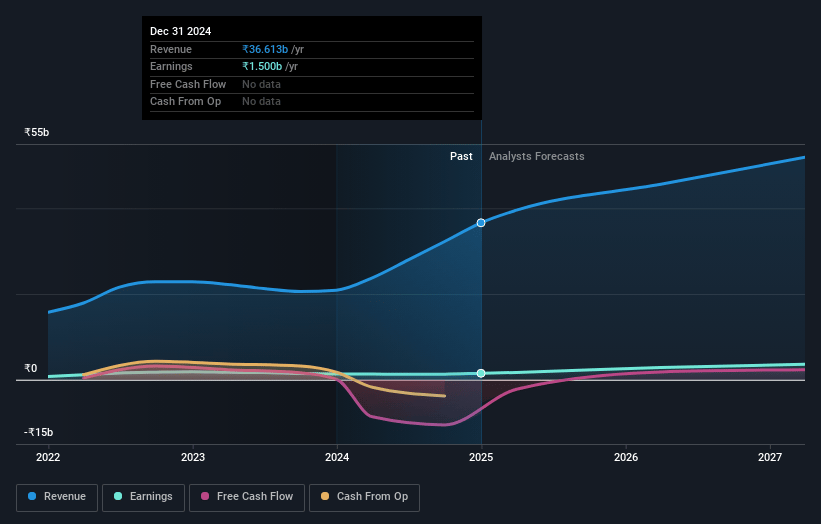

Gokaldas Exports Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gokaldas Exports's revenue will grow by 15.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.1% today to 8.1% in 3 years time.

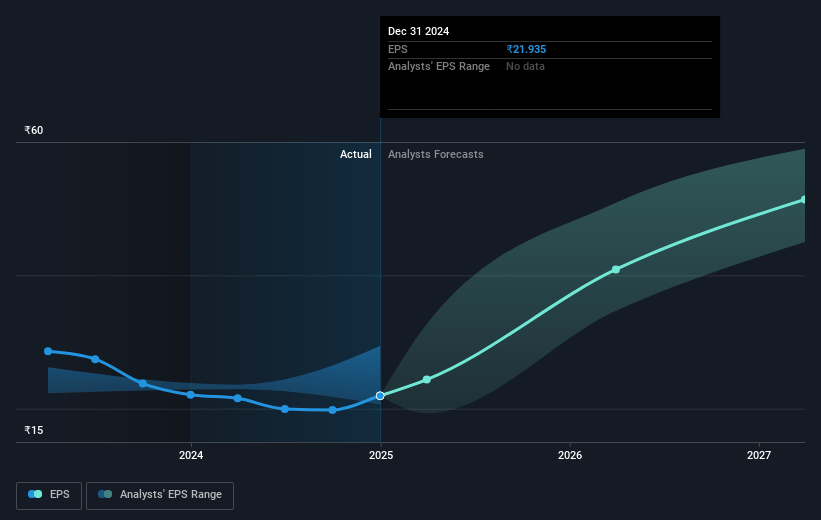

- Analysts expect earnings to reach ₹4.6 billion (and earnings per share of ₹66.98) by about May 2028, up from ₹1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.1x on those 2028 earnings, down from 40.4x today. This future PE is greater than the current PE for the IN Luxury industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.05%, as per the Simply Wall St company report.

Gokaldas Exports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent expansion efforts, such as the new facility in Madhya Pradesh and additional units in Karnataka and Ranchi, could temporarily strain margins due to upfront costs and the extended period required for new capacities to reach optimal productivity. This could affect net margins in the short term.

- The company’s reliance on regions like the United States, which accounts for over 75% of exports, may pose a risk if geopolitical tensions or new trade tariffs emerge, potentially impacting revenue stability.

- The apparel industry is subject to fluctuations in material costs, and while current indications show a downward pressure on cotton prices, any volatility could squeeze margins if not entirely passed through to customers.

- With significant expansions underway, the challenge of sourcing trained manpower and the necessity for intensive training might impact operational efficiency, thus affecting EBITDA margins during ramp-up phases.

- The acquisition of entities like Atraco posed initial margin pressures due to integration challenges, currency fluctuations, and geopolitical risks within regions they operate, which could hinder the predictability of earnings until fully stabilized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1224.0 for Gokaldas Exports based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1371.0, and the most bearish reporting a price target of just ₹1140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹56.7 billion, earnings will come to ₹4.6 billion, and it would be trading on a PE ratio of 35.1x, assuming you use a discount rate of 15.1%.

- Given the current share price of ₹848.55, the analyst price target of ₹1224.0 is 30.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.