Key Takeaways

- Strategic expansion and joint ventures in PCB manufacturing could unlock new revenue streams and bolster long-term earnings.

- Anticipated growth from government schemes and capex plans positions Amber Enterprises to capitalize on future industry trends.

- Strategic risks, including inventory strategies, reliance on government incentives, and supply chain vulnerabilities, could impact Amber's revenue and margins amid economic uncertainties.

Catalysts

About Amber Enterprises India- Provides room air conditioner solutions in India.

- The Consumer Durable division exhibited robust growth, with an anticipated positive summer season driving inventory buildup, which could lead to increased revenues and improved net margins.

- The Electronics division revised its revenue growth guidance upwards to 55% for FY '25, fueled by expansion in PCBA and bare board verticals, which is expected to significantly enhance earnings.

- The strategic expansion at the new Hosur facility and the joint venture with Korea Circuit for advanced PCB manufacturing could unlock new revenue streams and bolster long-term revenue and earnings.

- The Railway Subsystem and Defense division, despite current off-take delays, expects a return to normalized profitability by H2 FY '26, supported by a strong order book and expansion projects, which could stabilize net margins.

- The impending finalization of the government’s electronic component scheme, along with a robust capex plan, positions Amber Enterprises to capitalize on industry growth trends, potentially boosting future revenues and improving return on capital employed.

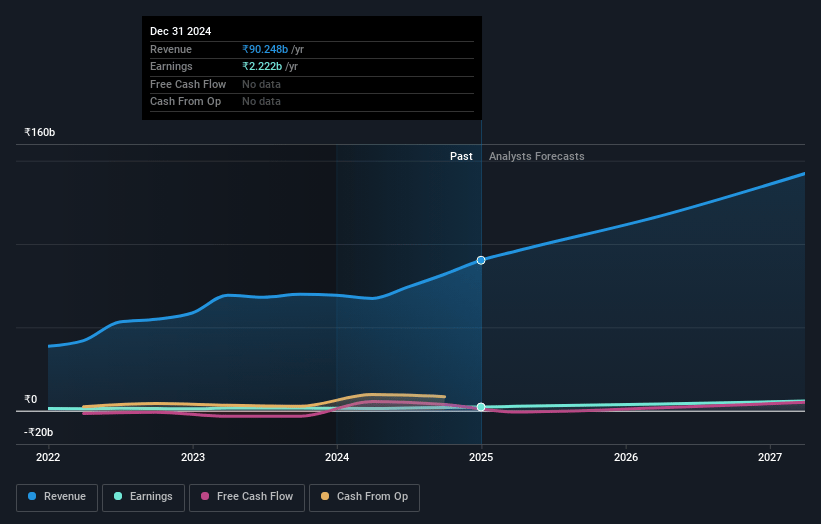

Amber Enterprises India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amber Enterprises India's revenue will grow by 20.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 4.4% in 3 years time.

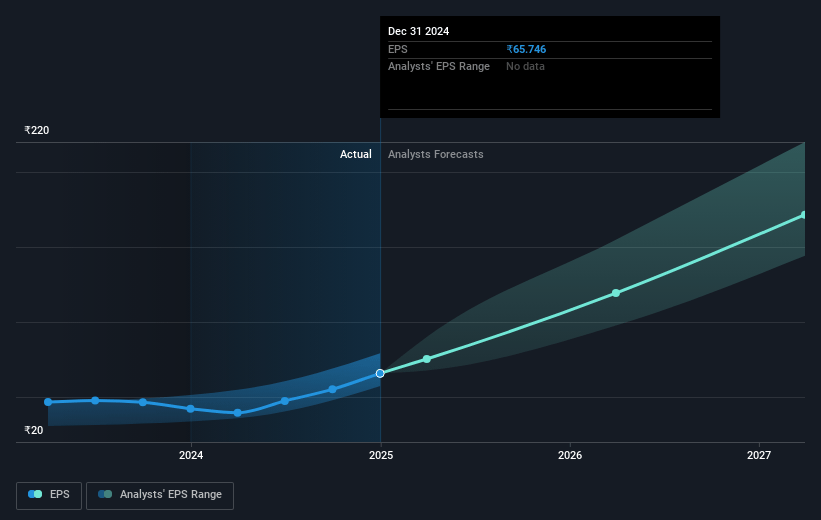

- Analysts expect earnings to reach ₹7.0 billion (and earnings per share of ₹193.21) by about May 2028, up from ₹2.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹4.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.7x on those 2028 earnings, down from 93.8x today. This future PE is greater than the current PE for the IN Consumer Durables industry at 42.9x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.36%, as per the Simply Wall St company report.

Amber Enterprises India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Railway Subsystem and Defense division reported a muted quarter due to delays in product offtake and expansion expenses, which could affect the division's future revenue and margin projections until they normalize by H2 FY '26.

- The company's reliance on inventory buildup strategies in anticipation of strong seasonal demand carries risk if consumer demand does not materialize due to macroeconomic factors, potentially impacting revenue and margins.

- Exchange rate fluctuations and commodity price increases, such as for refrigerants and gas, although managed, still pose challenges to maintaining stable gross margins across product divisions.

- The dependency on government incentives and approvals for strategic expansions, such as the JV with Korea Circuit for PCB manufacturing, may introduce delays and uncertainties affecting long-term revenue generation plans.

- Capacity constraints and potential supply chain disruptions, particularly in the compressor supply for air conditioners, could limit the ability to meet demand and affect revenue in peak seasons if not proactively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹7582.13 for Amber Enterprises India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹8845.0, and the most bearish reporting a price target of just ₹5192.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹159.6 billion, earnings will come to ₹7.0 billion, and it would be trading on a PE ratio of 56.7x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹6155.5, the analyst price target of ₹7582.13 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.