Key Takeaways

- Dixon's diversification into component manufacturing and display production aims to improve cost efficiency, margins, and competitiveness.

- Expansion in mobile manufacturing and global partnerships, including IT hardware, positions Dixon for significant revenue growth across markets.

- Dixon faces competitive pressure in mobile manufacturing, relies heavily on government subsidies, and risk delays in ambitious projects, affecting profitability and growth.

Catalysts

About Dixon Technologies (India)- Engages in the provision of electronic manufacturing services in India and internationally.

- Dixon Technologies is diversifying into component manufacturing, including precision components, camera modules, mechanicals, and battery packs. This backward integration is expected to lead to improved cost efficiencies and higher margins in the future. (Net margins)

- The company is set to expand its mobile phone manufacturing capacity with additional facilities, supported by strong partnerships with global brands like Motorola, Xiaomi, and a new joint venture with Vivo. This expansion is likely to drive significant revenue growth. (Revenue)

- Dixon's foray into export markets, especially in Africa, with its growing capabilities in mobile phone manufacturing, enhances its market reach and is expected to add substantial revenue streams. (Revenue)

- The planned large-scale investment into display manufacturing through strategic partnerships positions Dixon to achieve vertical integration and cost advantages, potentially enhancing margins and competitiveness. (Net margins)

- Dixon is exploring joint ventures in IT hardware with large global ODMs, including laptops and servers. This diversification could provide new revenue streams and expand its presence in high-growth markets. (Revenue)

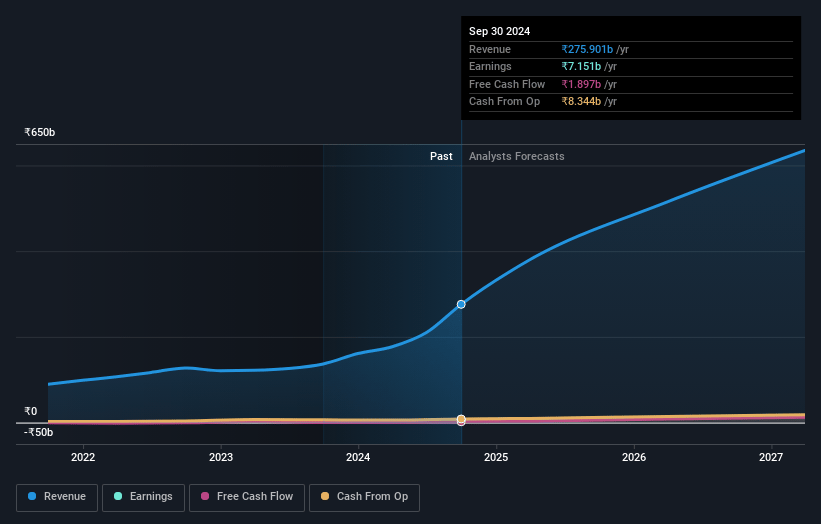

Dixon Technologies (India) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dixon Technologies (India)'s revenue will grow by 40.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.4% today to 2.0% in 3 years time.

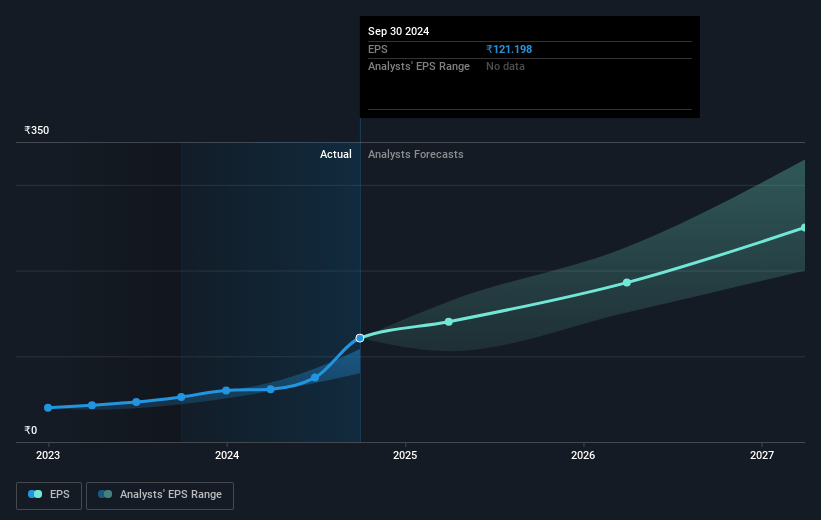

- Analysts expect earnings to reach ₹18.2 billion (and earnings per share of ₹307.69) by about April 2028, up from ₹7.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹20.2 billion in earnings, and the most bearish expecting ₹14.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.8x on those 2028 earnings, down from 116.3x today. This future PE is greater than the current PE for the IN Consumer Durables industry at 42.9x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.02%, as per the Simply Wall St company report.

Dixon Technologies (India) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant competition in the mobile phone manufacturing sector, including new entrants like Tata Electronics and others, could potentially impact Dixon's growth in mobile manufacturing, pressuring margins and market share.

- The dependence on government subsidies such as PLI schemes for profitability and expansion could be a risk if policies change or if subsidies are reduced, impacting Dixon's future margins and cost competitiveness.

- The ambitious plans for a $3 billion display fab depend on regulatory approvals, partner alignment, and government support. Delays or issues in execution could affect expected returns on capital employed (ROCE) and earnings.

- The transition period between the end of current PLI benefits for mobile manufacturing (FY '26) and the ramp-up of backward integration projects might temporarily compress margins, impacting profitability.

- The subdued demand in certain segments like LED TVs might lead to lower revenue growth in the consumer electronics segment, affecting overall profitability if the demand environment does not improve.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹16407.143 for Dixon Technologies (India) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹22005.0, and the most bearish reporting a price target of just ₹8696.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹916.8 billion, earnings will come to ₹18.2 billion, and it would be trading on a PE ratio of 65.8x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹15252.0, the analyst price target of ₹16407.14 is 7.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.